Stock Watch: Fevertree Drinks

Unearthing shares that are going to make you a lot of money is the holy grail of stock market investing. The hardest part is finding potentially great companies before others do. Sometimes though investment ideas are staring you in the face. They can be found in the products and services that many of us regularly use.

If you find a product or service that you think is good then there's a good chance that other people will too. This is a sign of a very good company. What's even better is that sometimes you can buy shares in it before many investors have even heard of it. These are the kind of shares that the famous investor Peter Lynch recommended people to buy as they have the potential to multiply in value many times over as more and more people find out about the company - the proverbial "ten bagger" type of share.

I've been reading a lot recently about the soaring popularity of gin and tonic as a drink of choice. Gin bars are popping up in many towns and cities. Whilst out on a hike last weekend I mentioned this to a few people and we ended up talking about how to make the perfect gin and tonic and which brand of tonic water to use.

The traditional Schweppes is apparently out of favour. If you are splashing out on a posh bottle of gin then you have to do it justice with posh tonic water as well. I was told that Fevertree tonic is apparently one of the best tonics you can buy. So I've decided to take a look at whether its shares have the makings of a good investment.

As you can see from the chart above, I am late to the party with this company. Its shares listed on AIM in November 2014 at 134p and have increased more than fivefold since then. Has the opportunity passed latecomers by? Or is there still more to go for?

Let's take a closer look.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

A bit of history

Fevertree was set up by Charles Rolls - who used to run the Plymouth Gin company - and Tim Warrillow. After first meeting in 2003 they decided to make premium mixer drinks. They had seen the shift in consumer buying habits towards premium drinks in the spirits markets and reckoned they needed premium tonics to go with them.

Fevertree wanted to create unique products which were different to other mixers on the market. It has done this by basing its products on natural ingredients sourced from some exotic locations such as a high grade of quinine - the main ingredient of tonic water - from the Congo.

Their first indian tonic water was produced in 2005 and was sold in Selfridges and Waitrose. The company built up its sales by wooing upmarket hotels, restaurants and bars as well getting endorsements from celebrities and the press. New products such as ginger ale, lemonade and soda water have been added to the product portfolio whilst the company is now selling its products in over 50 countries. 65% of its sales came from outside the UK in 2015, with the US, Spain and Belgium being very big markets for the company. Fevertree is the world's biggest seller of premium mixers by sales value.

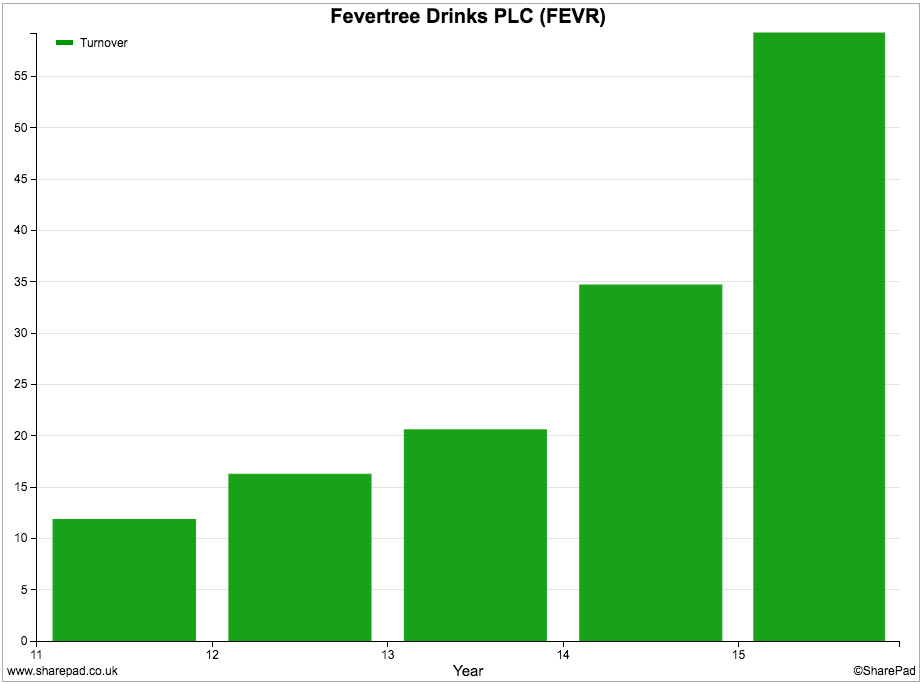

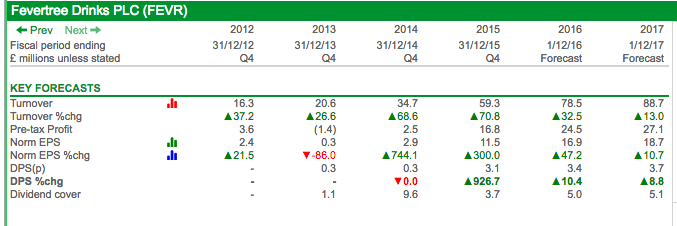

As you can see sales have grown rapidly in recent years.

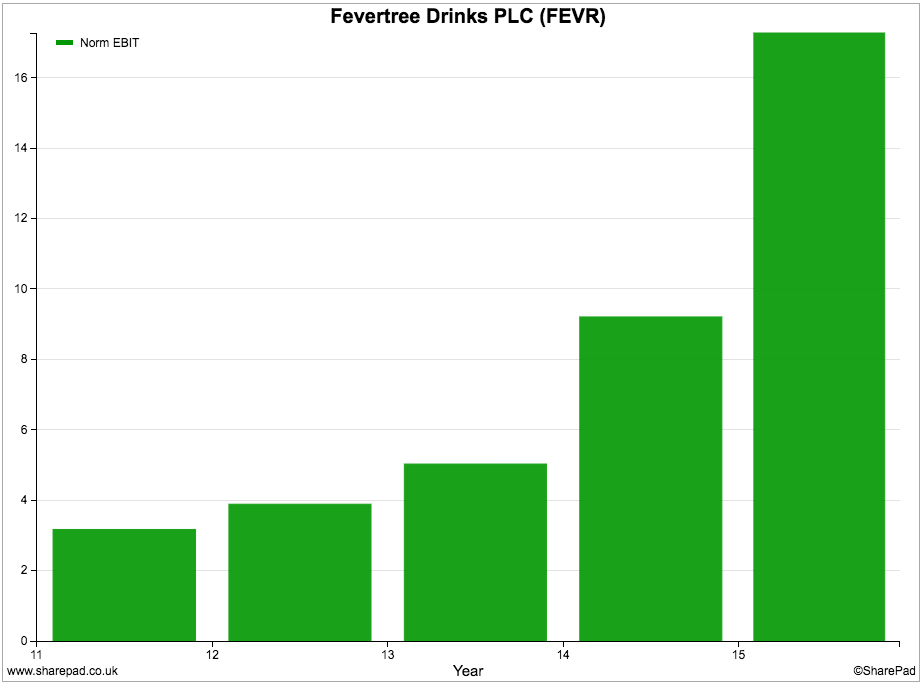

The same is true of profits and this can explain a large part of Fevertree's share price performance.

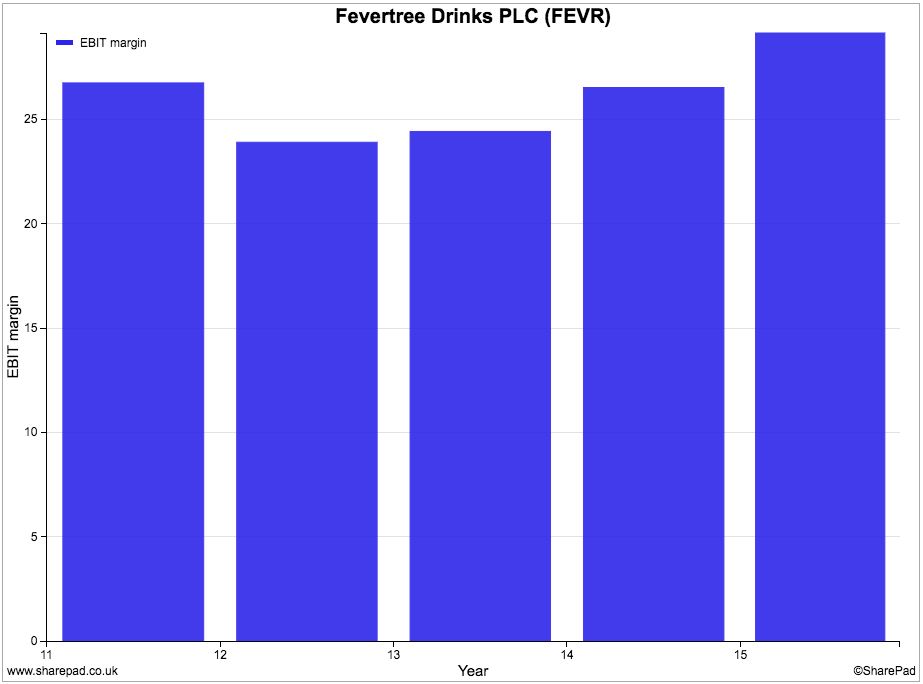

As you can see in the chart below, the company has very high profit margins which have been increasing. This is often the hallmark of a very good business.

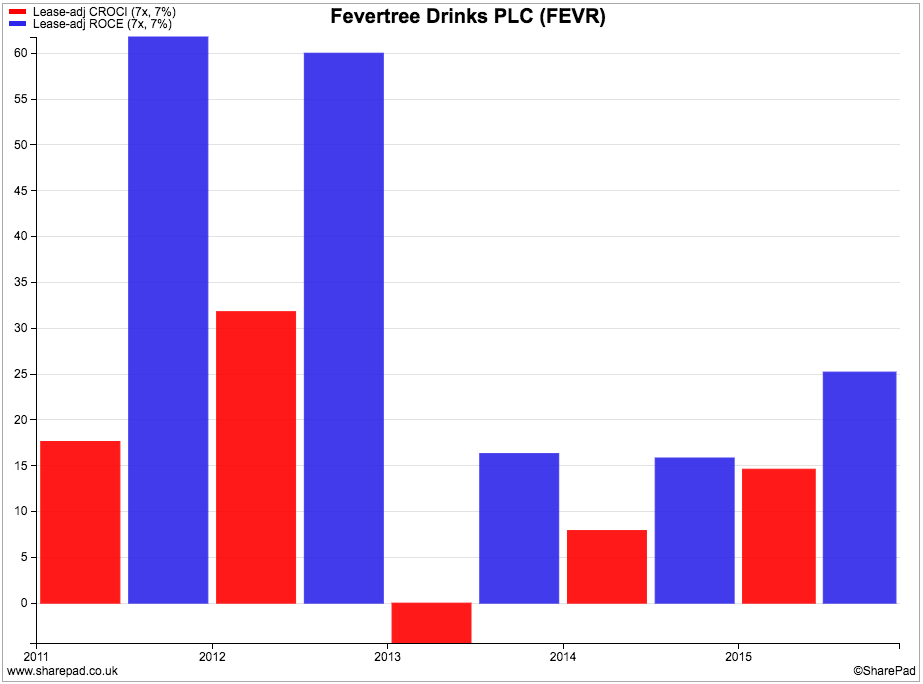

In terms of financial returns, the picture is also encouraging. ROCE in 2015 was over 25% and CROCI was nearly 15% with both measures on a rising trend. The big dip in ROCE and CROCI seen in 2013 can be explained by Lloyds Bank paying £45m for a stake in the business which increased the assets of the company.

Cash flow performance

If there is a lesson for investors in fast growing AIM shares during the past few years then it is to focus their attentions on a company's cash flows rather than its profits if they want to avoid losing money.

I do this anyway regardless of the company but most people still talk about profits and profits growth. Sadly, some AIM companies' profits have been proved to be a work of fiction and the picture of a fast growing company was never true.

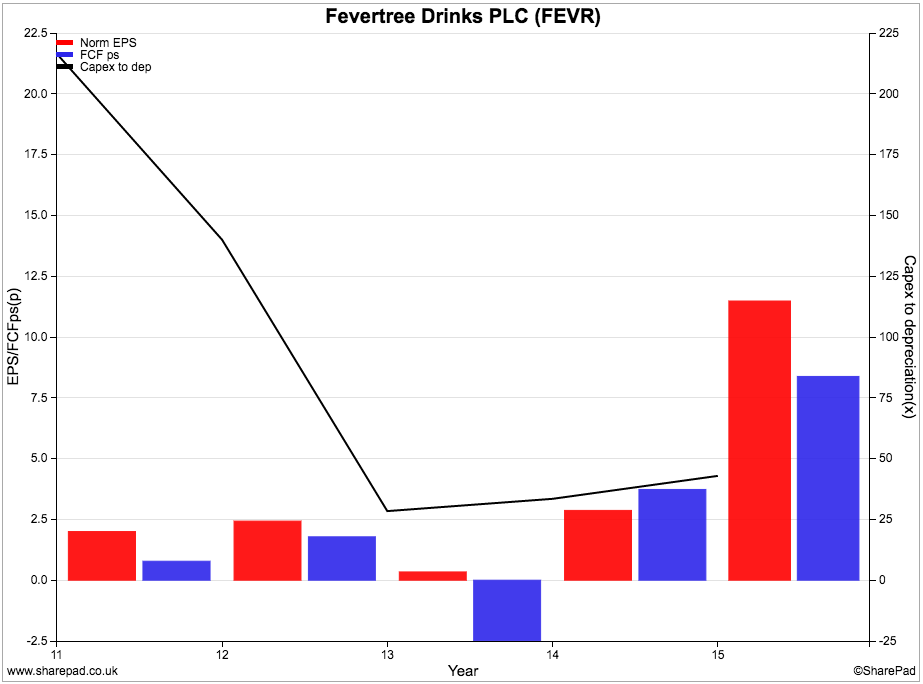

With Fevertree, we already know from the CROCI figure of just under 15% that the company does generate free cash flow but let's have a closer look to see what's going on in this area.

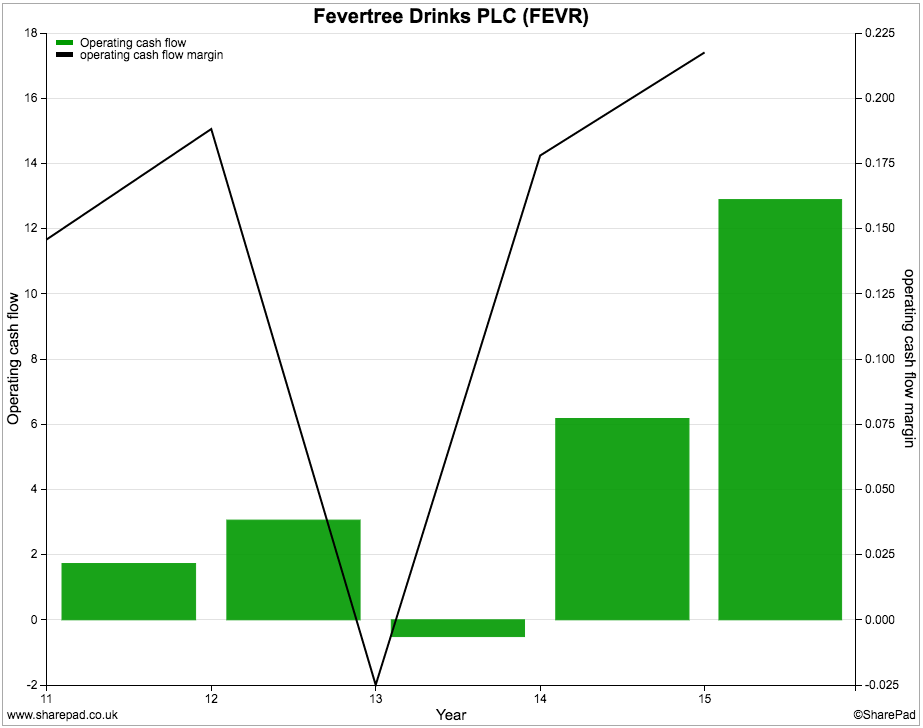

One of the key things you are looking for with a company with fast growing profits is to see the operating cash flow following suit. You also want to see a high proportion of turnover turned into operating cash flow. We can see from the chart below that Fevertree's operating cash flow and cash flow margin surged in 2015 but in 2013, cash was flowing out of the company from selling bottles of mixer drinks.

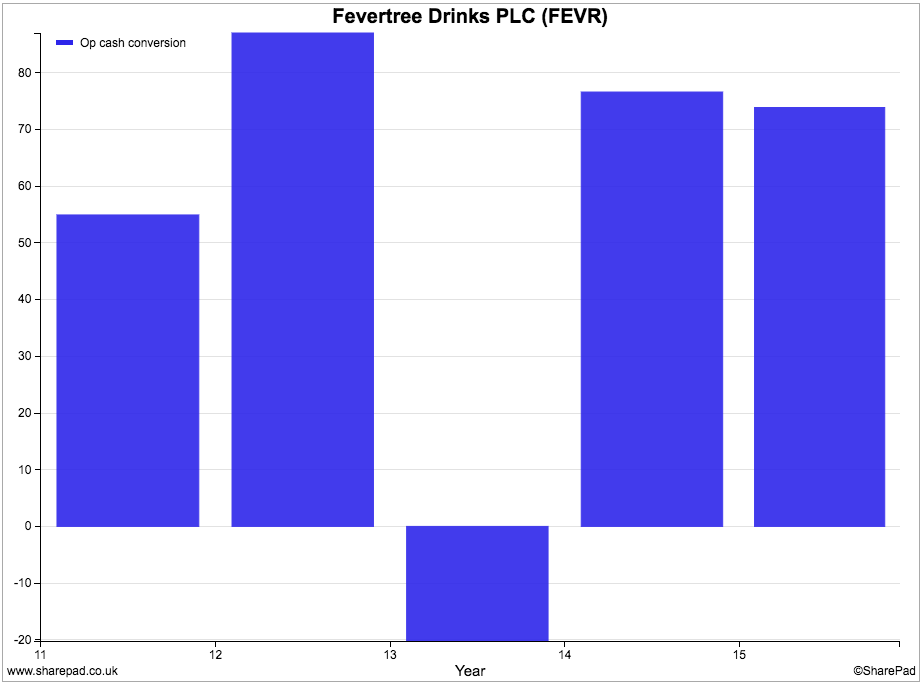

The other thing to keep an eye on is the ability of a company to turn its operating profits into operating cash flow. Ideally, this cash conversion ratio should be as close to 100% as possible - if not more.

This is not the case with Fevertree. It has struggled to turn its operating profits into operating cash flow as shown below. Is this a sign that its profits are less than believable?

Cash conversion is running at a rate of just over 70%. This is quite a low number and needs some investigating. We need to have a closer look at how Fevertree's operating cash flow is made up.

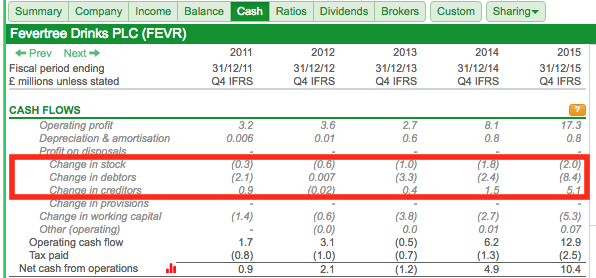

Looking at 2015's numbers we can see that £17.3m of operating profit converted into £12.9m of operating cash flow. As you can see from the table above, £2m of cash was eaten up by the build up of stocks. This is quite normal for a fast growing company. However, over £8m of cash was eaten up by selling goods on credit which was offset by getting £5m of cash in from delaying paying some bills.

The increase in debtors is a big number and could be worrying. One of the easiest ways for a company to grow is to offer more generous credit terms to its customers. Alternatively an increasing amount of debtors could be a sign of a powerful customer - such as a supermarket - flexing its muscles to get more credit and boosting its cash flow at the expense of the supplier's.

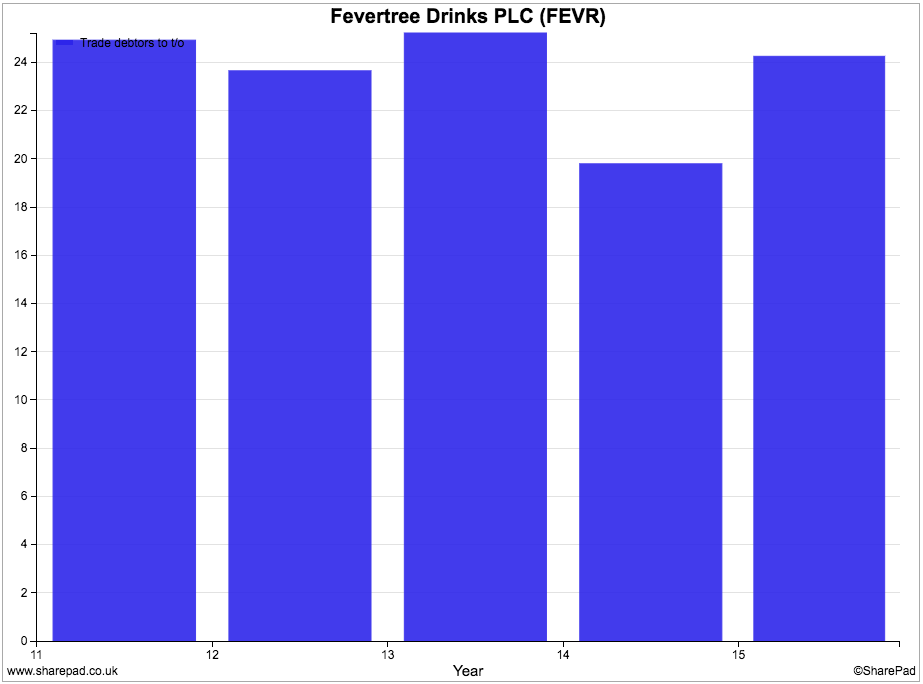

With Fevertree, I am not sure there is anything too much to worry about at the moment. The amount of annual sales unpaid at the balance sheet date was 24% in 2015 which is quite similar to levels seen in previous years. That said, there was a big jump in the ratio in 2015 and this will need to be monitored closely by investors. Ideally you want to see a stable or falling ratio here.

Elsewhere, Fevertree's cash flow looks to be all in order. One particular strength is that the company spends next to nothing on capex (new assets). This is because it has outsourced the making, bottling and distribution of its drinks to third parties.

Most of the production and bottling of the drinks is done by a company called Brothers Drinks based in Shepton Mallet in Somerset which also has a small ownership stake in Fevertree. This means that Fevertree has been able to grow without having to spend lots of money on new assets which in turn gives it a very good chance to produce lots of free cash flow - at least for the next few years. I'll have more to say on this arrangement later.

As you can see from the chart above, Fevertree's free cash flow per share has been growing strongly although it is below earnings per share due to the working capital issues I talked about earlier.

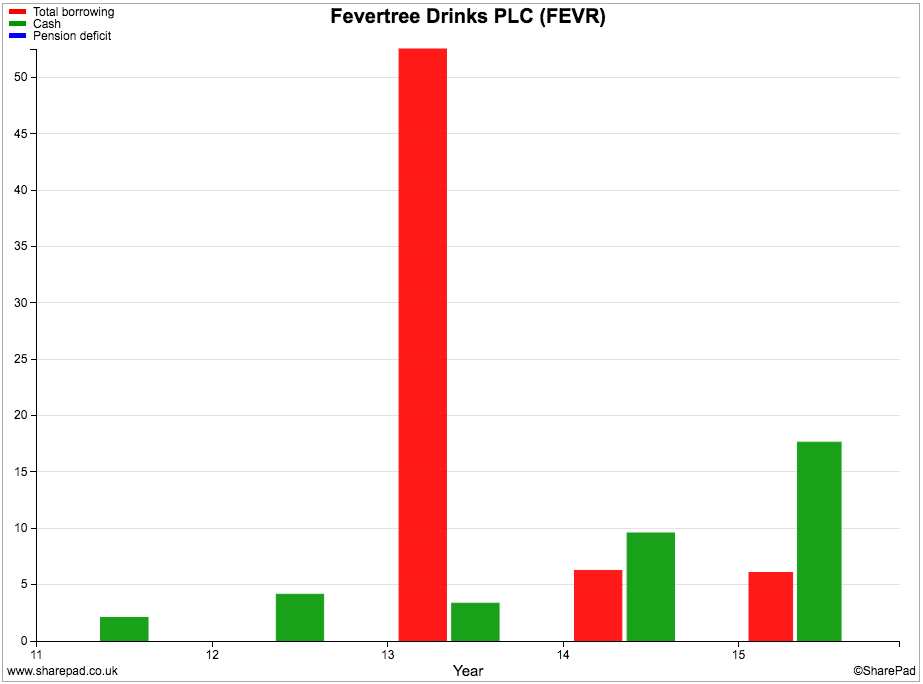

Debt has been virtually paid off

The company's financial position is very strong. All borrowings are likely to be paid off in 2016 and the cash balance is expected to continue building up. This gives the company money to invest in further marketing and branding to build up the sales of the business in new and existing markets.

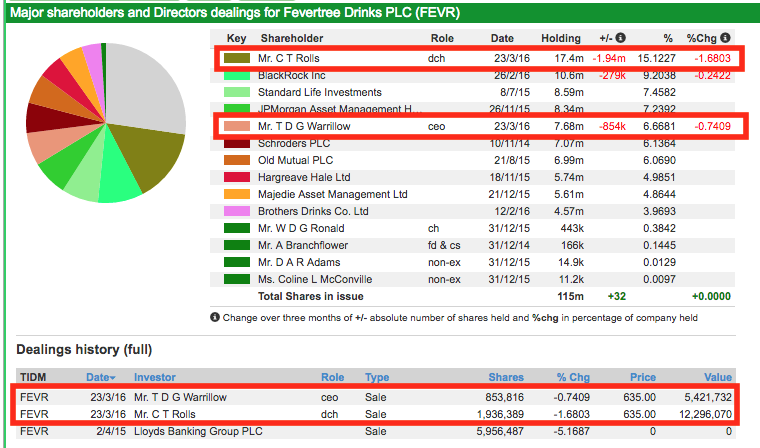

Director Dealings

The founders Charles Rolls and Tim Warrillow have already made plenty of money from Fevertree. As you can see, they sold a significant amount of shares back in March. This is not usually a good sign but was explained as a way to broaden the shareholder base of the company. Both of them still have a significant amount of money invested in the company and between them own over 20% of the shares outstanding.

Investors should also take heart that many prominent professional fund managers have significant stakes in the company.

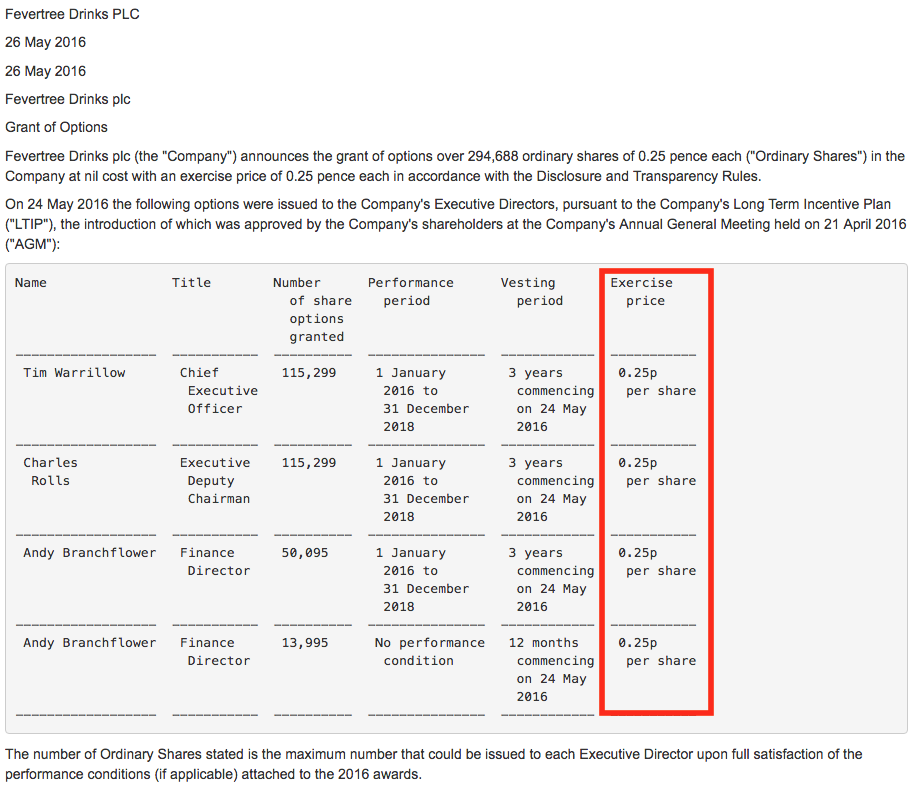

However, what is a little bit disappointing is that the directors have recently been awarded some very generous share options which allows them to buy more shares in the company for virtually nothing. This is essentially free money.

Valuation and Future prospects

So we know that Fevertree has been doing well. Its last trading statement on 19th May said:

"The Board is pleased to announce that momentum seen in 2015 has continued into the start of 2016. Fevertree has outperformed expectations in the first four months of the year as the premium mixed drink movement continues to grow. This strong performance, alongside a currently favourable foreign exchange environment, has also driven gross margin improvements.

Given the strong sales in the period to date, the Board anticipates that the results for the full year ending 31 December 2016 will be materially ahead of market expectations."

The company seems to have developed a nice habit of beating expectations which is one of the reasons why its share price has gone up so much. City analysts are expecting another year of rapid profits growth in 2016. It would not surprise me if the expected EPS growth of only 10% in 2017 is revised upwards in the coming months.

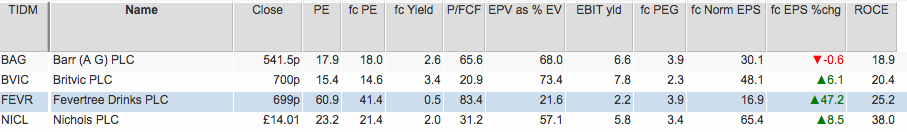

The problem facing potential investors in Fevertree shares is that it has done so well and is expected to keep on doing so that the valuation of its shares is very high. Below, you can see how the company's shares stack up on a number of different valuation measures and how they compare with other drinks companies.

If you are a bargain hunter then Fevertree shares are probably a bit too pricey for you. One of the most interesting valuations is the earnings power value as a percentage of the current enterprise value (EPV as % EV).

What this is telling you is that if Fevertree's 2015 profits stayed the same forever, the value of that scenario would only explain 21.6% of its current enterprise value. Put another way, nearly 80% of its current value is explained by the expectations of future profit and cash flow growth. For more on earnings power values click here.

If you look at more simple measures such as the PE ratio, the shares trade on over 40 times forecast EPS at a share price of 699p. Again this is factoring significant profit growth for years ahead.

One of the things you can do when you come across a company with a rich valuation such as this is to play around with some growth projections and see what the valuation of the shares would look like in a few years time.

So if we take the 2016 forecast EPS of 16.9p (which SharePad tells me was updated on the day of the 19th May trading statement so it is up to date) and grow it by 20% per year until 2020. This would give EPS of 35p in 2020 or a PE of 20 times at the current share price of 699p. Many would still see this as an expensive valuation and a clear example of how much future profit growth is expected at the current share price.

Can Fevertree grow enough to make it shares a good investment today?

So how is Fevertree going to live up to the lofty expectations baked into its share price?

The company does seem to have a lot going for it. There is a growing trend towards premiumisation of products across the world. We are not just seeing it in spirits but also in things such as craft beers, cigarettes, chocolate and crisps. It seems that there are plenty of people out there who are prepared to spend a bit extra for a bit of quality.

As far as Fevertree's drinks are concerned it also has a lot of support from the spirits companies who see premium mixers as a great way to promote their drinks. Retailers and distributors also seem to like the products. Because Fevertree's selling prices are significantly higher than those of standard mixers, they can make fatter profit margins from selling them and so they will be keen to stock them.

There's also the fact that the premium mixer drink market is a very small part of the overall mixer market. Back in 2014, Ernst & Young estimated that premium drinks accounted for only around 2.5% of a total market value of around £7.7bn in annual sales. In places such as Spain the share of premium mixers is around 16%. If this can be repeated elsewhere then there could be a lot of potential future growth for Fevertree's products.

What about the risks?

That's all well and good. But there is rarely a free lunch in business and opportunities tend to come hand in hand with risks as well.

At the top of the list is the threat of competition. High profits and growth in a market can attract competition like flies to a pot of jam. Schweppes has launched a premium tonic in some markets whilst there are other brands building up a presence such as Q Tonic and Fentimans.

Fevertree does have a significant advantage in that it has been around for a lot longer in the premium market which has allowed it to become established. Bars may stock many types of gin but they are unlikely to stock lots of different tonics. It might be hard for other brands to displace Fevertree.

The company itself has not been resting on its laurels. It is continually bringing out new products such as Fevertree Light - a low calorie tonic with no artificial flavours - and small cans that are being sold on British Airways and easyJet flights. The company is also trying to promote its products as a standalone drink and not just as a mixer.

Elsewhere, there are some significant risks which could pose problems for the company in the future.

One is the reliance on Brothers Drinks to produce its products. Can this company cope with rapid growth in Fevertree's sales? Fevertree says that Brother has enough capacity for now and can add more if needed. However, if it runs out of capacity Fevertree may struggle to keep on growing.

To counter this issue, Fevertree has recently started using another third party drinks maker in the UK and has its canned drinks made in Holland. This should reassure investors given that Fevertree's outsourced production and the cash flow benefits this brings is a major attraction of the shares.

The other thing to be watched is the company's supply chain, particularly for ingredients such as sugar, quinine and ginger root. The company does not seem to have any long-term supply agreements or hedging and it is therefore exposed to commodity price risks. Would it be able to pass on cost increases in higher selling prices? Big customers such as supermarkets and hotels might resist and have considerable clout to do so.

It is also exposed to foreign exchange rate risks. A fall in the value of the pound would push up the cost of ingredients as they are bought from overseas. To counter this, its products would become cheaper in overseas markets which given that they account for two thirds of sales would soften the blow. The opposite would occur if the value of the pound goes up - ingredients costs would fall and selling prices overseas would go up.

Finally it is worth noting that Fevertree's sales are seasonal. It sells more in the summer and at Christmas which means its profits are weighted to the second half of its financial year. Bad summer weather or a decline in consumer confidence - meaning people buy less expensive mixers - could hurt sales and profits.

To sum up

- Fevertree's shares have gone up a lot in a very short time.

- The company's sales and profits are growing rapidly.

- ROCE and CROCI are already at high levels and have been improving.

- The company has struggled to turn its profits into cash.

- Trade debtors as a percentage of sales are high and the trend needs to be watched.

- Outsourced production means that the company's capex bill is tiny. This is helps the company generate free cash flow.

- The company should be debt free in 2016.

- Current trading is very good.

- The valuation of the shares is very high and factors in very high profit growth for the foreseeable future.

- The company has good products and a strong market position.

- There seems to be lots of growth potential in its markets.

- Capacity issues are a risk to growth.

- Competition could increase.

- There is significant commodity price and foreign exchange rate risk.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.