Lower your risks with high quality companies

One of the fascinating things about investing in shares is that there are lots of ways to try and make money. Very few - if any - investing strategies will work all the time though. However there is one important thing that you can try to do every time you buy a share of a company - control your risks. One of the best ways you can reduce your risk is to buy the shares of top quality companies.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Why high quality companies are less risky

Warren Buffett is often cited as being a value investor (although these days he's probably more of a quality/growth investor). Buffett started out buying shares in companies that looked very cheap relative to their profits or assets. This was known as cigar butt investing which Buffett learned how to practice from his mentor Benjamin Graham.

Cigar butt investing is where beaten up shares with the potential to go up in price are bought and then sold when a good profit has been made. This is like a cigar butt, picked up off the street, which has one last good smoke left in it. Once the share price has recovered or the cigar has been smoked it has served its purpose.

This type of investing is very hard to practice in today's stock markets. The kind of shares that fit the description only tend to be plentiful in times of recession and bear markets when share prices are depressed. There are not many of them around at the moment.

Buffett initially made money buying distressed shares but the secret of his investment success has really been built around buying quality businesses and holding on to them for a very long time. Buffett learned this way of investing from a man called Philip Fisher who practiced this strategy and made a lot of money for his customers.

Fisher argued that high quality businesses were better investments with less risk because they could do things that their competitors could not - they had what is known as an economic moat. This allowed them to keep on making big profits in the future.

If you want to learn more about Philip Fisher then you can buy his book, Common Stocks, Uncommon Profits.

Economic Moats Explained

Most of us associate moats with castles where they have been very useful. Those big ditches of water represent a castle's first line of defence against intruders. The bigger and deeper it is, the better.

When you are looking for a company to invest in, moats are important here too. Not the ones full of water, of course, but economic moats.

If you buy anything be it a car, a kitchen or even a slice of a company what you'll tend to find is that the ones that are built better will last longer and will therefore be more valuable. When it comes to companies the main reason why this happens is because it has an economic moat - something that allows it to keep on making lots of money and stops other companies from stealing its customers.

Companies with economic moats are highly sought after.

By owning - at the right price - these businesses for a long time the investor can compound the high returns it makes and potentially become very rich. That's why Buffett invested lots of money in companies such as Coca-Cola, Gillette and American Express.

How to find a company with a moat

One of the most straightforward ways to identify a company with an economic moat is to look for ones with a consistently high return on capital employed (ROCE). Good companies earn lots of profit as a percentage of the money they invest. However, high returns attract competitors who want a slice of the cake. So if a company has had a high ROCE for a long period of time - say ten years or more - that suggests that it could have a moat that offers a strong defence against competition.

It's all very well looking at numbers. But it's also important to understand what lies behind them. There are lots of things you can look for which explain the existence of a moat. One of the chief reasons is the existence of branded products. Brands are a symbol of quality that customers identify with and often stay loyal to because they trust them. They can take years to build up and can be defended with large advertising budgets that a prospective competitor would struggle to match.

Related to brands are products that are habit-forming such as a particular brand of tobacco, alcoholic drink or products that are deeply entrenched within a business such as Microsoft Office software. Here, users are loathe to change their habits because of the cost or hassle of doing so - which means a lot of repeat business for the vendors.

Patents are another example. These protect products such as prescription drugs or technologies from competition. They explain why pharmaceutical companies have had very high returns. However, bear in mind patents do not last forever. They are also of little use if a better product comes along.

Look for companies that might have cost advantages. The sheer size of a company can give rise to what is known as economies of scale. This often means that they can spread the cost of making something over lots of units so they can make things cheaper than smaller competitors. They may also be able to buy goods and services cheaper as their size allows them to obtain bigger discounts with suppliers.

Bear in mind that the management of a company should not really be seen as a moat. A moat usually comes from a company's assets and products. That's not to say that good management doesn't matter. It does. However legendary US investor Peter Lynch offered some good advice when he said, "invest in a business that any idiot could run because some day one will."

How to screen for economic moats in SharePad and ShareScope

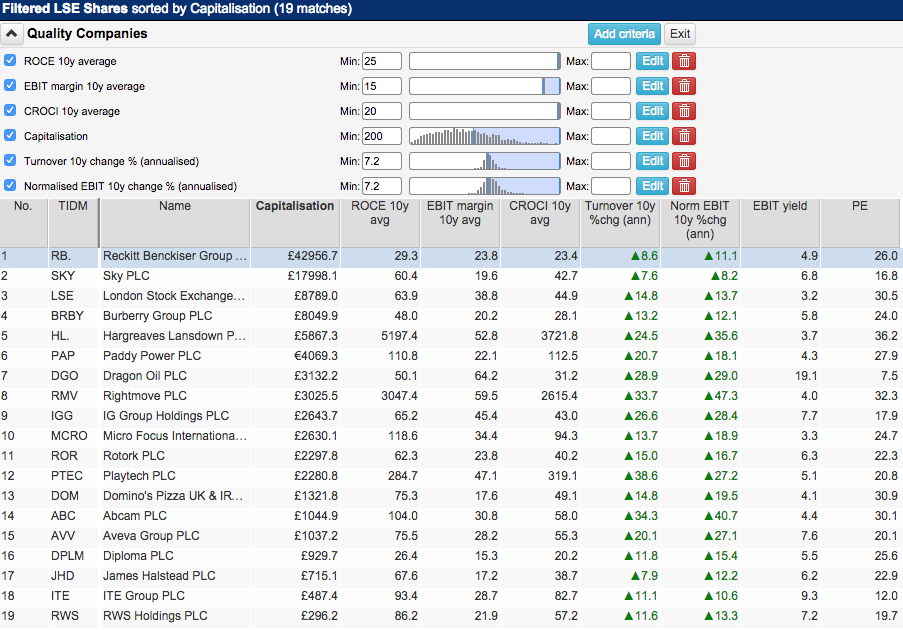

So how do you go about finding companies that might have economic moats in SharePad and ShareScope? There's no hard and fast rules as to what financial metrics you should use but I've put together a screen in SharePad below to try and help find some possible gems on the London Stock Exchange.

I am trying to find companies that have been able to churn out a consistently impressive financial returns for at least ten years. To do this, I am asking SharePad to calculate a lot of ten year averages for certain financial ratios.

Return on capital employed (ROCE)

A high sustainably high ROCE can be a sign that a company has an economic moat and that competitors haven't been able to enter its markets and eat its lunch. Remember, we are looking for exceptional companies here, so I've set a minimum ten year average ROCE of at least 25%.

EBIT (profit) margin

Whilst a high ROCE is probably your first port of call when looking for an exceptional company, the measure does have a few drawbacks that you need to be aware of. Firstly, ROCE can be artificially high if a company has a lot of old, worn out assets on its balance sheet. When these are replaced with new ones, ROCE can be a lot lower.

Also, some companies rent rather than own assets. Many high street retailers tend to rent their stores and so the value of them is not usually counted when calculating their capital employed which can result in very high ROCE figures.

This means that sustainably high profit margins could be a better benchmark of an exceptional business. I've set a minimum ten year average threshold of 15% here. High profit margins can also make for safer investments as businesses with them can absorb rises in costs much better than those with wafer-thin margins.

Cash return on capital invested (CROCI)

Good businesses turn a high proportion of their profits into free cash flow which can be paid to investors. High free cash flow returns on money invested in a business is a hallmark of quality. I've set a minimum ten year average CROCI of 20%.

Sales and profit growth

I want to see companies that have been able to grow their sales and profits strongly over the last ten years. To double them in that time, they would have grown at an annual average rate of 7.2% (The Rule of 72: divide 72 by the annual growth rate to get the years required for something to double). You also need to do a bit of digging and see how companies have grown. Has growth come from existing operations or has the company been buying up a lot of companies? Buying companies is a less preferable way of growing, but we should be covering ourselves by insisting on a high ROCE and CROCI as well.

Market capitalisation

To try and limit my search for shares that should be easier to buy and sell on the stock exchange, I've set a minimum market value of a company to £200 million.

Some general pointers

What this screen is doing is telling us what has happened in the past. Whether the companies listed will be good investments depends on what happens in the future. Your next steps should be examining the trends of the measures listed in the filters. Are they trending up or down?

Look at the news and broker forecasts sections in ShareScope and SharePad to see if profits are still expected to keep growing. Above all else, try to understand what the company actually does to earn its money as this will help you to make a judgment as to whether the good times can continue. If you can't understand a business despite its impressive financial performance then move on to the next company.

When to buy moat companies

Finding companies with moats is more straightforward than buying the shares of them. That's because lots of people know about them and bid up the price of their shares. You can see this is largely true in the table above as PE ratios tend to be high and EBIT yields are low. Buying a great company at too high a price is one of the biggest mistakes an investor can make and usually ends in disappointment.

You have to be patient when buying good companies. Set yourself a target price and stick to it. You need to buy them when they suffer a temporary setback or when the stock market is crashing. In the meantime, building a watchlist of great companies to buy is time well spent.

See my article How to calculate a target price for buying shares.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.