How to tell if dividend shares are cheap or expensive

With interest rates on savings accounts and government bonds at virtually zero, it is not surprising that income-seeking investors have flocked to dividend-paying shares.

The share prices of solid dividend payers have gone up a lot but how do you know if they have gone up by too much?

In this article, I am going to show you a neat little formula that can help you weigh up the valuation of steady dividend payers.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Introducing Gordon's Growth formula

When it comes to dividend shares there is a relatively simple bit of maths that you can use to work out a share's value. It was devised by Professor Gordon of Toronto University and is commonly known in the investing world as Gordon's Growth formula.

To work out the value of a dividend paying share you need three key inputs:

- A forecast for next year's dividend per share (DPS +1)

- A constant rate of dividend growth forever (g)

- A minimum interest rate or required rate of return demanded by shareholders (r) - sometimes called a discount rate.

The value of a share is worked out as follows:

Share Price = (DPS + 1) / (r-g)

Say you have a share with a forecast dividend per share of 10p. Investors reckon it can constantly grow its dividends at 4% forever and want a minimum return to own the shares of 8% per year. The value of the share would be:

10p / (8% - 4%) = 250p

This simple approach is one of the Investor tools in ShareScope. Alternatively you can use a calculator or a spreadsheet.

The views on what returns investors should want and what the future growth will be is what professional investors spend hours trying to work out. Unsurprisingly, different investors have different views on these key issues. One person may think the shares are cheap whilst another might think they are expensive.

Which shares suit Gordon's Growth formula?

It is important to note that this little formula only works well for relatively mature companies with a constant rate of growth and won't work if the growth rate is more than the required return.

Shares that are well suited to this formula are the big established companies in the following sectors:

- Tobacco

- Pharmaceuticals & Healthcare

- Defence

- Utilities

- Telecoms

- Property

The formula is not suited to fast-growing companies or companies with volatile profits and dividends.

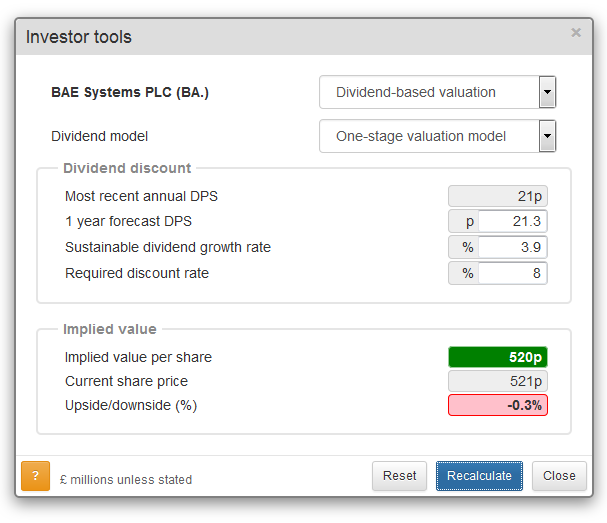

Here's a real world example using the dividend valuation tool in ShareScope:

ShareScope has taken the consensus forecast dividend per share from City analysts but you can use your own forecast if you want to. I've assumed a constant growth rate of 3.9% - more on this shortly - and an interest rate of 8%. On this basis, BAE Systems shares are fairly priced.

What I did here was to plug in a growth rate to solve for the current share price. This is because you can rearrange Gordon's Growth formula to work out what the constant rate of dividend growth is implied by the current share price.

I'm not going to get into the maths but to work out the implied rate of dividend growth of a mature company you take your required interest rate and take away from that number the forecast dividend yield.

Implied rate of growth = Required interest rate - forecast dividend yield.

At 521p and a forecast dividend per share of 21.3p, BAE has a forecast dividend yield of 4.1%. The implied rate of constant dividend growth is therefore:

8% - 4.1% = 3.9%.

This is exactly the same number used in the ShareScope valuation model above and proves that this formula works.

This also explains why shares with big dividend yields tend to have low rates of expected dividend growth or even falling dividend growth rates caused by dividend cuts.

Implied rates of dividend growth from high-yielding shares

Let's have a look at some of the current high-yielding shares in the FTSE 350 index. What I will do here is compare the implied rate of dividend growth with the growth being forecasted by City analysts.

I've prepared a table in ShareScope which gives me forecast dividend yields and forecast dividend growth. I've asked ShareScope to calculate dividend growth by comparing the forecast dividend per share in two year's time with next year's forecast dividend.

To avoid complicating matters, I have also excluded shares where dividend growth is being boosted by one off special dividends.

After exporting the table to a spreadsheet, I've then worked out the implied rates of dividend growth at different rates of interest. The thing to remember here is that the higher the rate of interest/return the investor wants, the bigger the rate of growth is required to justify the current share price and vice versa.

| Implied dividend growth at interest rate % | ||||||||

|---|---|---|---|---|---|---|---|---|

| Name | Close | fc Yield | fc DPS | fc growth % | 8 | 7 | 6 | 5 |

| Card Factory | 301.8p | 8.1 | 24.3 | 1.6 | -0.1 | -1.1 | -2.1 | -3.1 |

| Brown (N) Group | 187p | 7.6 | 14.2 | 0 | 0.4 | -0.6 | -1.6 | -2.6 |

| Lloyds Banking Group | 54.5p | 7.3 | 4 | 12.5 | 0.7 | -0.3 | -1.3 | -2.3 |

| Direct Line Insurance Group | 379.1p | 7.2 | 27.3 | -4 | 0.8 | -0.2 | -1.2 | -2.2 |

| HSBC Holdings | 547.5p | 7.1 | 39 | 0 | 0.9 | -0.1 | -1.1 | -2.1 |

| Redefine International | 44.09p | 7 | 3.1 | 3.2 | 1 | 0 | -1 | -2 |

| BP | 436.85p | 7 | 30.5 | 0 | 1 | 0 | -1 | -2 |

| Carillion | 288.1p | 6.7 | 19.4 | 4.1 | 1.3 | 0.3 | -0.7 | -1.7 |

| PayPoint | 984.5p | 6.7 | 66 | 2 | 1.3 | 0.3 | -0.7 | -1.7 |

| Legal & General Group | 215.6p | 6.7 | 14.4 | -4.9 | 1.3 | 0.3 | -0.7 | -1.7 |

| Phoenix Group Holdings | 855p | 6.3 | 54.1 | 1.3 | 1.7 | 0.7 | -0.3 | -1.3 |

| Royal Dutch Shell | £20.17 | 6.2 | 124.3 | 14.3 | 1.8 | 0.8 | -0.2 | -1.2 |

| Aberdeen Asset Management | 330.8p | 5.9 | 19.5 | 0 | 2.1 | 1.1 | 0.1 | -0.9 |

| Petrofac | 840.5p | 5.9 | 49.4 | -0.6 | 2.1 | 1.1 | 0.1 | -0.9 |

| SSE | £15.55 | 5.9 | 91.2 | 2.1 | 2.1 | 1.1 | 0.1 | -0.9 |

| Debenhams | 59.9p | 5.8 | 3.5 | 0 | 2.2 | 1.2 | 0.2 | -0.8 |

| Pearson | 896.5p | 5.8 | 52 | 0 | 2.2 | 1.2 | 0.2 | -0.8 |

| Marks & Spencer Group | 348.8p | 5.7 | 19.9 | -2.5 | 2.3 | 1.3 | 0.3 | -0.7 |

| Aviva | 420p | 5.6 | 23.6 | 13.6 | 2.4 | 1.4 | 0.4 | -0.6 |

| Stagecoach Group | 218.1p | 5.6 | 12.2 | 5.7 | 2.4 | 1.4 | 0.4 | -0.6 |

What you then do is compare the forecast rate of growth from analysts with the implied rate of constant growth implied by the share price.

Take Card Factory as an example. With an 8% required return, the implied rate of growth is -0.1%. With a 5% interest rate the rate of constant decline increases to -3.1%. City analysts are predicting growth of 1.6%.

They might be wrong or long-term growth is unsustainable and the dividend will have to be cut. However, if you do some more research on Card Factory and think that the dividend is sustainable then this formula is telling you that the shares are slightly cheap.

The basic rules of thumb to remember are:

- Shares possibly cheap if forecast growth is more than implied growth.

- Shares possibly expensive if forecast growth is less than implied growth.

Remember this formula is only suited to large or mature companies with lowish rates of constant growth assumptions forever. In the long run, profits and dividends cannot grow faster than the long run growth of the economy so implied growth rates of more than 5% per year (real growth plus inflation) are probably not realistic.

You need to spend some time trying to work out whether a company's dividend can grow or not. Check out My 5 rules for safe dividend investing" for how to do this.

Are some popular dividend shares overvalued?

I've applied this analysis to some popular dividend shares to see if they look cheap or expensive.

| Implied dividend growth at interest rate % | ||||||||

|---|---|---|---|---|---|---|---|---|

| Name | Close | fc Yield | fc Dps | fc growth % | 8 | 7 | 6 | 5 |

| SSE PLC | £15.55 | 5.9 | 91.2 | 2.1 | 2.1 | 1.1 | 0.1 | -0.9 |

| Centrica PLC | 235.7p | 5.2 | 12.2 | 2.5 | 2.8 | 1.8 | 0.8 | -0.2 |

| Royal Mail Group PLC | 516p | 4.4 | 22.8 | 5.3 | 3.6 | 2.6 | 1.6 | 0.6 |

| Intu Properties PLC | 311.3p | 4.4 | 13.7 | 0 | 3.6 | 2.6 | 1.6 | 0.6 |

| British Land Co PLC | 665p | 4.4 | 29.2 | 2.4 | 3.6 | 2.6 | 1.6 | 0.6 |

| Vodafone Group PLC | 239.7p | 4.3 | 10.3 | 3.9 | 3.7 | 2.7 | 1.7 | 0.7 |

| AstraZeneca PLC | £51.44 | 4.1 | 208.7 | 2.2 | 3.9 | 2.9 | 1.9 | 0.9 |

| Pennon Group PLC | 902p | 4 | 36.1 | 6.9 | 4 | 3 | 2 | 1 |

| National Grid PLC | £11.02 | 4 | 44 | 2.5 | 4 | 3 | 2 | 1 |

| BAE Systems PLC | 533.5p | 4 | 21.3 | 2.3 | 4 | 3 | 2 | 1 |

| United Utilities Group PLC | £10.03 | 3.9 | 38.8 | 2.6 | 4.1 | 3.1 | 2.1 | 1.1 |

| Electrocomponents PLC | 309p | 3.8 | 11.8 | 0 | 4.2 | 3.2 | 2.2 | 1.2 |

| Tate & Lyle PLC | 733.5p | 3.8 | 28 | 0 | 4.2 | 3.2 | 2.2 | 1.2 |

| Imperial Brands PLC | £41.16 | 3.8 | 155 | 10 | 4.2 | 3.2 | 2.2 | 1.2 |

| British American Tobacco PLC | £49.81 | 3.4 | 171.7 | 9.4 | 4.6 | 3.6 | 2.6 | 1.6 |

| Severn Trent PLC | £24.57 | 3.3 | 81.6 | 2.1 | 4.7 | 3.7 | 2.7 | 1.7 |

Using an 8% interest rate quite a lot of these shares look expensive.

Are utility shares overpriced?

The shares of National Grid, United Utilities and Severn Trent all have implied constant dividend growth rates that are higher than forecast dividend growth rates. Could this be a sign that these shares are looking expensive?

Maybe not.

The bulls of these shares would argue that they are very similar in makeup to bonds. They have predictable cash flows that can grow in line with inflation. Some would argue that they are inflation-linked bond proxies.

Given that index-linked gilts have negative yields, the yields offered by these shares could be very attractive.

But maybe they are overpriced.

These companies are mature, regulated utilities where the prices they can charge their customers are regularly reviewed by regulators. Once a price control has been set then companies know with reasonable certainty how much they can pay out in dividends for the next few years.

These three companies have told investors that they expect to grow their dividends by the rate of inflation until the next price review. On that basis, the forecast growth of dividends of around 2% seems sensible.

But what happens when the regulator looks at prices at the next regulatory review? A key determinant of prices is the allowed rate of return that companies can earn on their assets. This is a function of interest rates.

With interest rates on bonds falling, the regulators might argue that electricity grids and water companies can get by with lower returns in future and tell them to cut prices. This might lead to lower profits and lower dividends. If this happens then the current rates of implied dividend growth might be too high.

I'll leave you to work this out for yourselves.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.