A simple investment strategy: how to find "good" companies

There are lots of ways to try and make money from the stock market but if you are looking for a simple and effective strategy then it is hard to look further than two very straightforward rules:

- Buy "good" companies

- Hold on to them for as long as possible.

My definition of a good company is one that earns very high returns on the money that it invests. It gets a large amount of profit back compared with the amount of money it has put into the business. In financial jargon, it makes a high return on capital employed (ROCE).

Think about this. If you are given the choice of having a bank account which pays an interest rate of 2% or one that pays 10%, which one would you choose? Of course, you would go for the one paying 10%.

If you were investing £1000, the 2% account would give you an annual income of £20, giving you a total of £1020 at the end of the first year. But the 10% account would give you £100 of income or £1,100 at the end of the first year.

That is a reasonably big difference. However, the difference between the two savings accounts gets even bigger the longer the money is invested for. This is due to the power of compound interest, where the annual interest income is reinvested back into the bank account each year to earn even more interest.

| Year | 2% | 10% |

|---|---|---|

| Starting | £1,000 | £1,000 |

| 1 | £1,020 | £1,100 |

| 2 | £1,040 | £1,210 |

| 3 | £1,061 | £1,331 |

| 4 | £1,082 | £1,464 |

| 5 | £1,104 | £1,611 |

| 6 | £1,126 | £1,772 |

| 7 | £1,149 | £1,949 |

| 8 | £1,172 | £2,144 |

| 9 | £1,195 | £2,358 |

| 10 | £1,219 | £2,594 |

| 20 | £1,486 | £6,727 |

| 30 | £1,811 | £17,449 |

After 10 years, the saver in the 10% account has more than twice as much money accumulated as the saver in the 2% account. After 30 years, the difference is nearly ten times.

This process can work in exactly the same way with companies. A company earning a high ROCE can reinvest all or some of its profits into new projects earning high returns and compound wealth for shareholders over time. This pretty much explains the investing approach of Warren Buffett and UK fund managers such as Nick Train and Terry Smith and also goes a long way to explaining why they have been so successful.

With some very simple analysis in SharePad, I am going to show you how this approach can pan out in the real world. Note that this is not the only way to invest and other strategies can have their time in the sun as well.

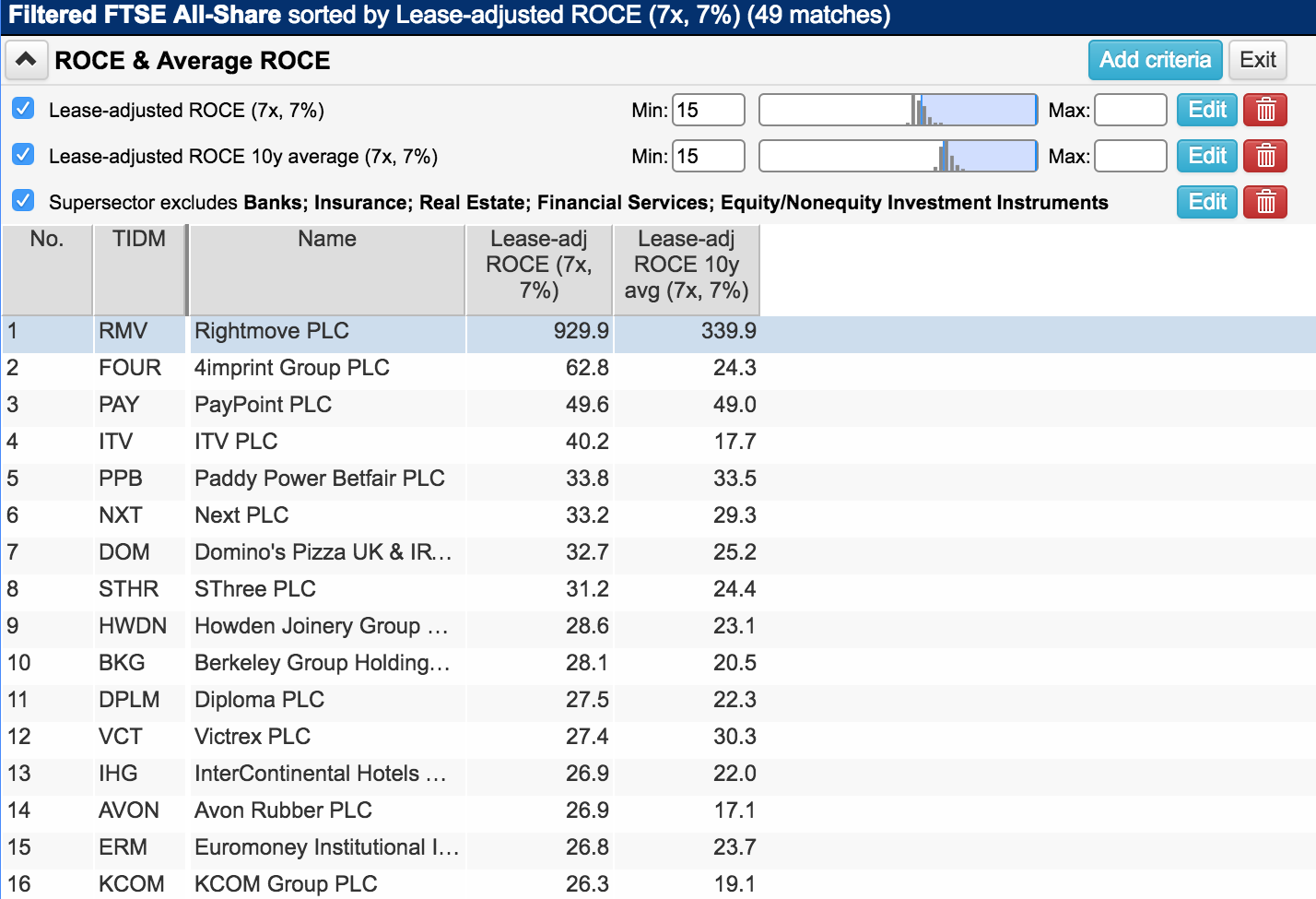

Below is a table showing the companies with the highest current ROCE in the FTSE All-Share index according to SharePad. I've excluded companies that have not been listed for 10 years.

Financial and Property companies are also excluded as they do not suit ROCE analysis. I've also calculated ROCE after adjusting for rented or leased assets. This means that companies which rent rather than own assets do not look better than they really are.

You can also see the total returns these shares have delivered for investors over the last decade.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Top 10 highest current ROCE

| TIDM | Name | ROCE % | 10y TR % |

|---|---|---|---|

| RMV | Rightmove PLC | 929.9 | 1010 |

| FOUR | 4imprint Group PLC | 62.8 | 361 |

| PAY | PayPoint PLC | 49.6 | 111 |

| ITV | ITV PLC | 40.2 | 90 |

| PPB | Paddy Power Betfair PLC | 33.8 | 830 |

| NXT | Next PLC | 33.2 | 233 |

| DOM | Domino's Pizza UK & IRL PLC | 32.7 | 564 |

| STHR | SThree PLC | 31.2 | 0.389 |

| PHTM | Photo-Me International PLC | 28.9 | 97.9 |

| HWDN | Howden Joinery Group PLC | 28.6 | 247 |

All of these shares have made money over the last decade, with some - such as Rightmove, 4imprint, Paddy Power and Domino's Pizza - delivering spectacular returns.

Top 10 lowest current ROCE

Now look at the companies with the worst current ROCE.

| TIDM | Name | ROCE % | 10y TR % |

|---|---|---|---|

| NANO | Nanoco Group PLC | -42.5 | -61.6 |

| OXB | Oxford BioMedica PLC | -38.3 | -89.6 |

| LMI | Lonmin PLC | -17.8 | -98.9 |

| IMG | Imagination Technologies Group PLC | -10.6 | 141 |

| CNE | Cairn Energy PLC | -6.8 | -12.1 |

| PSON | Pearson PLC | -5.4 | 48.9 |

| KMR | Kenmare Resources PLC | -5.4 | -96.6 |

| PFC | Petrofac Ltd | -2.8 | 187 |

| BP. | BP PLC | -2.3 | 14.3 |

| BBY | Balfour Beatty PLC | -1.8 | 3.76 |

Here the long-term performance of the shares has been more mixed with some big losers. However, you can also see that some companies such as Petrofac and Imagination Technologies have done well despite having poor current ROCE.

How to build a list of high-quality investment candidates

If you find this quality company approach to investing appealing, then you need to find a way of narrowing down your list of investment candidates to a manageable level. There are a couple of ways you can do this easily in SharePad.

When you come across a company with a high ROCE have a look to see if it has always been high or if returns are lumpy. You should look at the trend in ROCE over at least ten years.

I can't stress this point highly enough. One of the key - and first - things I look at with a company is how it has fared during a recession. I want to see if returns are steady and reliable or have a tendency to move from boom to bust. This means going back and looking at how the company was faring between 2007 and 2009. You can't find this out if you are relying on the current ROCE or even the last five years of historic data.

You can quickly do this by looking at the financial charts "carousel" at the bottom of the Financial Summary tab in SharePad (see below).

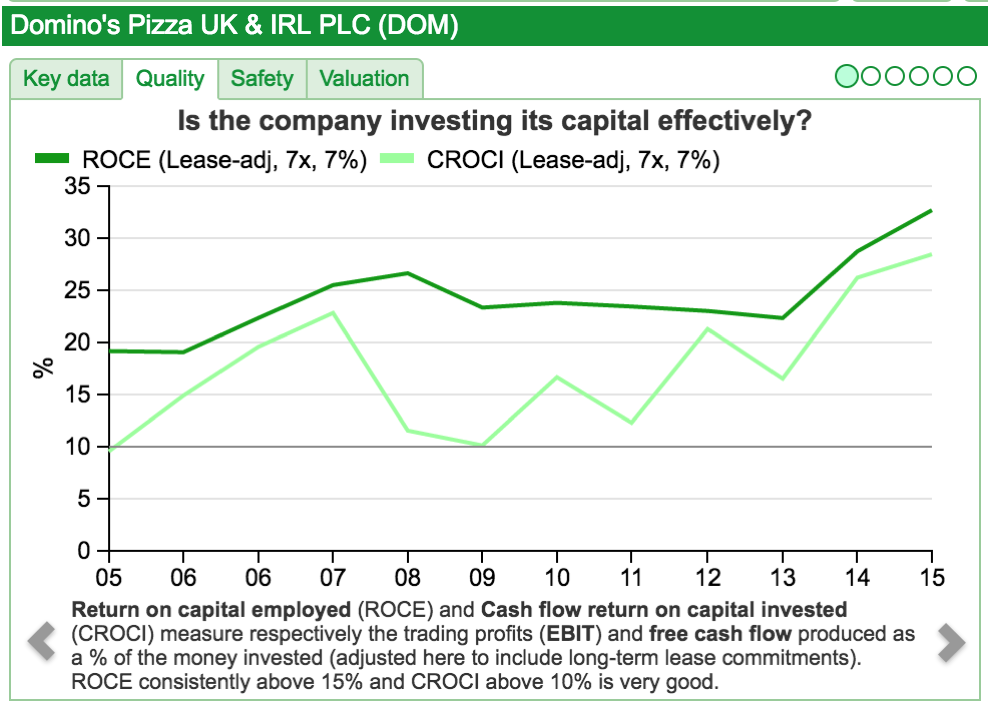

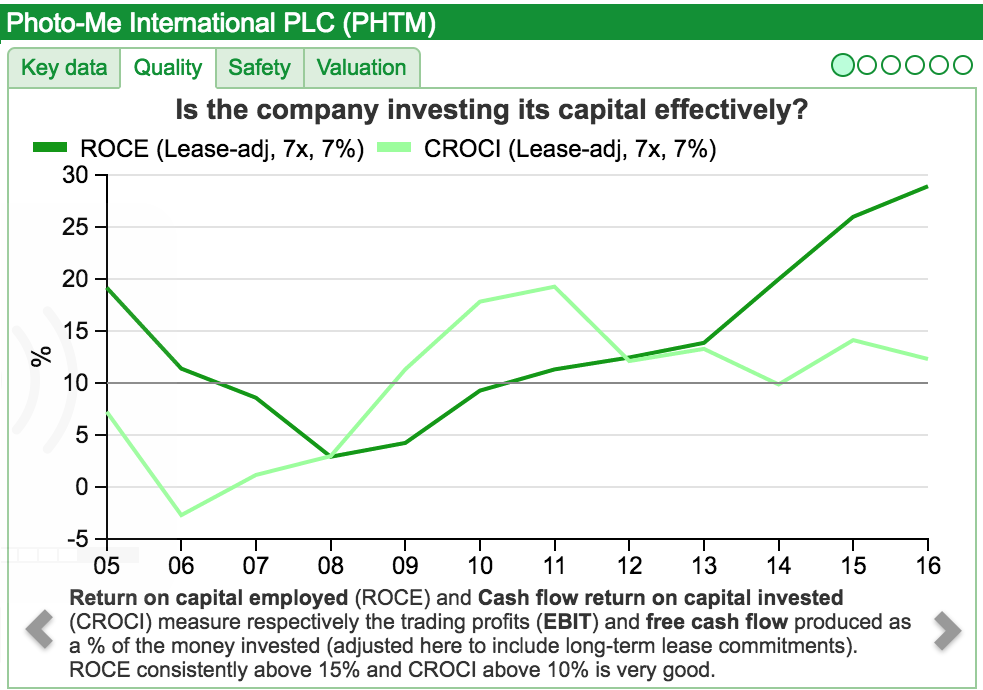

Click on the "Quality" tab on the carousel and scroll through to the chart which asks "Is the company investing its capital effectively?" This will show you its historical ROCE and cash flow returns on capital invested (CROCI).

Below you can see that Domino's Pizza has had a consistently high ROCE which is a good sign.

Photo Me's ROCE has been more erratic. Was the last recession a blip? Or will the next downturn see ROCE plunge again?

Another way to find consistently good companies is to build a very simple filter in SharePad. Here, I've asked SharePad to find me companies currently earning a ROCE of at least 15% - my minimum benchmark for a quality company - but which also have a ten year average ROCE of at least 15% as well. I want to look at companies which have been consistently good.

In a FTSE All Share Index of over 600 companies, only 49 companies pass this criteria which might just be telling us that there aren't that many outstanding businesses out there. However, there are probably enough to put together a solid, long-term (at least 10 years) portfolio. You don't need many good shares to get very good returns on your money.

What about growth and share valuations?

This article has covered the first step in a high quality investing approach - finding the shares you might want to buy. It has ignored two other important ingredients of a winning investment portfolio - the ability of the companies to grow in the future and the price you pay for their shares.

I will deal with these issues separately over the next couple of weeks.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.