Sector Watch: Industrial Machinery

For years people have banged on about the decline of British manufacturing. It is true that manufacturing's share of the economy has declined, but Britain remains the home of some world class engineering companies.

Companies in the Industrial Machinery sector are often referred to as "metal bashers" but that is to do many of them a great disservice. This is a sector that is home to some very good businesses - albeit ones whose fortunes tend to ebb and flow with the ups and down of the economy.

Let's take a look at how they have been getting on.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Are the shares in or out of favour?

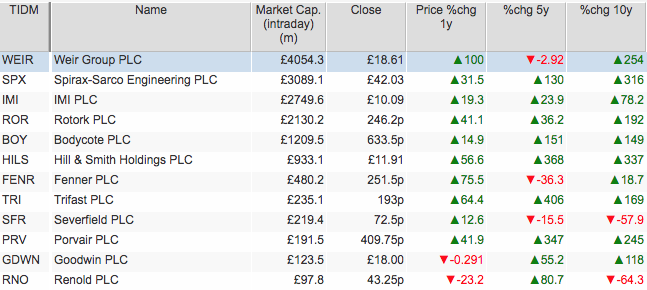

2016 has been a good year for most of the sector. Weir has been the standout performer with its shares doubling after a rough few years recently. It seems as if investors believe that the weakness in commodity markets is over and that the company can start growing again. This also explains the strong share price performance of Fenner.

As you can see, this is a sector that has produced some very dependable shares. Spirax, IMI, Rotork, Bodycote, Hill & Smith Holdings, Trifast and Porvair have all made money for shareholders over one, three and five years. Severfield and Renold have been poor long-term investments.

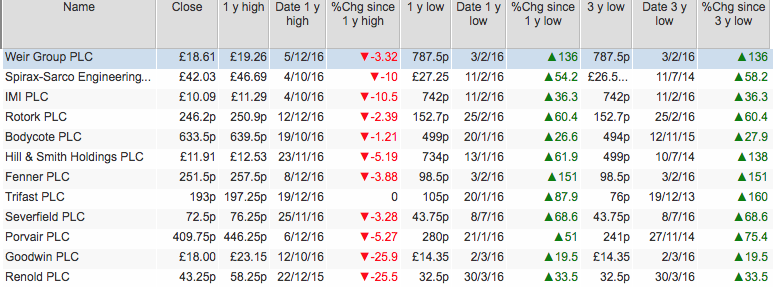

Sentiment towards shares in this sector is very positive. Many shares are close to their 52 week highs. Even laggards such as Renold are some way off their 52 week lows. This seems to be a sector that currently has a lot of momentum behind it. Will it continue in 2017?

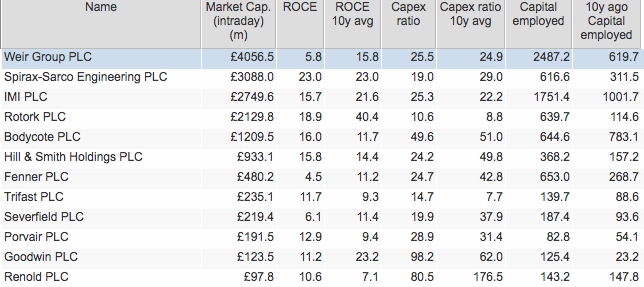

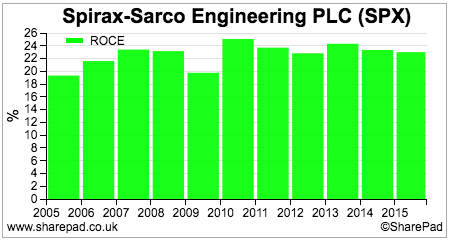

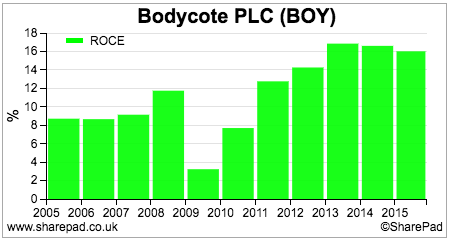

A look at the ROCE column shows that there are some decent businesses in this sector. Spirax-Sarco is the standout in terms of consistency. Its ROCE has been remarkably stable over the last decade.

The company has put this consistency to good use by doubling the amount of money invested in its business which has seen it post good rates of profit growth. If you were looking to invest money in the Industrial Machinery sector, then Spirax looks like a company to spend some time learning about.

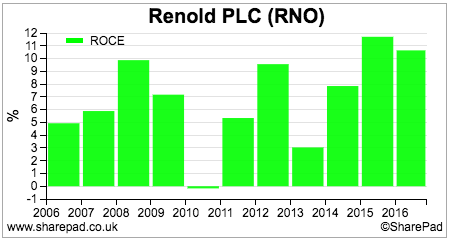

At the opposite end of the quality scale is industrial chain maker Renold. It has struggled to make acceptable returns on capital for a long time.

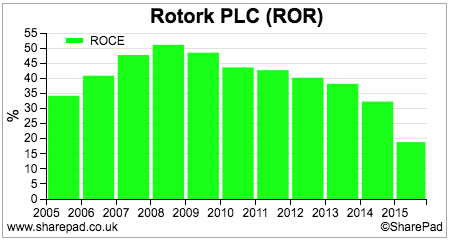

Rotork has had a difficult couple of years, having been the sector's star performer in term of ROCE. If the oil & gas sector starts ordering more of its valves and actuators then this may be the share to keep a keen eye on in 2017.

Arguably the key attraction of many of the companies in this sector is their low capital intensity. They don't seem to have to invest a lot of money to make money and this feeds through into very decent ROCE.

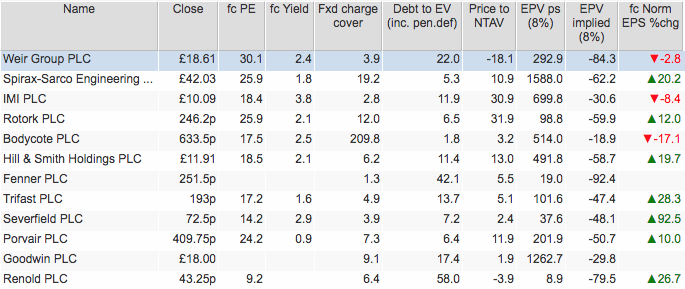

A capex ratio - the amount of trading cash flow ploughed back into the business - of below 30% is a desirable characteristic of a company. Rotork, Spirax and IMI stand out in this respect. Bodycote is very capital intensive. It is currently earning a high ROCE but it has been vulnerable in the past to recessions where ROCE has collapsed.

Valuation and Financial Position

There are no apparent bargains in this sector. High PE ratios attached to many shares are related to expectations of a strong recovery in earnings for some. Weir's shares could be seen as being very expensive based on the current expectations of EPS growth.

Given the strong share price momentum identified above and high valuations it might be the case that investors who are not already invested in this sector might have missed the boat.

An analysis of earnings power value (EPV) suggests that many shares have a lot of growth priced into them. I say this because current share prices are significantly higher than a value based on current trading profits staying the same forever (their EPV).

Renold and Fenner have quite high debt to enterprise value ratios which is partly due to their reasonably big pension fund deficits. If bond yields continue to rise and pension fund deficits fall, then these two shares could benefit. Fenner's fixed charge cover is low and close to the danger zone. It will need to grow profits to give itself some headroom on this measure.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.