Stock Watch: Treatt plc (LSE:TET)

Treatt plc has been in business since 1886. Based in Bury St Edmunds, the company specialises in making and selling products based on essential oils. It takes natural plant oils such as orange, lime, peppermint and eucalyptus and uses them to create flavours and fragrances to sell to consumer goods companies.

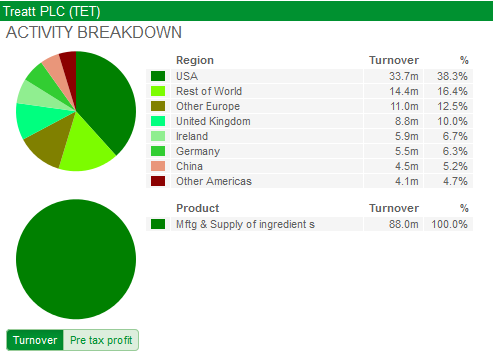

These flavours and fragrances end up in products such as air fresheners, cosmetics, shampoos, soft drinks and beers. Treatt has manufacturing plants in the UK, USA and Kenya and sells its products in over 90 countries. Its 2016 geographical breakdown of turnover (from SharePad) is shown below:

Its 2016 turnover breakdown by product area was:

- Flavour Fragrances (51%)

- Personal Care (19%)

- Beverages (19%)

- Other (11%)

Treatt's shares have been on a storming run recently as management's strategy of shifting the company's sales away from commoditised ingredients to more value added products seems to be paying off.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Financial Performance

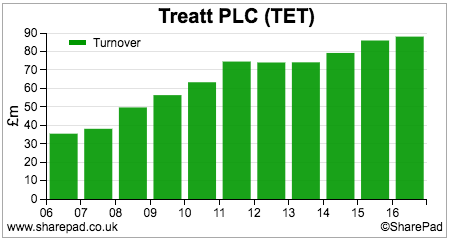

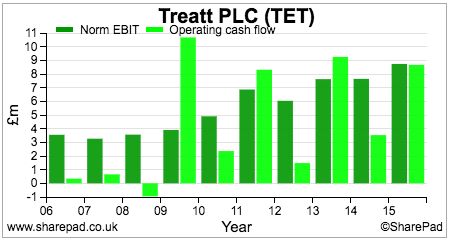

Turnover has been steadily increasing over the last five to six years but could hardly be considered to be stellar growth. Turnover growth was just 2.5% in 2016.

Of more importance is the company's ability to turn its turnover into profits.

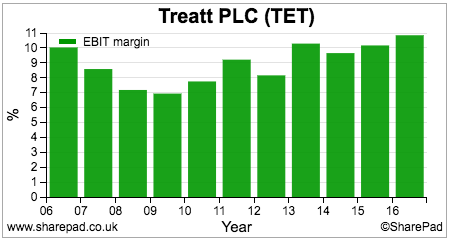

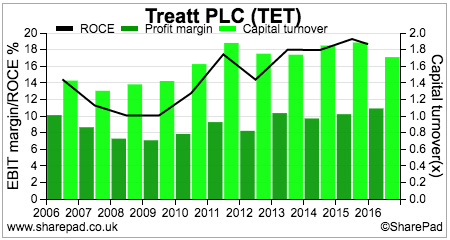

Trading profit (EBIT) margins are very respectable and were just under 11% in 2016. They have also been moving up as Treatt has been selling more innovative value added products which have higher profit margins.

High profit margins are a key sign of quality in any potential investment. Whilst Treatt is not earning the kind of profit margins achieved by big global consumer goods companies such as Reckitt Benckiser, the fact that they have been reasonably consistent and over 10% is a good sign.

Higher margins protect the investor from sudden profit declines and can make companies less risky. A company with profit margins of 11% is clearly more able to withstand a profit setback better than one with profit margins of 3%.

Treatt's profit margin history may also be telling us that its profits have been able to withstand the threat of competition, but more importantly the buying power of its large multinational consumer goods customers.

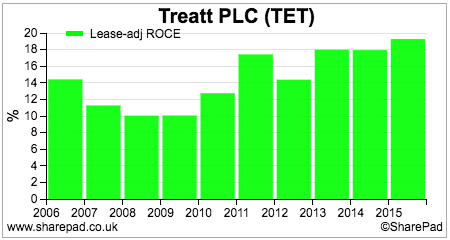

What is arguably more encouraging is that Treatt has been able to generate high and sustainable returns on capital employed (ROCE). This is often the sign of a very high quality business and one of the first things I look for in a company. Lease-adjusted ROCE in 2016 was 18.7% and has averaged 15% for the last ten years.

The other thing I spend a lot of time on when looking at a company is finding out how well profits and ROCE have held up in a recession. We can see here that there was a reduction in ROCE in the period 2007-09 which might be suggesting that the company suffered slightly. However, it is also possible that there was a business-specific issue behind the fall.

As with profit margins, ROCE has been on an upwards trend in recent years.

The Dupont analysis chart above is telling me that profit margins have been the main driver of ROCE improvement. Capital turnover (the amount of sales per £1 of capital employed) has declined slightly.

Improving profit margins are all well and good but significant growth requires meaningful sales growth as well. I'll have more to say on this important issue shortly.

Cash flow analysis

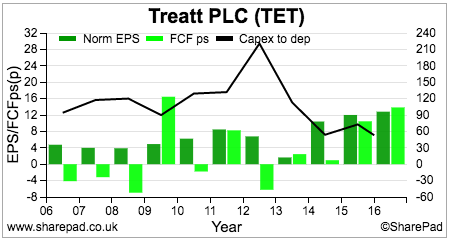

As well as having a high ROCE, I like to see companies turn a large chunk of their profits into free cash flow. Generally speaking, I want to see then turn at least 80% of their underlying or normalised earnings per share (EPS) into free cash flow per share over a 5-10 year period. Treatt has not been able to do this.

Free cash flow conversion has been good for the last couple of years, but the black line in the chart above shows that this has probably been due to a significant decline in capital expenditure (capex). This is leading me to take a closer look at Treatt's operating cash flow conversion - comparing operating cash flow with operating profits.

There is not a lot of consistency here. Operating cash flow and operating profit (EBIT) were broadly similar in 2016 but more often than not cash is less than profits.

Source: SharePad

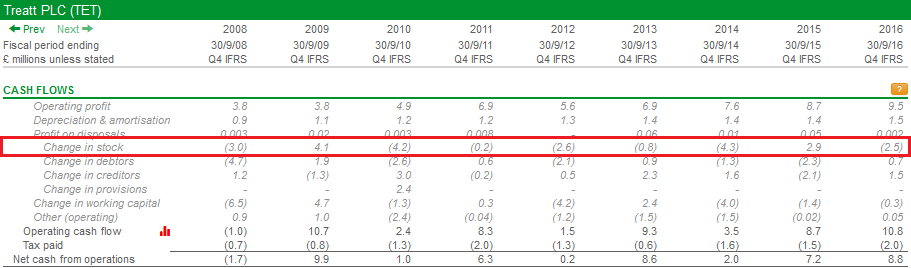

The main reason for this is cash outflows from the build up of stocks or inventories. Treatt is very upfront about this in its annual reports. The company has a deliberate policy of holding a significant amount of stock in order to maintain the security and reliability of its supply of products to its major customers.

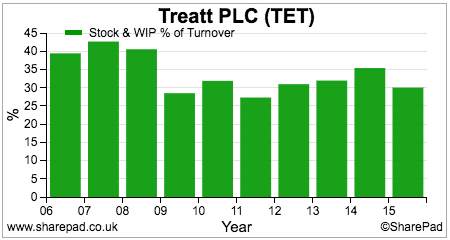

This is a cost of doing business with big powerful customers and is a slight negative for shareholders as it increases the amount of capital invested in the business. The ratio to keep an eye on is the level of stocks as a percentage of turnover. Ideally this should be stable or declining rather than rising which would potentially be a bad sign.

Treatt has a fairly high stock to turnover ratio but the chart above is telling us that it is being well managed. It is important to note that Treatt is not completely in control of its stock position. The price of its natural oil ingredients will be volatile and is also subject to changes in exchange rates at its balance sheet dates.

The changing value of its stocks does have the potential to introduce some volatility into its profits. 2016 profits benefitted from a £0.5m stock write back (this is where the value of a stock had been previously been reduced but had recovered in value) whereas 2015 profits saw a £1m hit to profits from a declining value of stocks.

I would expect Treatt's 2017 free cash flow conversion to be reasonable given the low capex spend. This will probably change in 2018 and 2019 when the company moves to a new production facility. This is expected to cost between £21m-£31m but will allow the company to become more efficient and serve its customers better. The size of this investment could also see a temporary decline in Treatt's ROCE, given that total capital invested - excluding leases - was only £55m at the end of 2016.

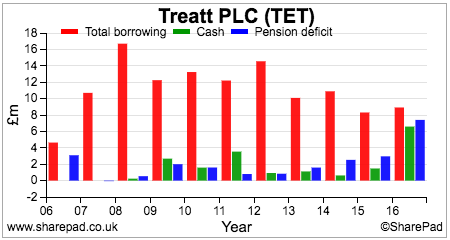

Financial position

Treatt's finances are in good shape. Net debt levels have been coming down and its fixed charge cover ratio is a very healthy 16.7 times. It does have a final salary pension scheme which was closed to further accrual back in 2012. The actuarial deficit is currently £1.7m which will see Treatt paying around £0.3m into the scheme - with a matching reduction in free cash flow - until it has been plugged. The company had been paying nothing into the scheme.

Current trading, future prospects and valuation

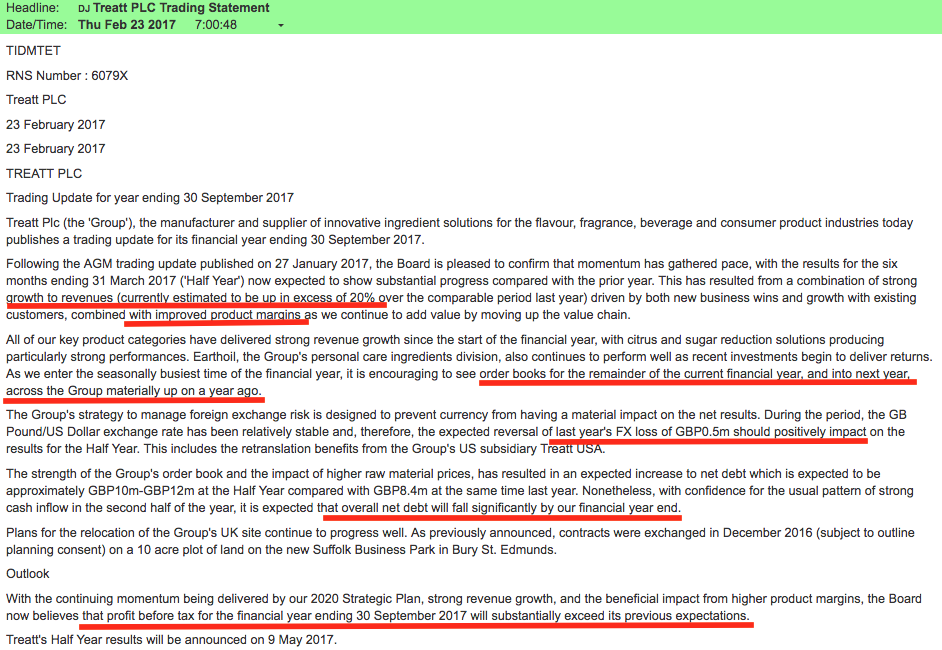

Treatt is clearly firing on all cylinders at the moment. A trading statement on 27th January 2017 confirmed that 2017 profits would be in line with expectations. This was followed by another update on 23rd February which said that profits would be materially ahead of expectations.

Turnover growth is currently growing at a rate of more than 20% due to new business wins and growth from existing customers. Profit margins are also higher as the trend of selling higher margin products continues.

Treatt is doing extremely well with its beverage customers at the moment. Its citrus flavours business is proving popular whilst it also has products that help reduce the sugar content of soft drinks. This could be a major growth driver for Treatt in the years ahead.

With its personal care products also selling well it is no surprise that order books are well ahead of last year. With good cash flow, net debt is expected to be lower at the year end in September.

This should feed through to materially higher profits.

When you are looking at relatively simple businesses with one main operating division it is possible to use trading and results statements to forecast annual profits. Don't be afraid to have a go at doing this yourself. It's a great way of getting you to think about the company you are analysing.

In just a few minutes it is possible to get a good idea of what Treatt's 2017 profits might end up looking like. In many cases, you will be pretty close to what city analysts are estimating.

The key to doing your own profit forecast is to look for keywords in a trading statement. Here's how I looked at Treatt below:

This led me to make the following simple 2017 profit forecast for Treatt:

Treatt: Simple 2017 profit forecast

| Treatt plc £m | 2016 | 2017F | Comment |

|---|---|---|---|

| Sales | 88 | 105.6 | 20% increase |

| EBIT | 9.549 | 11.616 | |

| Margin | 10.85% | 11% | Margins up slightly to reflect more sales of value added products |

| Net interest | -0.703 | -0.7 | Flat (conservative even though net debt expected to be down) |

| PBT | 8.85 | 10.92 | |

| Taxation | -2.18 | -2.67 | |

| Tax rate | 24.67% | 24.50% | Slight reduction to reflect lower UK rates |

| Profit after tax | 6.66 | 8.24 | |

| Shares | 51.895 | 52.7 | Higher no of shares |

| Underlying EPS(p) | 12.84 | 15.64 | |

| Dps(p) | 4.35 | 5.3p | |

| Dividend cover(x) | 2.95 | 2.95 |

EPS based on my forecast will be around 15.6p - 21.7% higher than a year ago. Based on a share price of 330p this equates to a forward PE of 21.1 times. That's pretty high but not out of kilter with the valuations of many high quality businesses. Profits growth is much better than many similarly valued are expected to achieve.

Based on dividend cover of 2.95 times (this is high as the company is conserving cash to pay for investment in the new UK facility), the shares have a projected yield of 1.6%.

Treatt may therefore be a share that might warrant some closer attention.

The key risk as far as I can see is the impact that the new production facility will have on the future growth and profitability of the business. It will see free cash flow take a significant hit in 2018 and 2019 whilst the big increase in capital employed will probably see ROCE decline in the short term.

On the positive side, new factory equipment should make the company more efficient with significant capacity for growth. If the trend to selling more innovative products continues then this could aid further profit margin improvements.

The other issue to be mindful of is exchange rates, particularly the £/US dollar rate. The devaluation of the pound has helped boost the sterling value of overseas profits but has also pushed up the cost of important natural oils. The impact of changing exchange rates on profits is not easy to predict.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.