Stock Watch: Elegant Hotels Group

Elegant Hotels is the owner and operator of a number of upmarket hotels on the Caribbean island of Barbados. The company has been in business for a while and was previously listed on the stock exchange under the name of St James' Beach Hotels until it was bought by a private equity firm in the late 1990s.

It returned to the stock exchange in May 2015 but its shares have not fared too well and are currently below the initial listing price. However, the company is likely to be interesting to some investors for three reasons:

- A very chunky dividend yield.

- The shares trade for less than their net asset value (NAV) per share.

- The well known entrepreneur Luke Johnson - of Pizza Express and Patisserie Holdings fame - owns 12.5% of the shares and has recently been appointed as a non-executive director.

Could this be a recipe for a money-making investment? I've decided to take a closer look.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

What do shareholders own a slice of?

Elegant owns seven upmarket hotels with a total of 588 rooms making it the biggest owner and operator in this sector in Barbados.

| Hotel | Location | Rooms/Suites | Market | Annual Revenue $m |

|---|---|---|---|---|

| Colony Club | Platinum/West Coast | 96 | 4-5 star luxury | 14.4 |

| Treasure Beach | Platinum/West Coast | 35 | 4 star Boutique/Adult | New |

| Tamarind | Platinum/West Coast | 104 | 4 star family | 10.5 |

| The House | Platinum/West Coast | 34 | 4-5 star Boutique/Adult | 5.3 |

| Crystal Cove | Platinum/West Coast | 88 | 4 star All inclusive | 10.6 |

| Waves | Platinum/West Coast | 70 | 4 star All inclusive | New |

| Turtle Beach | South coast | 161 | 4 star All inclusive | 13.4 |

| 588 |

With the exception of the Turtle Beach - which is on the south coast of the island - the hotels are all located along Barbados' prestigious west coast alongside the Caribbean Sea. It is known as the "Platinum Coast". Speaking from personal experience, this is a very nice part of the world to spend your holiday and also very expensive.

The cost of staying in these 4-5 star hotels doesn't come cheaply. To sum it up, if you have to ask the price of the drinks or the meals you probably can't afford it. 80% of Elegant's customer base is made up of reasonably to very affluent Brits who want somewhere upmarket to soak up the sun during the British winter.

The company also owns a posh Italian restaurant called Daphne's which is also located along the Platinum coast. The Daphne's name is courtesy of a franchise agreement with Caprice Holdings which expired a few years ago and doesn't seem to have been renewed (well I can't find anywhere saying it has). Elegant does own the freehold of the restaurant though.

Elegant also earns income from a management contract to run a hotel in Antigua and a sale and marketing contract with another hotel.

The business is very seasonal and makes the bulk of its money between September and March with peak revenues in the UK winter months.

How has the business been performing?

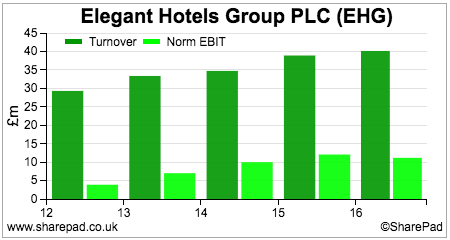

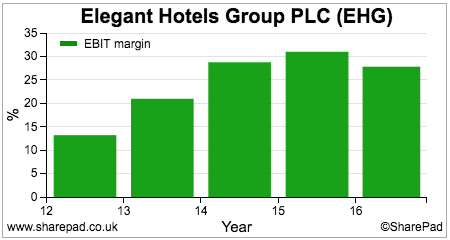

Up until 2016 the business had been ticking along quite nicely with revenues and profits growing.

Hotels need to be kept looking nice - especially the posh ones - so that customers want to keep staying there. This costs money - both in terms of operating expenses and investment in new assets or capex - but spend that money well and your hotels can fill up and you can start charging people more to stay there.

Elegant has been refurbishing its hotels over the years and this has helped it to keep customers reasonably happy. It has also been quite profitable. Charging an average of well over $400 per night comfortably covers the running costs of the hotel in peak season with plenty left over for the owners of the business. Elegant has been able to post some quite decent profit margins as a result.

Yet during the last 18 months, the company's fortunes have started to turn downwards. Elegant's hotel rooms are priced in US dollars and the fall in the value of the pound since June 2016 has significantly pushed up the cost of them for its British customers. So much so that some of them have stayed away.

The key performance measure of a hotel is its revenue per available room or REVPAR for short. REVPAR is calculated by multiplying the hotel's occupancy rate (how full it is) by its average room rate (how much it costs to stay there per night).

When times are good and demand for hotel rooms is high, a hotel can benefit from rising occupancy and higher room rates. REVPAR can increase rapidly as a result. Unfortunately, this process can work in reverse as well.

A hotel has a lot of fixed overheads and needs income to pay for them. In a weak market, room rates are discounted - or sometimes slashed - to keep the hotels reasonably full so that there is enough income being generated.

| Year | Occupancy % | Room rate $ | REVPAR $ |

|---|---|---|---|

| 2014 | 68.9 | 353 | 243 |

| 2015 | 68.4 | 373 | 255 |

| H1 16 | 69 | 464 | 320 |

| H2 16 | 56.8 | 292 | 166 |

| 2016 | 62.9 | 378 | 238 |

| H1 17 | 66 | 425 | 279 |

| TTM | 61.4 | 358.5 | 220 |

REVPAR and profits have been on rising trends from 2010 to 2015 according to the company's AIM admission document. This began to change in 2016. (Note the seasonality of the business shown in 2016 with much lower occupancy and room rates in the second half of the year between March and September)

Occupancy fell in 2016 but the company increased its room rates slightly. This did not stop REVPAR falling by 6.7% to $238.

2017 has seen trading deteriorate further during the peak season. Occupancy fell by 3% (most of this was due to the timing of Easter according to the company) but room rates fell by 8.4% leading to a fall in REVPAR of 12.8%.

I have estimated occupancy, room rate and REVPAR on a trailing twelve month (TTM) basis in the table above. By my reckoning the TTM REVPAR to March 2017 is 13.7% lower than its was in the year to September 2015 with most of this coming due to a fall in occupancy. The second half of 2017 is unlikely to have seen much improvement.

We can learn more by taking a closer look at revenue and occupancy trends per hotel.

| £m | 2014 | 2015 | 2016 | |||

|---|---|---|---|---|---|---|

| Hotel | Revenue | Occupancy % | Revenue | Occupancy % | Revenue | Occupancy |

| Colony Club | 12.3 | 67 | 14.1 | 73 | 14.4 | 71 |

| Tamarind | 11.3 | 64 | 11.9 | 66 | 10.5 | 58 |

| The House | 5.8 | 76 | 5.7 | 72 | 5.3 | 64 |

| Crystal Cove | 11 | 78 | 11.3 | 79 | 10.6 | 69 |

| Turtle Beach | 15.5 | 67 | 14.3 | 61 | 13.4 | 58 |

The flagship Colony Club has held up well as the company has chosen not to discount prices in order to maintain a premium pricing differential in the market. The same strategy has been employed at The House but revenues and occupancy have fallen here.

Elsewhere in the family and all inclusive hotels the fall off in revenues and occupancy and revenues has been more marked. The company mentioned in its half year results statement the growing trend towards low cost accommodation for holidays in Barbados, which raises the question as to whether a lot of its hotel rooms are at too high a price and that more discounting may be needed. Shareholders will be hoping that this will not be the case.

Where's the profit growth going to come from?

Elegant is clearly going through a bit of a rough patch. But this could change if sterling continues to strengthen against the US dollar which it has so far this year.

The company does seem to have some sources of profits growth which can help offset some of the current tough trading conditions.

The Waves hotel which was bought in 2016 has been refurbished and is seeing a pick up in trading which should help. The Treasure Beach - bought this year - will reopen in November and should provide a nice boost in time for the peak season. There is the extra income to come through from the hotel management contract in Antigua.

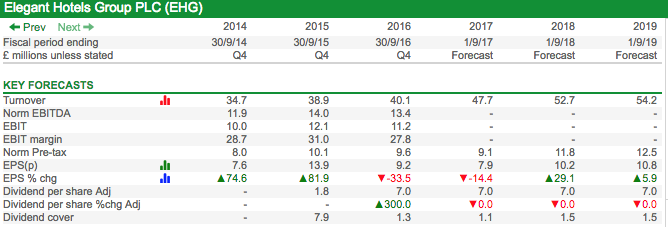

These have been factored into analyst forecasts which suggest that growth in profits could start picking up in 2018.

The company also has improvements planned at a number of its existing hotels. This also has the potential to improve REVPAR if the market conditions are helpful.

Buying other hotels in Barbados or elsewhere in the Caribbean is also a possibility.

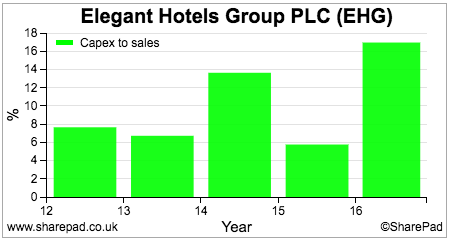

However, it is difficult to get away from the fact that hotels are quite asset intensive. You have to spend money to hold on to your existing profits before you can think about growing them.

As an outsider, it is always difficult to know how much money is needed to keep existing assets in good condition. What we can see is that capex spending is rising as a percentage of sales.

Some of this is spending on new assets such as The Wave but you can't help thinking that there is an element of catch-up spending on the rest of the hotels. On a TTM basis, capex to sales is running at 18% and free cash flow has just turned negative.

Spending enough money is the right thing to do for the long term health of the business but it does beg the following question.

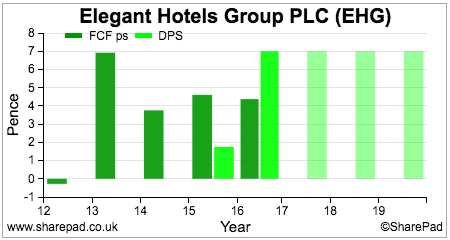

Is the capex bill threatening the dividend?

Elegant is paying a dividend of 7p per share with an annual cost of £6.7m. This compares with a current run rate of post-tax trading cash flow of just over £9m which makes the dividend look a bit generous when interest on borrowings has been paid and the replacement of existing assets has been paid for.

Free cash flow did not cover the cash dividend cost in 2016 and will not this year either.

Analysts are not expecting any dividend growth going forward and I do question how sustainable this dividend payment is.

Cutting the dividend is often seen as a bad thing to do but this is not always the case. Investing in assets can build more value for shareholders over the long run than paying out dividends.

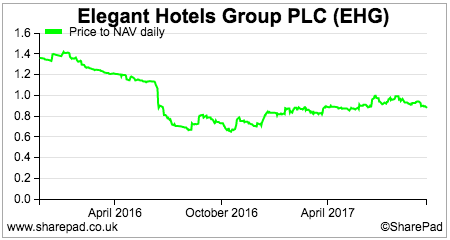

Yet it seems that the stock market doesn't rate the value of Elegant's assets too highly.

Is the valuation of Elegant shares attractive?

Elegant shares are currently changing hands for less than the balance sheet value of its net assets.

At 31 March 2017, the value of the hotels were stated on the balance sheet at $173.8m. Total equity was $118.26m which equates to just over 100p per share at an exchange rate of £1=$1.326. As I write, the share price is 86p.

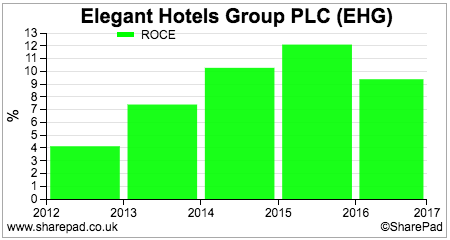

My first check on asset value is to look at the value in use by comparing the profits generated with their balance sheet value. My quick test is to look for a ROCE of roughly 8% or more.

Elegant passes that test in 2016 but profits have since trended lower on a TTM basis and ROCE has fallen to under 7% as a result. This suggests that the asset value is questionable and might be lower but if trading picks up there are grounds for arguing that it is a reasonable proxy for the hotel's value in use.

There could also be considerable substantial land value in the hotel assets. In 2015, CBRE (the international commercial property group) valued the hotel assets at $235m excluding Waves which was valued at $22m in 2016. Daphne's was valued at just over $5m by CBRE using an EV/Sales multiple of two times. If this valuation is true then Elegant would appear to be substantially undervalued at a current share price of 86p; it would imply a NAV per share of around 167p at current exchange rates.

| Hotel | CBRE/Cost ($m) | Assumed Occupancy | Actual Occupancy | Difference |

|---|---|---|---|---|

| Colony Club | 60.1 | 73 | 71 | -2 |

| Treasure Beach | 10.5 | |||

| Tamarind | 46.5 | 66 | 58 | -8 |

| The House | 33.9 | 73 | 64 | -9 |

| Crystal Cove | 40 | 76 | 69 | -7 |

| Waves | 22 | |||

| Turtle Beach | 45 | 65 | 58 | -7 |

| Daphne's | 5.2 | |||

| Total | 263.2 |

But is it a reasonable valuation?

My view is that it is not.

The trading performance of most of the hotels has deteriorated quite a bit since the valuation was made in spring 2015. The long-term occupancy rates assumed by CBRE at the time are significantly above current levels.

As a result, I would say the property value of $257m cited in the 2017 interim results presentation looks a bit too optimistic at the moment. If management believe it to be true then they should stop paying dividends immediately and start aggressively repurchasing shares on the open market as this would make shareholders richer. This is not happening.

That said, I think Elegant is an interesting share which is certainly not pricing in a bullish outlook and could be worth a bit more research by enterprising investors.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.