Does Magic Formula investing still work?

Since the stock market was invented people have been trying to find a proven way to make money from it. The truth is that there doesn't seem to be any foolproof method that can make you money in good times and bad.

That said, some methods make more sense and have a better track record than others. One popular way of trying to select winning shares is Joel Greenblatt's so-called magic formula which is all about buying good quality businesses at cheap prices.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

How does it work?

Greenblatt sets out his formula in the classic "The Little Book that Beats the Market" - a short and well written book that is a must for any investor's bookshelf.

His approach is very simple to understand - it's all about interest rates. The best businesses out there are the ones that earn the highest rates of interest on the money they invest.

You work this out by calculating a company's return on capital (ROCE). Greenblatt defines this as a company's trading profits divided by its tangible capital invested (stocks plus debtors less trade creditors plus fixed assets). ShareScope and SharePad include all money invested (including intangible assets) when calculating ROCE.

In terms of the price you pay for them, you look for ones with the highest earnings yield - what the business earns compared with the purchase price of the business. This is defined as a company's trading profits divided by the market value of the business (its market capitalisation plus net financial debt). Companies with higher earnings yields (a higher interest rate) are better than those with lower ones.

Greenblatt focuses on trading profits (also known as earnings before interest and tax - or EBIT for short) so that he can look at the profits that the whole business is making. This means that he can easily compare companies without worrying about the big distortions caused by debt levels and different tax rates that show up in measures such as EPS and PE ratios.

There are no predictions of future profits in this formula. All selections are made on the basis of current profits and prices - in other words, what is known now.

That's all well and good but how do you go about finding great companies at cheap prices? It takes a long time to do this with a newspaper and a notepad; you ideally need the help of a decent stock screening product such as ShareScope or SharePad.

Here's the theory:

- Select a universe of stocks with a minimum market value of say £50 million. This is to make sure the shares are likely to be big enough to buy and sell.

- Set a minimum return on assets or return on capital of 25% - rank them in order with the company with the highest returns having a rank of 1.

- Rank companies by their EBIT yield (EBIT/EV). The company with the highest yield will have a rank of 1.

- Ignore all utilities and financial stocks. This formula doesn't work well for these companies due to the way they are financed (with lots of debt).

- Then add the rankings together to get a combined score (the lowest scores are the best).

- Buy 5-7 top ranked companies. Repeat every 2-3 months until you have a portfolio of 20-30 stocks.

- Sell each stock after you have held it for a year and replace it with a new magic formula stock.

- Continue this process for at least three to five years but preferably for as long as you can.

The good news is that you don't have to do all this number crunching. SharePad and ShareScope do all the legwork for you. ShareScope will allow you to sort a list of shares by their Greenblatt rank, whereas SharePad will allow you to sort by their combined magic formula scores.

In SharePad, add a column and select Greenblatt Magic Formula from the Ratios tab. This gives the score for each qualifying stock. In ShareScope the process is almost the same but you'll need to add a Result column. In this case, you'll get the rank for each stock. Sort your column to find the top ranking/lowest scoring stocks. If you need any help with this, please call the Support team on 020 7749 8504.

What is it telling you to buy now?

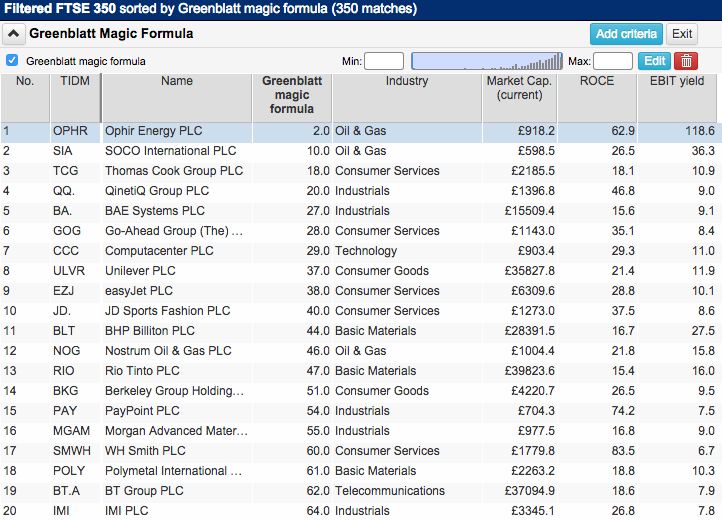

These are the top 20 magic formula shares in the FTSE 350 according to SharePad on 10th June 2015 (remember, the lowest scores are the best):

Does the formula work in the real world?

Greenblatt's book sets out an impressive market-beating track record. Between 1988 and 2009 a magic formula portfolio delivered average annual returns of 23.8% per year compared with 9.6% for the S&P 500 index. It had some stellar years with returns of over 70% in 1991 and 2001 and over 80% in 2003. However it had a bad year in 2008 losing nearly 40% which was worse than the S&P 500.

Its recent performance is not as stellar. Greenblatt's company set up some hedge funds where the magic formula forms a significant part of the investing strategy. As of 9th June 2015, the Gotham Absolute Return Fund has delivered total returns to investors of 44.1% compared with 58.78% for the S&P 500. Greenblatt might argue - as he did in 1999 - that the approach does not beat the market when stock markets are seen to be expensively valued as many think they are today. Over the long run he continues to believe that this strategy will reward patient investors.

Why not just buy cheap stocks instead?

The magic formula gives equal importance to quality (ROCE) as it does to value (EBIT yield). According to Wesley Gray, an American who is a bit of an expert on value investing, the magic from Greenblatt's magic formula all comes from the earnings yield or EBIT/EV part. Focusing on high returns on capital can lead to investors over paying for quality. According to him it's therefore better to just buy shares with a high interest rate on the basis of EBIT/EV.

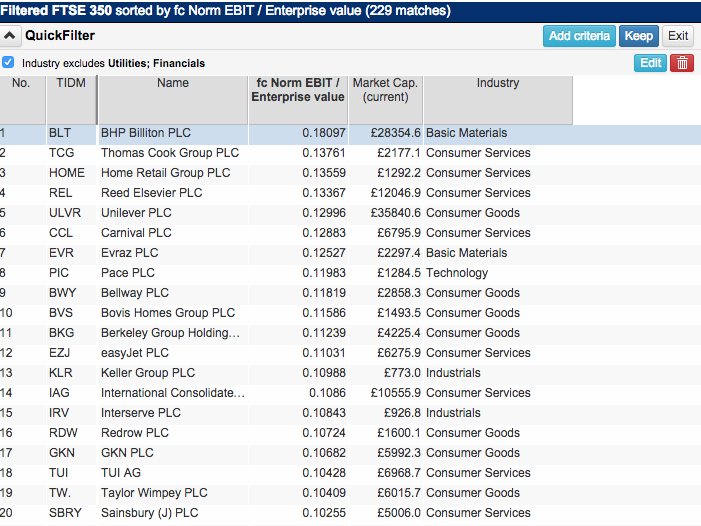

Here are the cheapest 20 shares in the FTSE 350 on the basis of EBIT yield as of 10th June 2015 according to SharePad.

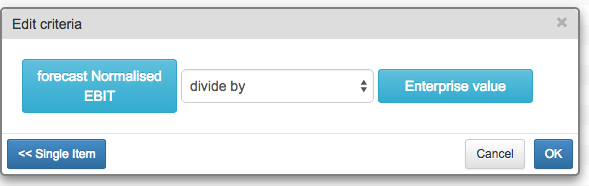

These are based on the last reported EBIT. If you want to you can look at EBIT yield on a forecast basis by creating your own DIY filter. You do this by asking SharePad to divide forecast EBIT by enterprise value by combining the two items. You then apply a sector filter to exclude financial and utility shares.

Some people prefer using latest reported EBIT because it is a known number. Forecasts can be wrong but some people prefer to base their decisions on these numbers. It's up to you.

Other things to look out for

No strategy works all the time. Blindly investing to a formula takes a lot of emotion out of investing but is not always a good idea. The Magic Formula may lead you to lots of shares that are heavily concentrated in a particular industry that are out of favour making for an unbalanced and risky portfolio.

The return on capital calculation in Greenblatt's formula also ignores intangible assets (SharePad's does not) and fails to adjust for companies that rent - like lots of retailers - rather than own assets or have big pension fund shortfalls. This could lead to companies looking good when they are not.

Enterprise values are usually based on end-of year net debt or net cash figures when a company wants to look its best. These sometimes flatter a company as average debt levels throughout the year can be a lot higher than they are at the year end. This will lead to a lower enterprise value and higher EBIT yield figure than might be warranted. Housebuilders and travel companies are good examples of this.

Watch out for trading costs too. Buying and selling up to thirty companies a year - if you want to try the strategy out - will cost you a lot in dealing commissions and this will reduce portfolio returns, particularly if you are investing smaller amounts of money.

Personally, I might not build a whole portfolio on the magic formula rules. However, the reasoning behind it makes a lot of sense to me and I use ROCE and EBIT yield as two of my key yardsticks when buying shares.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.