Stock Watch: Marston's

Investing in pubs and pub companies is not for the nervous. History tells us that pub profits tend to move in line with the ups and downs of the economy and consumers' willingness to spend money. On top of that the pub companies themselves have had an unhelpful tendency to push the self-destruct button from time to time.

Back in the late 1990s they spent lots of money on city centre pubs and trendy bars and didn't get enough profits back. This meant that a large chunk of the money invested didn't make their investors any better off; it was wasted.

The early 2000s saw tenanted pubs (where pub landlords run their own business and pay rent to the pub owners) become all the rage and the supposed path to riches. That too ended in tears for many pub owners. Lots of back-street boozers that were once seen as a safe bet were loaded up with debt by financial engineers only to find that they couldn't survive when times got tough. The tenants struggled to pay the rents to the pub companies which then made it difficult to pay the interest on all the extra debt that had been taken on.

The pub sector has also been clobbered by a triple whammy of the smoking ban, rising beer taxes and a horrible recession during the last decade which wreaked havoc with profits and share prices. Marston's did not escape the turmoil and had to slash its dividend. Many pubs have closed or have been sold.

Given this backdrop it begs the question as to why you might even consider investing in a pub company. Well, it seems that the pub companies have learned some hard lessons and have been enjoying better times of late. So let's open up ShareScope and SharePad and take a closer look at Marston's.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

How Marston's makes money

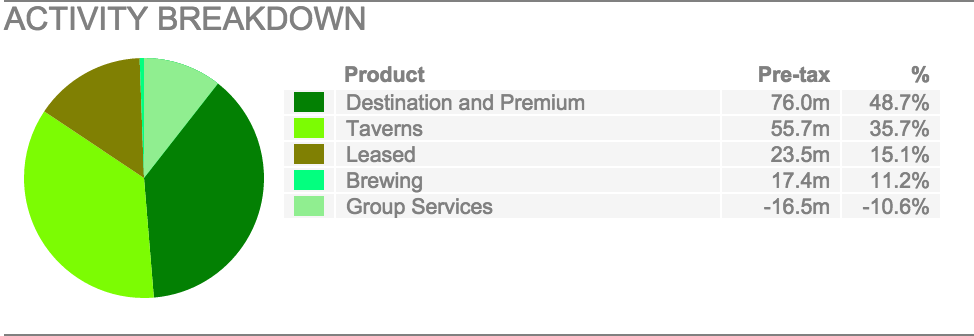

Here's an activity breakdown taken from SharePad.

The company used to be known as Wolverhampton & Dudley Breweries before changing its name to Marston's in 2007. It makes most of its money from owning and running pubs. These pubs are split into three distinct groups: Destination & Premium (town centre bars and pub restaurants), Taverns (community pubs) and Lease (Marston's pubs rented by other people). It still has a substantial brewing business with well known brands such as Marston's Pedigree, Hobgoblin, Bank's Bitter and the recently purchased Thwaites.

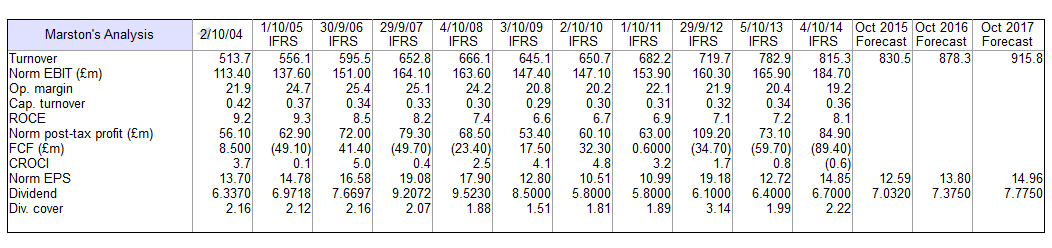

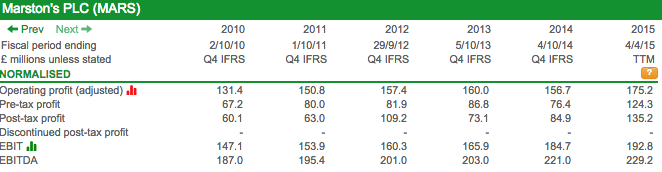

Opening up a results table in ShareScope allows us to see what's been going on with Marston's over the last few years.

What you can see is that there has been steady progress in turnover and profits (earnings before interest and tax or EBIT) over the last decade. EBIT took a tumble with the recession in 2009 and has been recovering since 2011.

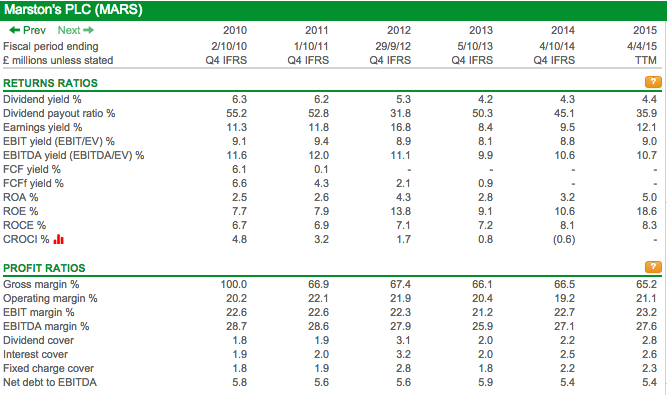

However, if we turn our attention to some important profit ratios there have been some interesting developments over the last few years. Looking at the operating margin (the percentage of turnover converted into trading profits), we can see that Marston's is not as profitable as it once was. Operating margins were over 25% in 2007 but were 19.2% in 2014. The profit margins are still quite high compared to those earned in other industries, but you need to find out what has caused the margin to fall.

If it is due to the fact that profits are being squeezed then that could be a warning sign. However, there could be less to worry about if the mix of profits has changed and a bigger chunk is coming from lower margin activities.

As I've said before in my previous articles, return on capital employed (ROCE) is arguably the best measure of whether a company will be a good investment or not. Marston's ROCE is not very high. It may achieve high profit margins but it has to invest a lot of money in land and buildings to generate its profits.

ROCE was a very modest 8.1% in 2014 but has been on an upwards trend from the 6.6% achieved in 2009. Marston's arguably needs to improve its ROCE if it is to become more attractive to investors. I'll have more to say on this shortly.

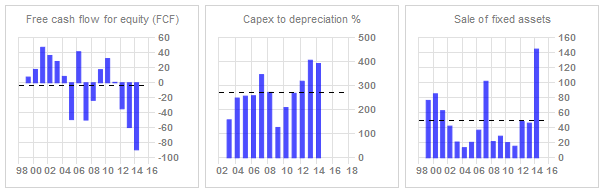

Another quite alarming figure is Marston's free cash flow - the amount of money left over after bills such as interest, tax and spending on new assets (capex) have been paid. It seems that Marston's isn't that good at generating surplus cash and the trend has been getting worse over the last couple of years as shown below.

The main reason for cash to flow out of a business is usually a period of heavy investment in new assets to grow the size of the company. You can look at this by comparing the ratio of capex (spending on new assets) to depreciation (what a company needs to spend to maintain the value of its existing assets).

With Marston's we can see that it has been spending much more than depreciation for a long time (the average rate is more than 200%). Is it investing too much or is the depreciation charge too low and therefore its profits too high? (for more on this subject click here).

One important fact to bear in mind is that both ShareScope and SharePad calculate free cash flow in a very conservative way in that cash inflows from selling assets are not included in the figure. Some investors include asset sales and could argue that pub companies such as Marston's sell chunks of their pubs regularly. This would make Marston's free cash flow performance look better. We exclude them to be prudent as selling assets to generate cash flow is not related to the trading activities of a company in most cases.

Lots of borrowings and weak finances

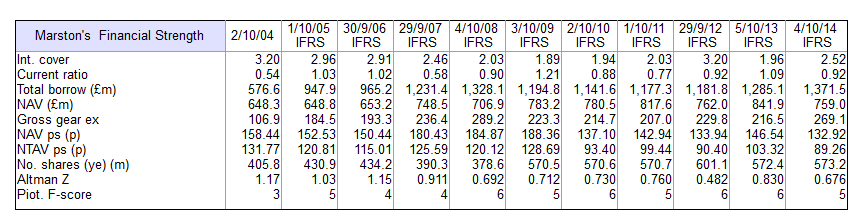

Turning to Marston's finances, the first thing to stand out is that the company has a lot of debt - nearly £1.4bn at the end of 2014. High debts tend to increase the risk for shareholders. Marston's ability to pay the interest on its debt - as measured by its interest cover - is only 2.5 times its profits (EBIT). Should profits take a plunge then Marston's ability to pay its current dividend per share of 6.7 pence could be under threat.

A large chunk of Marston's borrowings are secured against the asset values of its pubs. In the event of Marston's getting into financial difficulty, it is difficult to see much money being left over for shareholders if the assets were sold off to pay debts.

Marston's net tangible asset value (NTAV) per share has been falling too. It fell from 103.3p in 2013 to 89.3p in 2014. Given that pub companies are often seen as being a form of property company it would be more reassuring to see NTAV per share increasing.

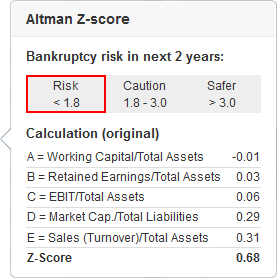

The Altman Z-score of 0.68 is telling us that the company has weak finances and says there is a risk of bankruptcy in the next two years. That said, its Z-score has been saying this for the last decade.

Looking at the ShareScope results table which examines Marston's financial strength above, you can see that the number of shares in issue jumped sharply in 2009. Sometimes this might be down to a share split (where the company's share capital is divided amongst a greater number of shares) but it also can tell you that a company issued more shares to raise money. Given Marston's relatively weak financial position there is a risk it could have to do this again if trading turns down in the future.

How can Marston's improve?

Marston's management are very aware of the issues raised above and have set out a strategy to make the company better.

If we look at the trailing twelve month (TTM) data in SharePad (soon to be available in ShareScope) we can see that the company is making steady progress.

Normalised (ignoring one-off gains and losses) EBIT has grown by another £8m from October 2014 to March 2015. Looking at some financial ratios, we can see that profit margins, interest cover and ROCE have all improved which is a good sign.

Marston's is ploughing money into its destination and premium pubs where it can get much higher profits per pub than in its Taverns or leased pubs as well as a decent return on capital. At the same time, it is shrinking the number of taverns and leased pubs by selling them or converting them to franchise. This will free up cash for investment and should see debt levels come down and ROCE go up.

Its brewing business is also doing well and should be improved by the recent purchase of Thwaites. Marston's looks to have a number of strong craft and premium ale brands that are capable of growing sales and profits.

All in all, it looks as if Marston's is doing the right things and is making its business a better one.

How's current trading?

Not too bad it seems.

The news section in ShareScope and SharePad tells us that the company issued a trading update on 22nd July. The company's key destination and premium pubs - which account for half of the company's total profits - seem to be doing reasonably well:

"In Destination and Premium, like-for-like sales for the 41 week period were 1.7% ahead of last year, including like-for-like food sales growth of 1.6% and like-for-like wet sales growth of 1.6%. In the last 10 weeks of the period, like-for-like sales are up 2.0%. Operating margin is slightly above last year and we remain on track to complete 25 new-build pub restaurants in the current financial year."

Marston's also said that it could probably cope with increases in wages expected over the next few years:

"The recently announced Government plans to introduce a mandatory Living Wage by 2020 are consistent with our expectation that the gap between the National Minimum Wage and the Living Wage would be closed over time. The additional cost of meeting the higher target of GBP9 per hour by 2020 will mean that wage costs will be modestly greater than we had expected, but the impact compared to our plans is mitigated by the fact that we had anticipated increases above the rate of inflation, and the lower rate of corporation tax from 2017. Our view remains that Government should prioritise taxation and business rate reductions to reduce the cost of doing business and increase consumer confidence."

However, the high burden of taxes on pubs which have to charge VAT on food continues to put them at a big disadvantage to the supermarkets who keep on selling very cheap alcoholic drinks.

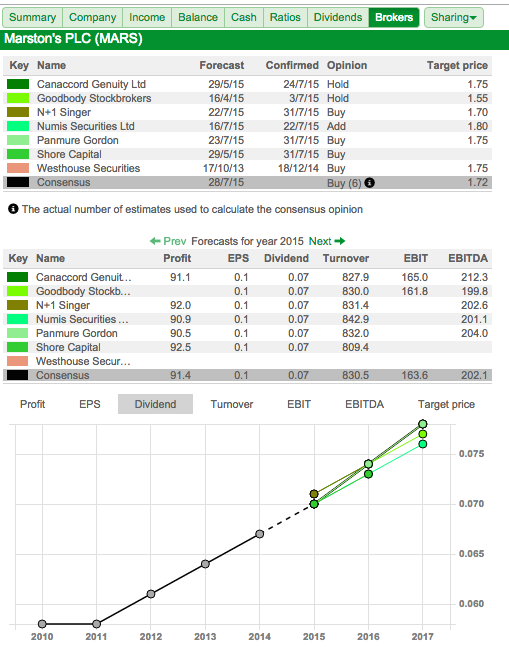

City analysts are still expecting modest profit and dividend growth in the next few years as shown in the table from SharePad below.

These analysts have a target price for the share of 172p compared to a current price of 155p at the time of writing. However, I would take these price targets with a pinch of salt. As always, do your own research and work out whether a share is reasonably valued or not. Let's have a look at Marston's valuation in more detail.

Marston's Valuation

There are two ways you can use ShareScope and SharePad to weigh up the valuation of a share. The first way is to look at the valuation of the company on its own. You can then compare its valuation with other similar companies.

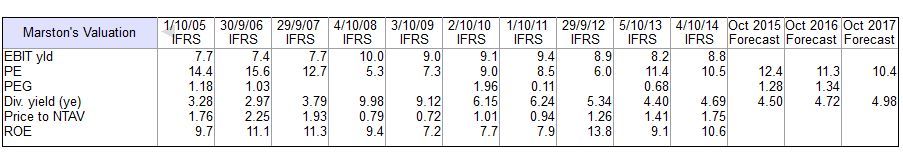

Here's a results table I've created in ShareScope to look at the valuation of Marston's over time. The shares trade on 12.4 times 2015 projected EPS - higher than it has been for seven years. Its dividend yield of 4.5% looks reasonably attractive as dividends are expected to keep growing but you've been able to pick up the shares for higher dividend yields in the past. A price to NTAV of 1.75 is hardly screaming "bargain buy" at the moment and is not far off the levels seen during the peak of the last UK economic cycle back in 2007.

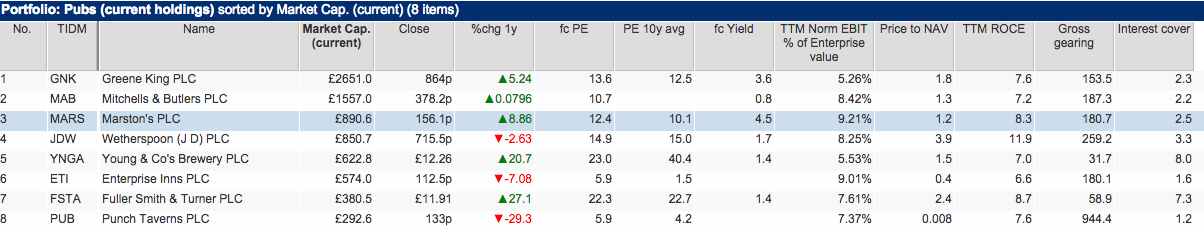

How does Marston's compare against other quoted pub companies?

Quite well is the answer. It offers the highest dividend yield in the sector and the highest EBIT yield based on TTM numbers. But does this mean that Marston's shares are a good investment at the current share price? You can also see that it has a similar ROCE to many of its peers. It seems that most pub companies cannot generate a high ROCE at the moment. Unless this can change, then perhaps there are better homes for your money elsewhere?

My aim with these articles is not specifically to give you a buy/sell rating for a stock although I will often express an opinion. It's to help you get into the mindset of a stock analyst and learn the types of question to ask and how to interpret the answers. Some questions will be sector-specific but others can be applied to most if not all companies.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.