Stock Watch: Patisserie Holdings - can you have your cake and eat it?

The famous investor Jim Slater has often uttered the words "elephants don't gallop" when talking about shares. What he means by this is that big companies find it difficult to get proportionally bigger because they are already big. These companies don't tend to multiply in value and make you rich.

Smaller companies on the other hand can. If you are looking to find a share that might make a big difference to the value of your ISA or SIPP then you need to be spending your time looking for smaller companies that have a great product or service to sell. The fast growth in profits that can come from them can see share prices go through the roof. Find a few of these and the dream of a comfortable retirement could become a reality.

The pursuit of this dream has seen many investors turn their attention to the Alternative Investment Market (AIM) in the search for acorns that can turn into oak trees. Yet AIM has a patchy track record with just as many horror stories due to poor quality companies as big winners. If you are going to invest in an AIM listed company then you need to be very careful and do your research before parting with your cash.

This week I am going to look at the shares of what seems to be one of AIM's better quality companies - posh cakes and sandwich seller Patisserie Holdings (AIM:CAKE).

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Background

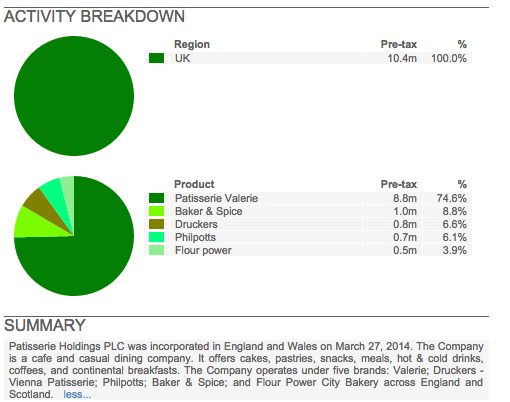

The company makes most of its money from selling affordable high quality cakes through its Patisserie Valerie chain of cafes and website. The first Patisserie Valerie shop opened in London in 1926. The story of today's business goes back to 2006 when 8 shops were bought by Luke Johnson (the man who made his money building up the Pizza Express restaurant chain during the 1990s) and his private equity firm.

The company has grown rapidly since then. It has been busy opening up new cafes across the UK as well as buying up similar companies such as premium sandwich seller Philpotts. It is looking to open up 20 new shops in 2015 and currently has 156 of them.

Its shares have been a big hit with investors. Having listed on AIM at 170p back in May 2014 they are now trading at around the 300p mark. The shares have been as high as 350p in May 2015.

So is Patisserie Holdings the kind of growth investment that every investor should have in their portfolio? Let's open up ShareScope/SharePad and have a closer look at its financial performance and future prospects.

A short financial history

Ideally you should look back at least ten years when studying a company's past financial performance. Unfortunately, we cannot do this with Patisserie Holdings as the company has only published financial information going back to 2011. Its key performance metrics are shown in the ShareScope results tables below.

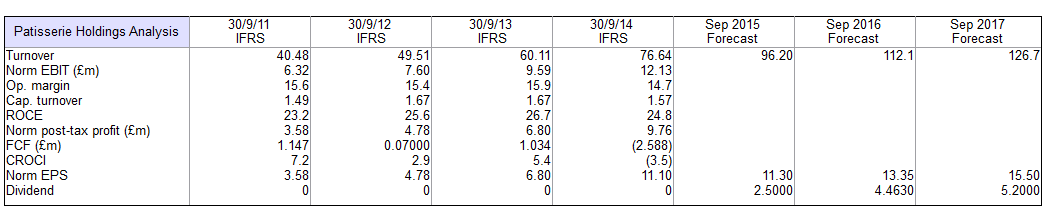

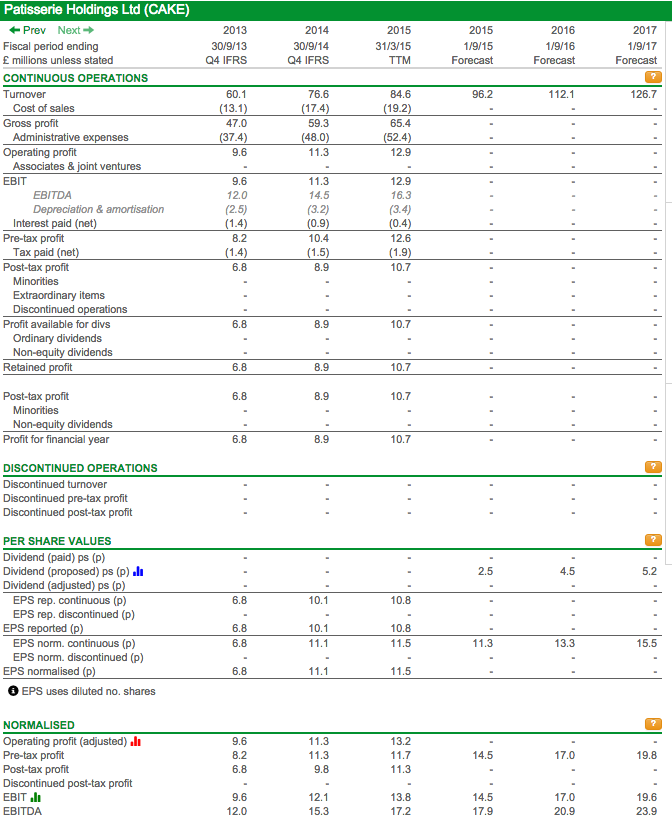

Based on the information that we have, it would seem that the company has the hallmarks of being a growth company. Turnover and profits (EBIT) almost doubled between 2011 and 2014. Earnings per share (EPS) tripled over the same period.

Some of this growth has come from buying other companies but a large chunk of it has come from expanding the existing business. City analysts expect growth to continue as shown by the rising forecast turnover and EPS figures in the table. The company is expected to pay its first dividend this year.

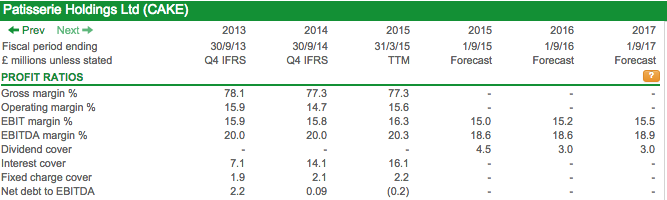

Patisserie Holdings scores well on the key benchmarks of operating margin (the percentage of turnover turned into trading profits) and return on capital employed (ROCE) or how much trading profit a company is getting as a percentage of the money it has put into the business).

Operating margins were 14.7% in 2014, down from 15.9% in 2013. These high profit margins are an encouraging sign but you need to look into why they fell slightly in 2014 and that this is not the beginning of a worrying trend. The same can be said for ROCE, where the 24.8% posted in 2014 is a high number. Bear in mind though that many retail companies rent rather than own their shops and the value of the properties being used will not be included in the calculation of capital employed. If they were, then Patisserie Holdings' ROCE would probably be lower than the figure it currently reports. For this reason, I would probably pay more attention to operating margins than ROCE when looking at this company.

We can also see that the company is not producing much in the way of free cash flow (the amount of cash left over after the bills for interest, tax and spending on new assets has been paid). This shouldn't be surprising given that the company is expanding rapidly by opening new shops across the UK as this costs money.

If you have a copy of SharePad, you can check on the progress that company has been making since the end of 2014. Half year results to March 2015 have been reported since then which means that SharePad can calculate its rolling or trailing twelve month (TTM) performance (this feature is coming to ShareScope shortly).

On the basis of the TTM data, I would say that things are looking good for Patisserie. Have a look at the TTM data for per share values and normalised figures.

What we can see is that the normalised EPS figure (this excludes one-off gains and losses) of 11.5p is already ahead of the average forecast EPS for 2015 from City analysts of 11.3p. This could be a sign that the company will comfortably beat these forecasts, especially if it is still growing strongly and opening new shops.

Normalised EBIT of £13.8m has almost reached the £14.5m forecast for 2015 which looks like a good sign. I can't be totally sure of course, but it would not surprise me if City analysts had to increase their profit forecasts during the next few months given the current trends in profits.

We can also see that operating margins on a TTM basis have gone back up again which is encouraging, but this figure needs to be closely watched.

Very sound finances

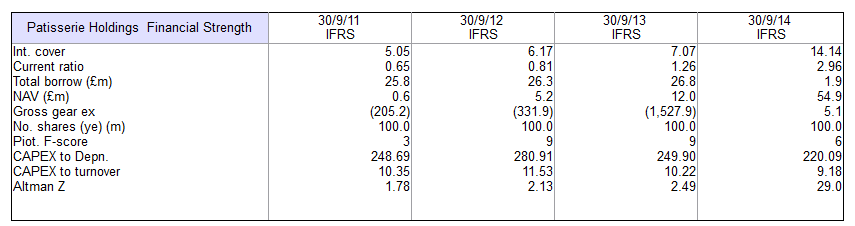

Patisserie Holdings seems to be in a very strong financial position. Borrowings have been falling sharply and had completely disappeared at the end of March 2015.

The capex to depreciation ratio compares the amount of money spent on new assets with how much is needed to maintain the existing fixed asset base of the company (depreciation). As the company is expanding, spending on new assets is unsurprisingly more than depreciation. The fact that the company can do this whilst getting rid of its borrowings is telling us that the underlying cash flow of the business is strong.

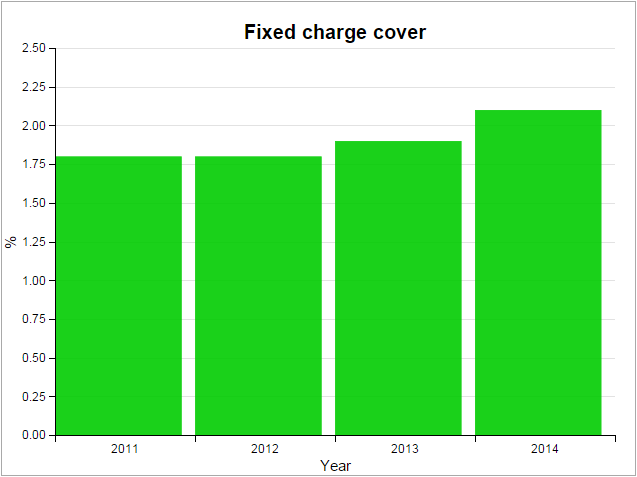

An important ratio shown in SharePad is called fixed charge cover. This looks at the ability of a company's profits to pay its fixed charges such as rents on buildings and equipment and the interest payments on borrowed money. This ratio is particularly important for a company like Patisserie given that it rents rather than owns most of its shops.

Fixed charge cover is over 2 times which is comfortable and nothing to worry about. It has also been on a rising trend as newer shops mature and become more profitable. A figure of 1.5 or less would be of more cause for concern.

Are the company's profits believable?

Sometimes when a company tells you that its profits are growing quickly they aren't really. You have to be on your guard that it is not manipulating its profits to make them look better than they are in reality. Unfortunately, this has been the case with quite a few smaller companies (and big ones such as Enron) in the past.

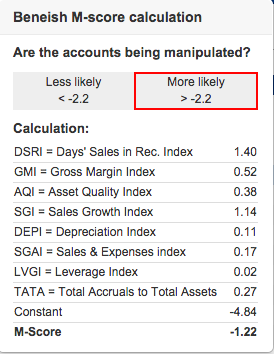

The Beneish M-score is a formula used to spot companies that might be manipulating their profits (to read more on this formula click here). According to the M-score in SharePad, Patisserie Holdings profits might be being manipulated.

Hold on just a minute though. The M-score has been good at spotting dodgy companies but that doesn't mean that you should take every dangerous score as gospel. Patisserie scores badly because it sales are growing quickly and items such as trade debtors (money owed by customers) have increased in 2014.

Remember, a number such as the M-score should be a sign for you to do more digging, not something that should be blindly accepted. Sometimes it correctly identifies a dodgy company but that's not always the case. In my opinion, Patisserie Holdings' profits look fine.

Why do I say this?

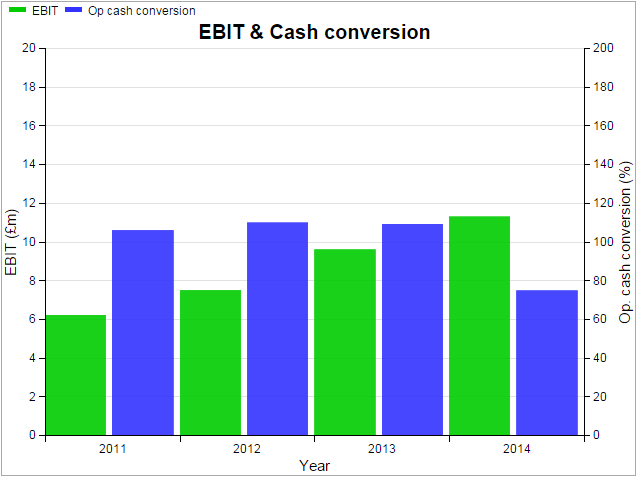

One of the main ways of checking on profit quality is looking at how much operating profit turns into operating cash flow (known as cash conversion). This is shown in the chart below.

Patisserie's cash conversion has been generally good at over 100%, but dipped down sharply in 2014. A look at the TTM figures shows that this has bounced back to over 90% in 2015 so far. It's perfectly normal for a growing business to have swings in stock levels, debtors and creditors (known as working capital). Cash conversion is near enough to 100% for this not to concern me too much. Also, the fact that all the company's debts have been cleared whilst it is expanding and growing is also reassuring.

Does the company have a credible growth strategy?

So far, the company's financial performance seems to stand up to close scrutiny. All that will be irrelevant though if the company's growth strategy is flaky.

It's very easy to question Patisserie's strategy. After all, isn't the UK saturated with coffee shops on every street corner? When you are looking at any company as a possible investment, you have to spend a lot of time thinking about whether its business model is sustainable.

Above all else, you need to ask this question:

What does this company do which allows it to earn sustainably high profits?

You are looking for a company's source of competitive advantage - how does it stop other companies from eating its lunch and keep its profit margins high?

This is where a visit to the company's website and investor documents can prove very worthwhile. On Patisserie's website you can find information about its strategy from when it listed its shares on AIM in May 2014.

First and foremost, the company is operating in a growing market. Coffee shops and casual dining are popular amongst time-crunched consumers as well as being a popular leisure activity. But how does the company differentiate itself from the crowd?

The answer rests with a focus on quality food (high-end cakes, sandwiches and drinks) and the fact that it is positioning itself as a halfway house between a coffee shop (where customers don't spend too much) and a restaurant (where people tend to spend more). The company hopes that this format will appeal to a wide range of customers and that the smaller sites needed for these shops will allow it to get a good bang for its buck.

Patisserie reckons that there is scope for at least another 250 outlets in the UK that can meet the financial returns of its existing shops. It costs around £250,000 to set up a new shop, but they can quickly get to annual cash profits (EBITDA) of over £100,000 and pay back the cash outlay in less than two years. That's a pretty juicy return on investment (100/250 = 40%). If Patisserie can meet this growth target then it's possible to see why the stock market is so enthusiastic about its shares.

Isn't this rosy outlook already reflected in the share price?

It might be. Businesses with a strong track record of growth and the potential of a lot more to come can rarely be bought for a cheap price. At 300p per share, Patisserie Holdings trades at 26.1 times its TTM EPS of 11.5p (A TTM PE ratio of 26.1) which looks to be pretty expensive.

A forecast PEG ratio (comparing the forecast PE with the forecast EPS growth) of 1.5 also suggests the shares are pretty pricey. Ideally, growth investors look to pick up shares with a PEG of less than 1 - or where the PE ratio is less than the expected growth in EPS.

Paying too high a price (or a high PE ratio) is a big risk when buying shares such as Patisserie Holdings. There's a chance that the company doesn't grow its profits by as much as people expect. There's also a possibility that the stock market will put a lower PE ratio on the EPS as well. Or you could get a double whammy when both EPS is lower than expected and the PE ratio goes down at the same time.

So could you still make money buying Patisserie shares today?

Of course, but this will probably depend on the current PE ratio staying high or going higher. If analysts' EPS forecasts are met, then the future share price with a PE of 26.1 could look like this:

| 2015 | 2016 | 2017 | |

|---|---|---|---|

| Forecast EPS(p) | 11.3 | 13.3 | 15.5 |

| Share price at PE of 26.1x | 295p | 347p | 405p |

But what if the PE ratio falls to 20 times?

| 2015 | 2016 | 2017 | |

|---|---|---|---|

| Forecast EPS(p) | 11.3 | 13.3 | 15.5 |

| Share price at PE of 20.0x | 226p | 266p | 310p |

You would not make any meaningful gains by 2017 and could lose money in the meantime by coughing up 300p. It seems that there is little room for disappointment priced in at the moment.

Directors have been selling shares

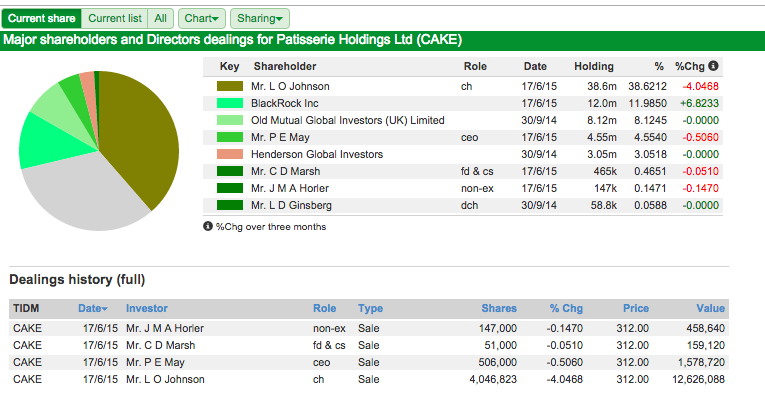

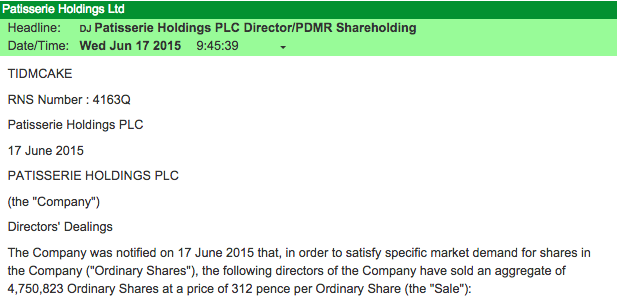

It's usually a very good sign when you can see the directors of a company own a lot of shares. It means that their financial interests are aligned with other shareholders which should mean that they act in everyone's best interests. Patisserie ticks the box nicely here, especially Luke Johnson who owns over 38% of the business.

However, we can see from the SharePad table above that there has been significant selling of shares by the main board directors at 312p per share on 17th June 2015. Luke Johnson offloaded over 4 million shares for a consideration of £12.6m.

Directors sell shares for a number of legitimate reasons (divorce settlements and tax bills are two examples of this). It doesn't always mean that they think that the shares of the company are overpriced. That said, share sales of this magnitude are always eye-catching and cannot really be seen as a bullish sign.

But in this case the company has provided an explanation for the share sales. You can see this by looking in the news section of ShareScope or SharePad.

We are told that 4.7m shares have been sold to satisfy "specific market demand for the shares". Presumably this was to allow an investor or investors to buy a significant stake in the company. If you look at the previous table, you can see that on exactly the same day, Blackrock Inc increased its stake in the company.

Final thoughts

The analysis suggests that Patisserie Holdings is a growth company. The recent decline in its share price might be seen to be a good time to buy the shares if you believe that the company can keep on growing for many years to come. On the other hand, there are grounds for thinking that the shares are too richly valued (the PE ratio is too high) and that it might be better to wait for them to become a bit cheaper.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.