Stock Watch: TalkTalk Telecom - a safe dividend or a risky bet?

The events of Monday 24th August 2015 will not be easily forgotten by stock market investors. If you wanted an example of how quickly share prices can fall when the investor herd starts to panic then that Monday was one of the best ones I have seen in over eighteen years of following shares.

For the inexperienced or the reckless Monday's share price plunges will have been a sobering lesson. Especially so if they had their money invested in very small companies where the price to sell out quickly can be very expensive. It's also a lesson that paper gains from a rising share price can disappear in a flash.

The wild up and down movement in share prices is a major risk of owning shares. Sometimes they work for you and sometimes they don't. But investing in shares isn't just about changes in share prices - you can get a return from being paid a dividend (your share of the company's profits) as well.

I say this a lot but the great thing about a dividend is that once it has been paid to you it cannot be taken away. It is a tangible return on your shares that is completely unrelated to the daily gyrations of the stock market. I like this. It's the main reason why I often invest my own money in dividend paying shares.

If you want to reduce your risks from investing in shares, then history suggests that buying and owning ones that pay a meaningful dividend can be the way to go (by this I mean shares with a reasonable dividend yield). Studies show that high dividend paying shares tend to have less volatile share prices than low dividend ones (they don't bounce up and down as much). Combine that with the power of reinvesting dividends and it is possible to build up a nice nest egg as long as you have chosen sound businesses to invest in (for more on dividend investing click here).

In my experience, when the stock markets enter a rocky phase investors often flock to high yielding shares that are backed by defensive businesses - the kind whose products and services tend to be bought whatever the economic climate.

Telecom companies can be highly sought after in such situations. Running a filter for high dividend yields in ShareScope or SharePad highlights TalkTalk Telecom (LSE:TALK) with a forecast dividend yield of 5.2% as a share that might be of interest to more risk averse investors.

High yields can often be a trap for the unwary. They can be a sign that the dividend won't grow much or might even be cut in the future. Sometimes though, they can also be a sign that a share is cheap.

Let's have a look and see which camp TalkTalk fits into.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Background

Many readers will be familiar with the TalkTalk brand name and may even be customers of the company. It is a leading provider of home telephone, broadband internet, TV and mobile phone services to households. It also provides phone and broadband services to businesses. These are the kind of services that few households and businesses can do without, which on the face of things could make TalkTalk shares a nice steady and reliable investment.

The company was spun off from Carphone Warehouse back in 2009 and has a somewhat chequered history. It has positioned itself at the value for money end of the telecoms market but damaged its reputation in its early days with a poor record for customer service. It has been doing a good job of rebuilding customer goodwill in recent years and has become the fourth biggest phone and broadband company in the UK behind BT, Sky and Virgin Media.

Up until June this year its shares had been doing well and were changing hands for over 400p each (see chart above). Since then, it seems that the market has become concerned about the company's future prospects and its share price has fallen sharply. Could it be that those chunky dividends it is currently paying can't be relied upon?

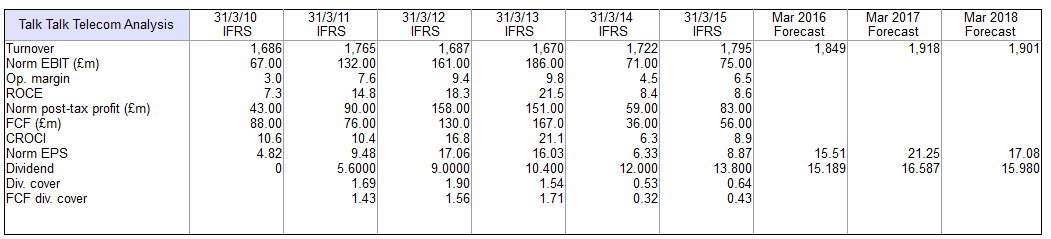

Financial History

Before turning your thoughts to a company's future it's nearly always a good idea to look at its past. By doing this you can often spot trends that can significantly improve your understanding of how a company works and give you a good idea about what might be in store for it in the years ahead.

We can see that during its short history, TalkTalk has been able to grow its turnover modestly. This has been done by a combination of buying small telecoms companies and growing its customer numbers.

What's concerning though is that its profitability has fallen off a cliff during the last couple of years. Falling profits and profit margins have fed through to a sharp decline in return on capital employed (ROCE). In 2013, TalkTalk produced earnings before interest and tax (EBIT) of £186m and an impressive ROCE of 21.5%. In 2015, those numbers were £75m and 8.6% respectively.

The first thing to do is head for the company's 2014 annual report to see why this has happened. A quicker way to do this is to look in the news section in SharePad or ShareScope for the 2014 full year results.

On finding this information it is quickly revealed that the company spent an extra £112m on winning customers for its new TV service (a lot of this will have been marketing and the cost of subsidising set top boxes). It had yet to benefit from the extra revenue that this could bring in.

Quite often when I am analysing a part of a company's financial performance I will take some numbers from a company's annual report and study them more closely in a spreadsheet. I have found this to be an extremely useful way of increasing my understanding of a company and what issues to consider about its future. Given the big decline in TalkTalk's profitability I've decided to take a closer look at its costs and turnover between 2013 and 2015. You can see this laid out in the table below.

| TalkTalk Telecom (£m) | 2013 | 2014 | 2015 | Change 2013-15 |

|---|---|---|---|---|

| Turnover | 1670 | 1722 | 1795 | 125 |

| Gross profit(A) | 919 | 953 | 980 | 61 |

| gross profit margin | 55.03% | 55.34% | 54.60% | 48.80% |

| less: | ||||

| Operating expenses | 395 | 427 | 426 | 31 |

| Subscriber acq costs and marketing | 234 | 318 | 309 | 75 |

| Total(B) | 629 | 745 | 735 | 106 |

| EBITDA(A-B) | 290 | 213 | 245 | -45 |

| EBITDA margin | 17.37% | 12.33% | 13.65% | |

| As % of turnover | ||||

| Operating expenses | 23.65% | 24.72% | 23.73% | |

| SAC and marketing | 14.01% | 18.41% | 17.21% | |

What I've done here is to look at the trends in turnover, operating expenses and subscriber acquisition (SAC) and marketing costs and how they have affected profits. In this case, I am looking at profits before depreciation and amortisation costs are taken away (EBITDA).

What we can see is that there was a big jump in operating expenses and SAC's of £116m (from £629m to £745m) in 2014. Even though gross profit margins went up, these costs - especially SAC and marketing - as a percentage of turnover went up substantially leading to EBITDA falling by a whopping £77m and EBITDA margins falling by just over 5%.

Moving forward a year to 2015 and we can see that costs have actually come down slightly which is a good sign. This has allowed EBITDA and EBITDA margins to go up. However, it is clear that TalkTalk has lots of work to do to improve its profitability. In short, it needs to sell more products to existing customers and get more new customers on board. And it needs to do this without increasing its costs too much and ideally bring them down.

Why?

Because it is borrowing money to pay its current dividend.

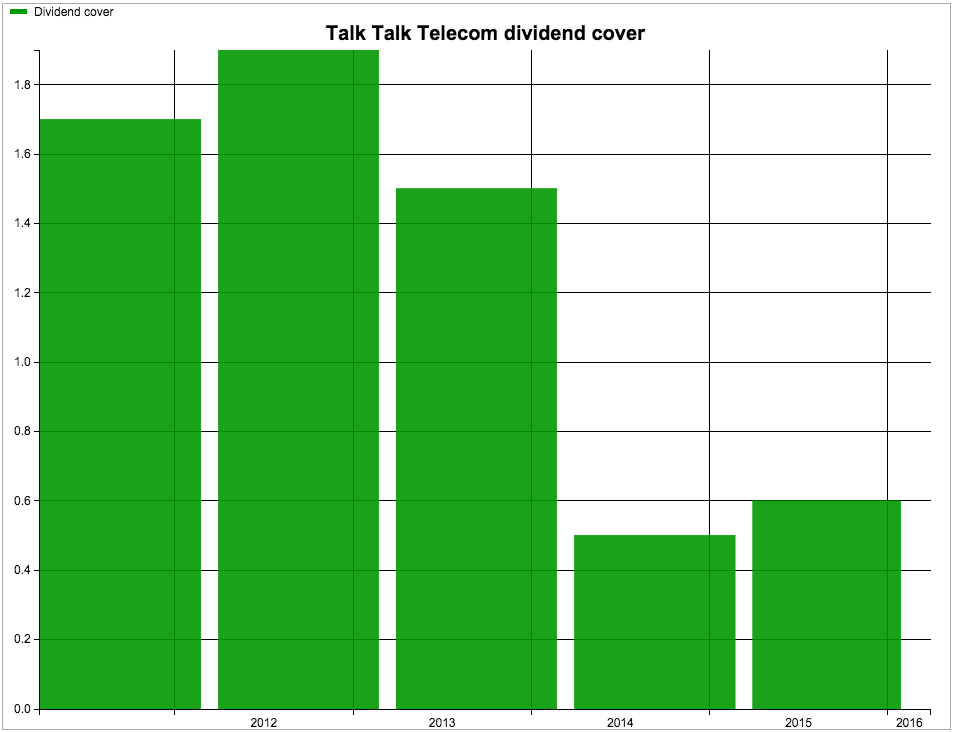

The fall in the company's profitability has seen it paid an uncovered dividend in 2014 and 2015 - its dividend per share was more than its earnings per share. This did not stop TalkTalk growing its dividend by 15% in 2015 though. Either the company is being very reckless or it is signalling to shareholders that it expects profits to grow strongly in the future so paying the dividend won't be a problem.

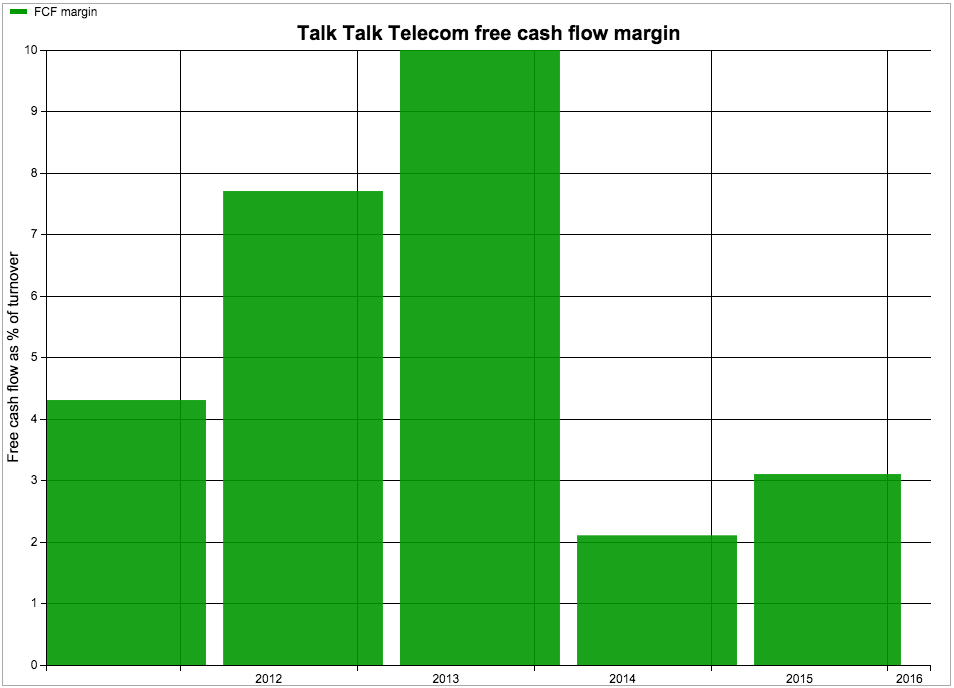

Cash flow has also taken a hit during the last couple of years. The company was generating an impressive £167m of free cash flow in 2013 (a 10% free cash flow margin) but this fell to £56m in 2015. Considering that the 2015 dividend payment cost £116m there is clearly an issue here. Unless profits and free cash flow increase significantly, TalkTalk will probably have to cut its dividend.

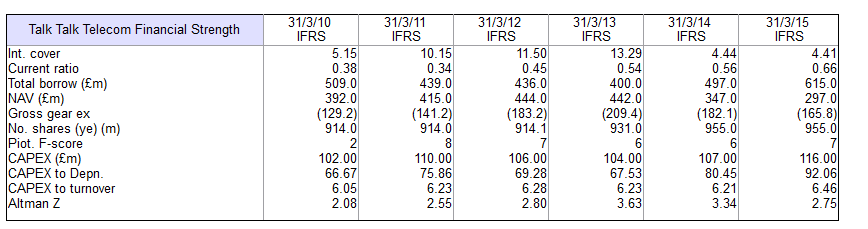

Despite the fall in profits and free cash flow, TalkTalk's finances look to be in reasonable shape. Interest cover of just over 4 times shouldn't be anything to worry about as long as profits don't fall again.

It also seems that TalkTalk is not going to have to spend huge amounts of money on new assets to maintain and grow its business. Capex as a percentage of turnover (sales) has been remarkably consistent at 6-6.5% for the last five years and the company has said that this trend is likely to continue.

Can TalkTalk increase its profits and free cash flow?

TalkTalk has some big ambitions. It says that it is on target to achieve an EBITDA margin of 25% by 2017. To put this into perspective, the target equates to an EBITDA figure of around £475m in 2017 - more than £250m higher than 2015. How on earth is it going to do that? Put very simply it intends to:

- Sell more products to existing customers and gain new customers

- Cut costs

Cutting costs is something that a company can control; growing sales or revenues is much harder. To do this a company has to offer a good product at a competitive price. When you are looking at a company to invest in, one of the most important questions to ask is what is this company's competitive edge? Is it product quality, service or cost leadership? In short, what can it do that its competitors cannot?

TalkTalk's competitive advantage - a low-cost telecoms network

TalkTalk operates in a ferociously competitive market. It's up against giants such as BT, Sky, Virgin Media and soon Vodafone in the battle for household telecom and TV business.

This market is changing fast. All these companies are attempting to persuade customers to have all their home phone, broadband, TV and mobile phone provided by them - known in the trade as a "quad play" proposition.

In theory customers can save money by having all four products with the same company rather than separate accounts with different companies. Companies can make more money by spreading the income from four different products over a lot of fixed costs. Customers also tend to be more loyal which means that companies have to spend less money to keep them. Everyone's a winner or so it seems.

TalkTalk has positioned itself at the value for money end of the market. It has an advantage over its competitors as it has its own very modern, low-cost telecom network. This allows it to offer cheaper home phone and basic broadband packages than its competitors and still make reasonable profits.

But beyond this you have to ask where else does it have an advantage? If you look at the key areas of the quad play market things are less clear. For example:

- Can it provide superfast broadband better and cheaper than BT or Virgin?

- Does it own compelling TV content like Sky or BT?

- Does it have its own mobile network like Vodafone or soon BT?

TalkTalk is trying to address these issues. It is currently building its own ultrafast broadband network (with impressive download speeds of 1 gigabyte per second) in York which could be very lucrative if it can build it cheaply enough and win enough customers. It reckons that there is a potential market of 10 million households in second tier UK cities which could allow it to compete more effectively with BT and Virgin - by offering faster broadband speeds at a cheaper price.

In mobile it already offers customers some very cheap deals. How profitable they are is not certain. Unlike Vodafone and BT, TalkTalk doesn't have its own mobile phone network. Instead it rents space from O2 which means its costs to serve customers will be higher at the moment. Things should improve here though as TalkTalk is building a mobile network to work alongside O2's and this should bring costs down and provide a better service. This could make TalkTalk more competitive.

An area where TalkTalk could continue to bring more money in is by selling more telecom services to business customers. This area accounts for around 20% of TalkTalk's revenues and has been growing strongly as it has been offering customers a lot cheaper prices than BT.

Cutting costs

TalkTalk reckons that it can bring in another £100m of income from growing sales. To meet its profit target it is also looking at taking a sledgehammer to its cost base.

It has been making its business less complicated and investing in technology to help customers manage their own accounts. It hopes that this will bring down costs such as engineer visits as well as improving customer service.

However, the company is hoping that it can slash its subscriber acquisition costs as services improve and customers take on more products - lowering the cost to serve them - and less people leave (a lower churn rate). It is targeting a £100m reduction over the next two years. This looks very ambitious and could be where TalkTalk comes a cropper.

So why has the share price fallen so much recently?

It seems that some investors are getting worried about the intense competition for broadband customers at the moment. You only have to watch TV for a short time to see that various companies are promising big savings if you switch to them.

In a trading statement on 22 July 2015 the company gave a mixed message to investors. It said:

"We have made a good start to FY16. We are on track to deliver full year revenue growth of 5% and strong growth in EBITDA and Free Cash Flow as we make progress towards our FY17 targets."

This is reassuring, but this was less so:

"...the broadband market was softer than we have seen in recent quarters, with higher promotional activity in the sector."

This comment spooked investors and triggered a sharp fall in the company's share price. Analysts are always trying to read between the lines in company announcements but it appears that they have taken this comment to mean:

"There are lots of low prices being offered for broadband at the moment which means that we aren't winning as many new customers as we expected to and/or we are having to cut our prices by more than we would like."

So whilst the company is growing revenues and making progress towards its 2017 targets, there could be some doubt as to whether the progress is good or fast enough. It's also entirely possible that people have read too much into the tone of the trading statement and have overreacted. This can happen quite often in the world of professional investing.

Weighing up the value of TalkTalk shares

So are TalkTalk shares cheap or expensive? I suppose it comes down to whether you think the company will meet its profit targets or not.

| Name | Price | TTM Norm EBIT Yield | fc Norm EBIT Yield | fc PE | fc Yield | fc Dividend cover |

|---|---|---|---|---|---|---|

| TalkTalk Telecom | 289.75p | 2.20% | 6.03% | 18.9 | 5.2 | 1 |

(I created the EBIT Yield columns using the Combine Item feature in SharePad).

If I look at the company's valuation on some different measures, its shares - with the exception of the high dividend yield - don't look that compelling. At least analysts are forecasting that the dividend will be just about covered this year.

Learning to think for yourself

Analysts' forecasts may or may not be any good. As a private investor you probably shouldn't rely on them. Instead you can try and work things out for yourself. Here I am going to show you how you can turn yourself into an analyst to try and answer the most important question about TalkTalk shares:

What will its profits and cash flows look like if it hits its 2017 target?

This sounds difficult because you will have to make a forecast. It isn't really. TalkTalk's annual report and the financial statements in ShareScope and SharePad give you all the information you need to have a go.

Whether your forecast ends up being right or not is not the issue here. All you are trying to do is see how attractive or not the shares might be if you are almost right. Professional fund managers do this all the time. It's referred to as a "back of a cigarette packet" approach and can give you a reasonable shot at answering important questions

Making your own profit and cash flow forecast

You can do this with a pen or paper if you wish or in a spreadsheet. Try and be conservative with any assumptions that you make. This gives you some protection if you are wrong - which you will almost certainly be. Here are the ingredients that you need.

- Turnover - Take the £1795m from 2015 and grow it by 4% per year for the next two years (the company forecasts 5% annual growth).

- EBITDA - Apply a 25% margin (the company's target) to your 2017 turnover figure.

- Depreciation and Amortisation - Keep this at 7% of turnover as it was in 2015. Take this away from EBITDA to get EBIT.

- Net interest - keep this the same as 2015 at minus £22m. You won't be too far away. Take this away from EBIT to get a pre-tax profit figure.

- Tax - assume a tax rate of 20% and apply that this to the pre-tax profit figure to get an estimate of the tax bill. Take this away from pre-tax profit to get a post tax profit figure or profit for shareholders.

- EPS - divide this profit for shareholders by 955m shares.

- Capex - assume 6.5% of turnover to maintain the existing assets. Add another 2% to take into account the building of fibre and mobile networks (this information has been taken from the annual report).

Here's the profit forecast.

| TalkTalk 2017 Forecast (£m) | £m |

|---|---|

| Turnover | 1941.5 |

| EBITDA | 485.4 |

| Dep & Amortisation | -135.9 |

| EBIT | 349.5 |

| Net interest | -22 |

| Profit before tax | 327.5 |

| Tax @ 20% | -65.5 |

| Profit for shareholders | 262 |

| Shares(m) | 955 |

| EPS(p) | 27.4 |

The cash flow forecast.

| Cash flow Forecast | £m |

|---|---|

| EBITDA | 485.4 |

| less: | |

| Interest | -22 |

| Tax | -65.5 |

| Capex | -165 |

| Free cash flow | 232.8 |

| Shares(m)955 | |

| Free cash flow per share(p) | 24.4 |

And what the valuation might look like if the forecasts turn out to be true.

| Current share Price(p) | 289.75 |

| Current Market cap | 2767 |

| Current Net debt | 605 |

| Current Enterprise value | 3372 |

| Est. PE | 10.6 |

|---|---|

| Est. Free cash flow yield | 8.41% |

| Est. EBIT yield | 10.36% |

My profit forecast is considerably higher than the average projected by City analysts right now which is for EPS of 21-22p per share. So I might have made a mistake - which is entirely possible - or you could deduce that the analysts don't believe that TalkTalk will hit its target. But it does look as if the 2016 forecast dividend per share of just over 15p could be affordable even if the company falls quite a way short of its target.

As always, you have to work out whether the company's targets are achievable and whether analysts could be wrong. Hopefully, the exercise above shows you how you can go about answering these questions and learning more about a company as a potential investment.

If you have found this article of interest, please feel free to share it with your friends and colleagues: