Should you be a momentum investor?

Conventional wisdom says that to make money from the stock market there are two simple rules you should follow: Buy cheap shares and buy them when they are unpopular. Like lots of things in life this is easier said than done. This is the theory behind value investing which has been practiced so successfully by investing legends such as Warren Buffett, Seth Klarman and John Templeton.

Successful value investing boils down to buying low and selling high. Value investors don't buy the latest hot shares thinking that the prices will keep on going up. To them paying high prices for shares is too risky. The chances of losing money are too great.

To me, value investing makes a lot of sense. But there are people out there that follow a different path. Their strategy is to buy high and sell higher. Surely you can't make money this way?

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

The world of momentum investing

Well, it seems that you can if you follow a strategy known as momentum investing.

Here you buy the shares that have been going up recently in the hope that they keep on going up for long enough for you make a good profit. You can also sell the shares (known as going short) that have been going down in the hope that they keep on going down enough for you to buy them back at a lower price and pocket a tidy profit.

In its simplest form, momentum investing has nothing whatsoever to do with analysing company fundamentals such as profits, cash flows or valuations. It's all about betting that recent price trends will continue. To its critics, momentum investing is little different from gambling and is therefore a very risky strategy. But it is a strategy that history suggests can work very well indeed.

James P O'Shaughnessy in his book "What works on Wall Street" shows some very supportive evidence that momentum investing has been a good way to beat the returns of the stock market.

The strategy is very simple in theory. You buy the top 10% of shares with the biggest price appreciation for the previous six months and hold on to them for a year. So in an index like the FTSE 100 you would buy the ten best performing shares from the previous six months. According to O'Shaughnessy doing this would have resulted in an investor making 14.1% per year between 1927 and 2009. This compares with 10.4% per year for the US stock market as a whole - a significant difference.

Over shorter time periods, as well, this strategy beats the market. According to O'Shaughnessy, though, it is rarely a good idea to buy the worst performing stocks in the market as it is harder to make short-term gains when share prices are falling. This flies in the face of many popular value investing strategies that focus on buying unpopular shares. In his view this only works at the bottom of bear markets such as 1973/4 or 2009.

So why does momentum investing seem to work? Even though investors are literally flooded with information about companies and markets, some experts reckon that the professionals are actually quite slow to react to it. A good example might be something like a higher profit forecast from City analysts.

When professional investors do cotton on they buy the shares of the company concerned and its price goes up. Companies have also become increasingly clever at carefully guiding analysts on future profits. There is a tendency for them to drip-feed good news - rather than all in one go - so there is a series of increased profit forecasts. This can explain why shares prices that have gone up a lot can keep on going up.

Taking a closer look at momentum investing in ShareScope and SharePad

I have to admit that I am usually quite sceptical about the claims of some investing strategies. It's not impossible to get data to fit the story that you want to tell.

So I decided to do some digging for myself. Whilst ShareScope and SharePad don't have a facility to backtest investment strategies, they contain loads of historical data (back to 1992 for many companies) which will allow you to get a pretty good idea as to whether something has worked in the past.

This is what I did to find out more about momentum investing:

- The sample of shares was taken from the current members of the FTSE All share index. This has 637 shares in it at the moment. The only drawback of using these shares is that when looking back at a strategy you will miss out on shares which no longer exist but which made a contribution to the strategy. This is more significant the further back you go. However, I think it is still possible to get a reasonable feel for things.

- The shares were ranked in terms of share price performance for selected six monthly periods. This is very straightforward to do in ShareScope and SharePad by adding a column for the price change between two dates.

- The top ten percent (64 shares) were then used as an equal-weighted portfolio (the same amounts of money were assumed to be invested in each share) and the performance of that portfolio was calculated (in price terms only - ignoring dividends) and compared with the performance of the FTSE All Share index for the next year.

- I chose the top performing shares in the six months prior to the following time periods to check out the strategy - 2003, 2009, 2014, 2015 (so far) and the period from June 2015 to the end of October 2015. This represents a selection of bull and bear markets.

The performance of each cohort of shares is shown in the table below:

| % change | Basic Momentum | FTSE All Share Index | Difference |

|---|---|---|---|

| 2003 | 35.9 | 15 | 20.9 |

| 2009 | 24.7 | 21 | 3.7 |

| 2014 | -1 | -2.1 | 1.1 |

| 2015 so far | 12 | -1.4 | 13.4 |

| Since June 2015 | -1.8 | -2.4 | 0.6 |

Whilst I have only run five separate tests they are telling me that momentum works in theory - it can beat the stock market in good times and bad. The test is also telling me that 2015 has been a stellar year for momentum investing so far. The top twenty shares are listed below:

However, taking the best performing shares from the first six months of 2015 isn't working that well at the moment. They have lost money and have only just lost a little bit less than the stock market as a whole.

Here you can see that some of the best performing shares during the first half of 2015 seem to have run out of momentum.

That said, we are only four months into a strategy which is based on holding on to a portfolio of shares for a year. These shares still have time to recover and deliver good results.

However, the poor performance of these shares so far does highlight a very important point about momentum investing in that it can really test your patience and discipline. Can you cope with holding on to a bunch of shares that are currently losing money? Will you sell out in fear of losing even more?

If the answer to these questions are respectively no and yes then perhaps momentum investing is not for you.

The past results of momentum strategies are all very interesting but not really very relevant to the private investor or very practical either. Buying and selling 64 different shares is very expensive when all the broker commissions, stamp duty and bid-offer spreads (the difference between the buying and the selling price of the shares are taken into account) are added up. I've ignored the impact of capital gains taxes as well. This means that the results in the tables above are overstated.

Even if you followed this strategy with a spread betting account it is still a rather messy and time consuming way to put your money to work. Ideally, you need a way of reducing the number of shares you will buy to a more manageable level.

Combining momentum with value

One potential option I tried out was to combine shares with the highest momentum and the most attractive valuations. For valuation, I only selected shares with an EBIT yield (EBIT divided by enterprise value) of at least 10% - in other words, fairly cheap. I then selected the ten shares with the highest share price momentum that met the valuation criteria.

I performed this test for 2014, 2015 so far and for 2015 between June and the end of October. The results were mixed.

| % change | Momentum & Value | FTSE All Share Index | Difference | Diff Vs Basic Mom |

|---|---|---|---|---|

| 2014 | 22.8 | -2.1 | 24.9 | 23.8 |

| 2015 | 15.1 | -1.4 | 16.5 | 3.1 |

| Since June 2015 | -7.8 | -2.4 | -5.4 | -6 |

Putting in a value filter would have given you better results in 2014 and for 2015 so far compared with a basic momentum approach. But since June, you would have been worse off (so far).

Here are the ten shares that met the momentum and value criteria at the start of 2015. As you can see, there have been some stunning share price performers such as JD Sports and Greggs.

| TIDM | Name | %chg 30/6/14 to 31/12/14 | 1y ago EBIT yield | %chg 2/1/15 to 30/10/15 |

|---|---|---|---|---|

| GMD | GAME Digital PLC | 75 | 11.4 | -34 |

| EMG | Man Group PLC | 53 | 14.4 | 3.9 |

| GRG | Greggs PLC | 37 | 10.9 | 64 |

| JD. | JD Sports Fashion PLC | 26 | 12.6 | 90 |

| BDEV | Barratt Developments PLC | 26 | 12.5 | 33 |

| BWY | Bellway PLC | 24 | 13.9 | 35 |

| EZJ | easyJet PLC | 22 | 11 | 4 |

| GEMD | Gem Diamonds Ltd | 22 | 12.9 | -47 |

| MTVW | Mountview Estates PLC | 20 | 11 | 7.3 |

And below are the ones that you would have picked on 1st July 2015. Here the news is not as good so far.

| TIDM | Name | %chg 2/1/15 to 30/6/15 | EBIT yield | %chg 30/6/15 to 30/10/15 |

|---|---|---|---|---|

| RDW | Redrow PLC | 52 | 11.2 | 4.8 |

| INDV | Indivior PLC | 51 | 21 | -8.5 |

| HRG | Hogg Robinson Group PLC | 44 | 16.1 | 1.6 |

| GFRD | Galliford Try PLC | 39 | 10.4 | -14 |

| MNZS | Menzies (John) PLC | 38 | 11 | -18 |

| TTG | TT electronics PLC | 37 | 12.8 | -12 |

| BKG | Berkeley Group Holdings (The) PLC | 36 | 13.5 | -0.84 |

| NOG | Nostrum Oil & Gas PLC | 35 | 18.2 | -27 |

| BDEV | Barratt Developments PLC | 33 | 10.6 | -0.33 |

Momentum investing and the private investor - does it really work?

There's no doubt that there seems to be a lot of theoretical evidence which suggests that momentum strategies can help people make money in the stock market. That said, I don't think it is very easy for private investors to exploit it.

It seems best suited to short term traders using spread betting accounts to keep their costs lower and who have the temperament to cope with the short-term gyrations in share prices. Trying it in a long-term savings plan like a SIPP or ISA would be very expensive, time consuming and often stressful.

Like all strategies, momentum does not work all the time. Given the difficulties in buying lots of different shares, a lot of care is arguably still needed when picking momentum shares. You are not guaranteed to pick winners. Very few private investors can practically juggle a large portfolio of momentum shares which replicate the results that theory suggests have been possible.

This is essentially true of all investment strategies where the past results are based on buying a basket of shares (often a large one). Most of us can't or won't do that in practice. It therefore makes sense to do a little bit more research before buying any shares.

That said, I think momentum can play a useful role in your stock picking process. If you have owned shares such as JD Sports, Greggs and Domino's Pizza for the last year then momentum would have worked very nicely for you.

Above all else though, you need to know when to sell. It is very easy to become too greedy and hang on for even bigger gains. I see momentum investing as being very much like riding the white water rapids. You hope you can hang on long enough and not go crashing over the waterfall.

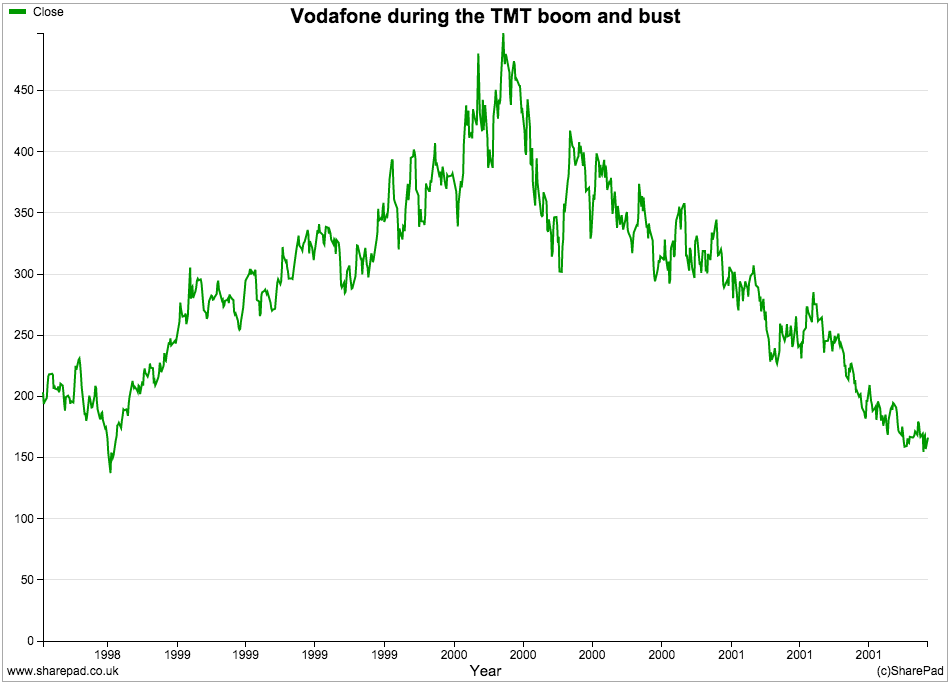

History tells us that momentum can change very quickly with shares. Vodafone (shown in the chart above) was a classic momentum share during the bubble in telecom shares during the late 1990s. Once the bubble burst, the shares fell sharply. Nearly fifteen years later, Vodafone shares trade at less than half their 2000 peak.

Even sophisticated momentum portfolios in exchange traded funds (ETFs) show that it is not easy to make money and beat the market.

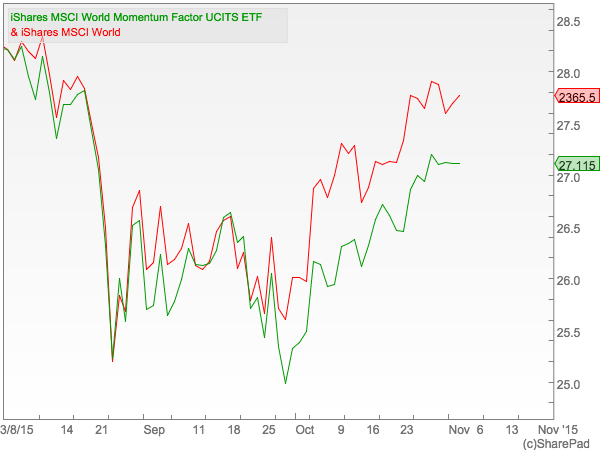

The iShares MSCI World Momentum Factor ETF has beaten the MSCI World index during the last year as shown in the chart below.

But it hasn't done so during the last three months.

Elsewhere, the evidence is far from compelling. AQR - a specialist in quantitative investing (investing by numbers) runs a number of momentum funds. Since launching just over six years ago, the performance of the AQR Large Cap momentum fund has just matched the returns (slightly less, actually) of its Russell 1000 benchmark index.

The Powershares DWA Momentum ETF has marginally beaten the total returns of the S&P 500 index so far in 2015. Over 5 years though it has only matched rather than beaten the S&P 500.

Momentum investing in practice is not as easy as it would seem.

Some things to consider

- Momentum strategies can help you make money from shares.

- Theory and real life are two different things.

- Practical momentum investing is not easy. It is probably more suited to spread betting accounts rather than buying shares (otherwise it can be very expensive).

- I would still recommend researching the companies. Are profits and analysts' forecasts still going up? Is the company still expanding? Or has a profit recovery or share price bounce run out of legs?

- Consider adding valuation and quality criteria (high ROCE or low debts) to reduce your momentum candidates to a manageable number.

- Work out when to sell all or part of your position (take profits) early on. Don't get too greedy.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.