Using cash flow to find high quality companies

During the last twenty years I've tried out lots of different investing strategies. I've dabbled with buying beaten up shares and ones that have already gone up a lot and never felt comfortable.

However, there is one strategy that I've become more comfortable with than any other. To me, long-term investing is all about buying the shares of top quality companies. In this article, I am going to show you how I use SharePad to find a list of high quality companies to focus my research on.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Why buy quality?

Successful investing is all about managing the trade off between risk and return. Too many investors focus on how much money they might make and forget about how much they might lose.

Investing in quality companies can help you manage this trade-off very well. High quality companies are able to earn high returns on the money they invest year in, year out. They can do this because they can do things that their competitors cannot (due to lower costs, brands, patents etc.) and have what is known as an economic moat. This moat protects the company and its investors from competition and lowers their risks at the same time.

If you can buy these types of businesses at the right price and own them for long enough then it is possible to see your investment compound in value over time. This is the approach that has made Warren Buffett very rich.

So how do you go about finding high quality companies?

Introducing cash return on capital invested (CROCI)

Quality companies have many characteristics. When it comes to looking at their financial performance, I am paying particular attention to two things above anything else:

- A consistent ability to make high returns on money (capital) invested in the company.

- A consistent ability to produce lots of surplus or free cash flow. This is because cash flow is a lot harder to fudge than profits.

Looking for companies that produce high returns is not too difficult. Many people will start their search by looking for companies with a high return on capital employed (ROCE). I'm a big fan of ROCE as a measure but it is vulnerable to aggressive accounting.

Free cash flow is a little bit trickier. That's because free cash flow on its own is just a number. The fact that a company produces free cash flow is usually a good sign - providing it is not skimping on investment to do so - but it doesn't actually tell you anything more.

Thankfully, help is at hand. There is a way of identifying companies that produce high returns and generate lots of free cash flow at the time. It's called cash return on capital invested or CROCI for short. It is calculated by dividing a company's free cash flow by its capital invested or capital employed and is expressed as a percentage.

CROCI = free cash flow to the firm/capital invested

Free cash flow to the firm (FCFf) is the amount of cash left over to pay the interest on a company's borrowings and to pay shareholders. It is the money available to pay the providers of the company's finances or capital.

To calculate free cash flow to the firm, you start with a company's operating cash flow and then take away any tax paid and money spent on new assets (capex).

Capital invested is calculated by adding total borrowings to total equity and other long-term liabilities such as pension fund deficits and provisions.

CROCI is my go-to measure of company performance and I use it as a key tool when looking at shares to go in my SIPP or ISA. It can also be a good way to spot takeover candidates. Private equity companies like to buy companies with lots of free cash flow and use it to pay off the debt they use to buy them. This process is known as a leveraged buyout or LBO.

Building a CROCI filter in SharePad

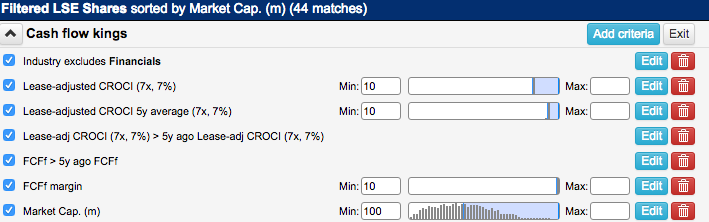

Here's one of the CROCI filters that I use in SharePad. You can easily build this yourself by selecting Filter on the List view menu. If you need any help building filters, don't hesitate to call our brilliant customer support team.

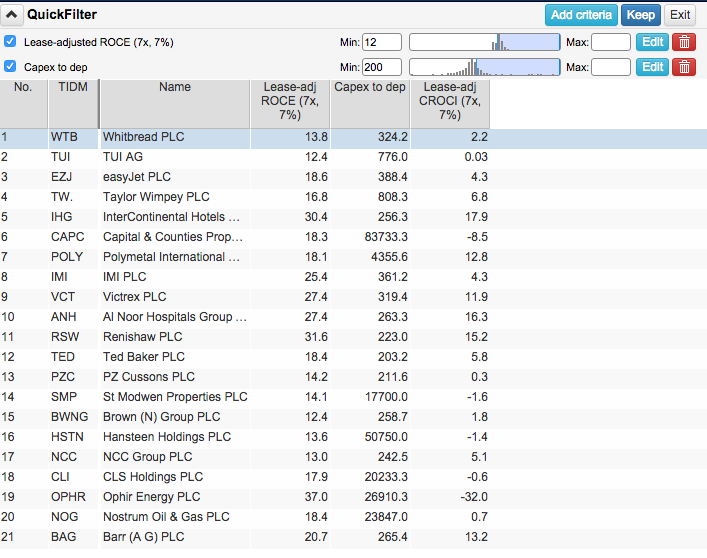

It has the following building blocks as shown above.

- Financial shares are excluded as CROCI is not that useful a measure for them.

- Lease-adjusted CROCI of at least 10%. I use the lease-adjusted option because I want to avoid picking shares that have a high CROCI but only because they have a lot of hidden debts. High street retailers and transport companies spring to mind here. SharePad estimates the hidden debts by multiplying the annual rent expense by 7. It then applies 7% interest on this hidden debt figure and adds this on to free cash flow to get a lease-adjusted value. 10% is my minimum CROCI to qualify as a good company.

- A 5 year average lease-adjusted CROCI of at least 10%. I want to see some consistency in CROCI, not just a one-off figure.

- CROCI to be higher than CROCI five years ago. The trend in CROCI is important too. A rising, high CROCI is preferable to a falling one. This will be one of the things to pay close attention to when doing any further research.

- A rising amount of free cash flow. I want companies where the CROCI is being driven by rising free cash flow to the firm (FCFf) and not a shrinking amount of money invested. I am looking for companies that can grow.

- Free cash flow margin of at least 10%. This is an additional safety measure. Companies with high free cash flow margins (free cash flow to the firm as a percentage of sales) are better placed to survive tough times than companies with low margins.

- Minimum market capitalisation of £100m. I want to avoid very small companies which might be more risky.

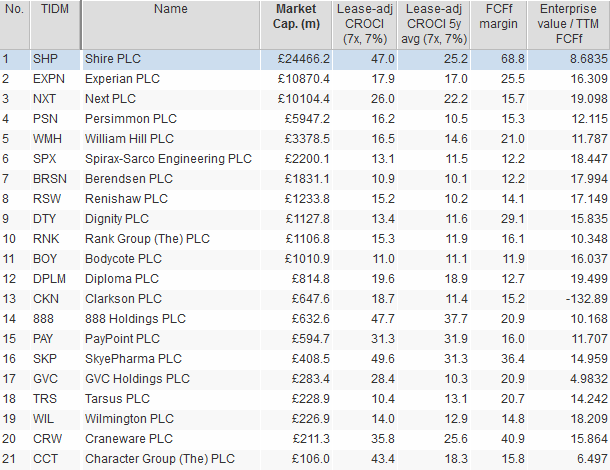

This gives me a list of 44 shares to look at which is too many. I need another criteria to narrow down my list further.

High CROCI companies at a fair price

The all important price criteria is missing. Good companies only make good investments if you buy them at a fair price. I stress the word "fair" because you can rarely buy good companies at a cheap price unless its fortunes are about to take a turn for the worse or if the market in general is falling.

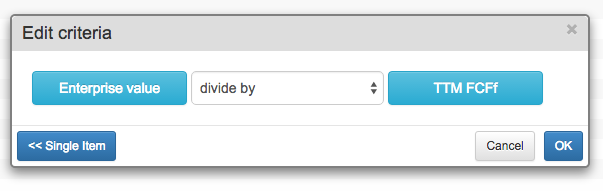

So, I've set a maximum price of 20x trailing twelve month (TTM) free cash flow for firm. In other words, a Price to FCFf of no more than 20.

Note that I don't use SharePad's default Price to FCF which uses free cash flow for equity (FCF). FCF is FCFf less interest payments.

To calculate Price to FCFf, I get SharePad to divide the current enterprise value (EV) by the TTM free cash flow for firm - using the Combine items feature in the bottom left of the Add criteria dialog.

This narrows the list down to 21 shares - a more manageable number. You can now start doing some more in-depth research or add extra criteria to narrow down your list further.

Valuation rules

It is important to remember when you are valuing a company using multiples to match the right numbers with each other. For example, when you are looking at enterprise value (EV) you need to match it against the appropriate profits, cash flows or assets. This is why we have EV multiples such as:

- EV/EBIT

- EV/EBITDA

- EV/Sales

- EV/FCFf

- EV/Capital Employed

Matching EV against profit after tax doesn't make sense because you are looking at a profit measure after interest has been paid on borrowings. These borrowings are included in the EV so you need to include all the profits generated by them.

If you are using market capitalisation (the market value of the equity - or shares) then you need to match it against just the profit, cash flow or assets attributable to shareholders.

This gives us multiples such as:

- Price to earnings per share (PE)

- Price to free cash flow (P/FCF)

- Price to net asset value (P/NAV)

Practical things to consider

I am a big fan of CROCI but like most tools in investing it is not perfect.

One of the good things about it is that it keeps you away from companies and industries that have to spend a lot of money on new assets (capex) to stay in business. So CROCI would have kept you away from supermarket shares in recent years and also many utility shares.

However, CROCI penalises companies that are investing heavily today at the expense of current free cash flow but could have lots of free cash flow and high CROCI in the future. One way that you could try and spot these kinds of companies is to look for those with a reasonable ROCE (which only deducts depreciation rather than total capex) of say more than 12% and where capex to depreciation is currently high (well above 100%) and look at them more closely to see what's going on.

For example, Whitbread has a lease-adjusted ROCE of 13.8% but a CROCI of only 2.2%. But it is investing heavily in new hotels and coffee shops with a capex to depreciation ratio of over 300%. When investing levels come down to stay in business levels rather than their current growth mode, Whitbread's CROCI is probably going to look a lot better than it does now. (To read my analysis of Whitbread shares click here.)

You also need to pay very close attention to how a company's free cash flow is made up. Is it for good reasons such as growing profits or bad or temporary reasons such as cutting investment, squeezing suppliers or peak profits at the top of the economic cycle?

To sum up

- Buying quality companies can be a profitable and less risky investment strategy.

- Quality companies earn high returns on money invested and produce lots of free cash flow.

- CROCI is a good way of spotting quality companies.

- The trend in CROCI is just as important as the number.

- CROCI with rising free cash flow is preferable.

- Consider adding free cash flow margin as an extra cash flow criteria.

- CROCI penalises companies that are investing heavily.

- Understand where a company is getting its free cash flow from.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.