Stock Watch: Dignity

One of the sad facts about life is that one day it comes to an end for all of us. This makes the funeral industry one of the most stable and predictable out there.

Since it floated on the stock market back in 2004, Dignity (LSE:DTY) has proven to be a very dependable long-term investment. Its business is very simple and easy to understand which is probably one of the reasons investors seem to like its shares. It organises and conducts funerals, owns crematoria and sells pre-paid funeral plans.

Let's open up SharePad and see if Dignity has any of the hallmarks of being a very good business.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Returns on capital invested

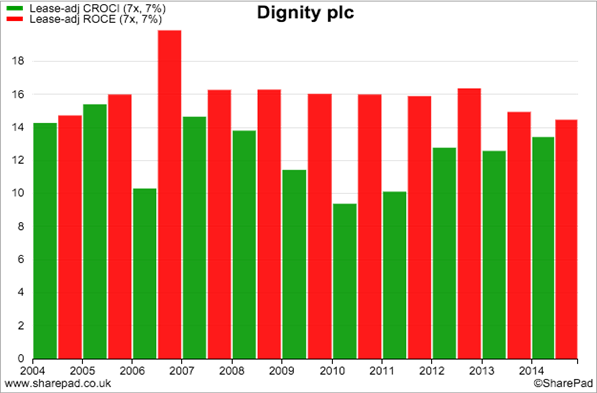

As always, I am looking at Dignity's returns on the money it has invested including any hidden debts (known as lease-adjusted returns).

Starting with its free cash flow returns (CROCI) below, we can see that the company does consistently produce free cash flow which is always a good sign. Lease-adjusted CROCI over the last ten years has usually been above 10% which is the minimum level I set for a good business. Its current CROCI is 13.2%. So on this measure, Dignity looks like a pretty decent business.

This is also confirmed by looking at its return on capital employed (ROCE) figures. In many cases, you should usually expect ROCE to be higher than CROCI as ROCE only takes away depreciation (an estimate for how much money a company needs to spend to maintain its assets) rather than the total amount of money spent on new assets in the CROCI calculation. ROCE tends to be higher than CROCI when a company is spending more than its annual depreciation expense on new assets - i.e. the capex to depreciation ratio is more than 100%.

It is also worth noting that ROCE is calculated before tax whereas CROCI is an after tax measure. This should also see CROCI lower than ROCE when a company pays tax.

As you can also see in the chart, Dignity's ROCE (the second or red bar) has been very stable which is a good sign. It has trended downwards during the last couple of years but is still running at a very respectable 14.4% adjusted for leases.

Profit & cash flow margins

As well as looking at returns I think it's also a good idea to look at a company's profit and cash flow margins. High profit margins are preferable to low ones for many reasons, but above all else they can give more protection to an investment.

This is because higher profit margins can fall further before a company runs out of profit altogether and gets into trouble. If a company has low profit margins, a small business set-back might put the solvency of the company at risk.

Also look at the trend in profit margins. Are they going up or down? Dignity's EBIT margins are very stable and have been above 30% for the last ten years showing just how profitable the funeral business has been.

Free cash flow margins (free cash flow to the firm as a percentage of sales) also look to be very healthy and have increased significantly during the last five years.

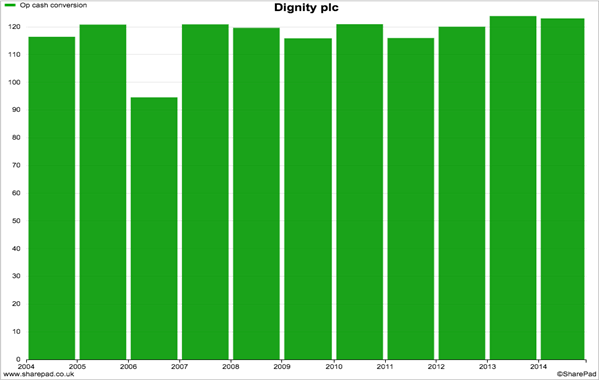

Cash conversion

How good is Dignity at turning its profits into cash flow? Given that ROCE and CROCI are fairly similar numbers the initial signs are good. Dignity passes the first test of cash conversion as operating cash flow is consistently more than operating profit as shown in the chart below.

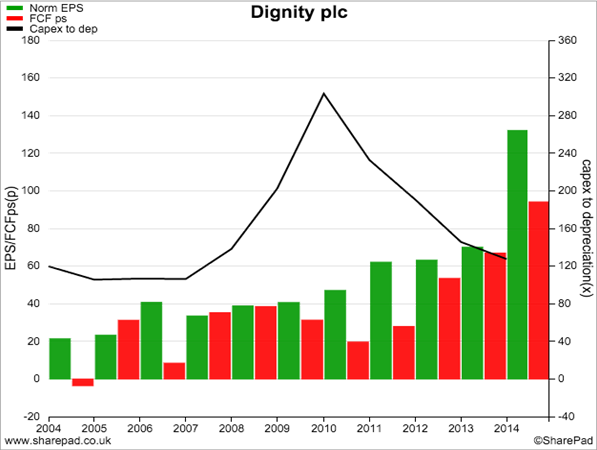

But if we look at the profits and cash flow for shareholders, the track record is a little bit more patchy - a large chunk of earnings per share hasn't always been turned into free cash flow per share.

That said, things haven't been too bad on this score, especially as Dignity has been spending quite heavily on new assets as shown by a few years when capex was significantly higher than depreciation. As capex has come down in recent years, free cash flow per share has been increasing significantly which is encouraging to see.

Does dignity have too much debt?

Too much debt can often be a warning sign for potential investors. The interest paid on debt magnifies the changes in sales and trading profits on EPS and free cash flow per share - this is known as financial gearing. Gearing is great when times are good but can wipe out shareholders when times are bad.

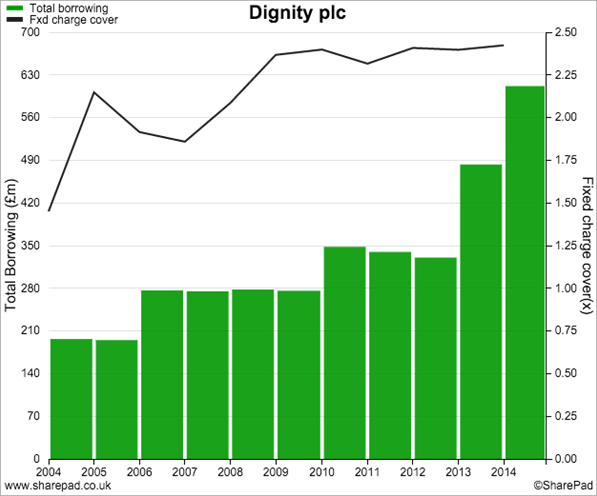

So should people be worried by the big increases in total borrowings at Dignity recently?

I don't think so. Dignity's sales and cash flows have proven to be very stable. This means that it has the kind of business that can finance itself with borrowed money without shareholders losing too much sleep about it.

Dignity borrows money by issuing debt securities known as notes. It refinanced the business back in 2014 issuing £238.9m of notes paying interest at 3.55% which are due to be repaid in 2034. It also issued another £356.4m of notes paying interest of 4.7% which are due to be repaid in 2049. These notes give Dignity something very similar to a fixed rate mortgage with an average interest rate of 4.2%. This looks like it has locked into a fairly decent long-term financing of its business which shareholders should be fairly comfortable with.

Fixed charge cover of 2.4 times also tells us that Dignity's debts are not something to worry about at the moment.

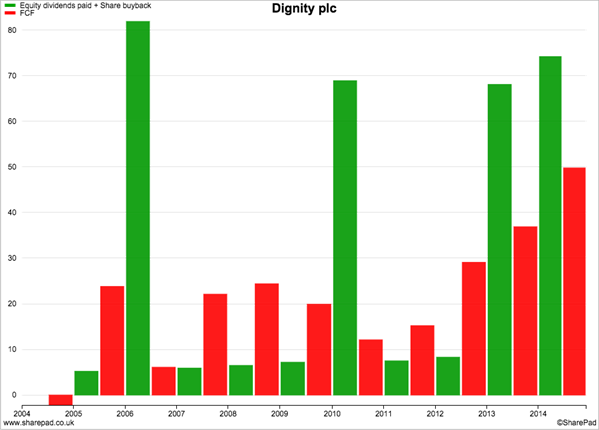

Dignity has used debt to fund some big buybacks and special dividends in recent years.

Between 2005 and 2014 Dignity has paid out nearly £335m in buybacks and small annual dividends.This is compared with £239m of cumulative free cash flow generated over the same period.

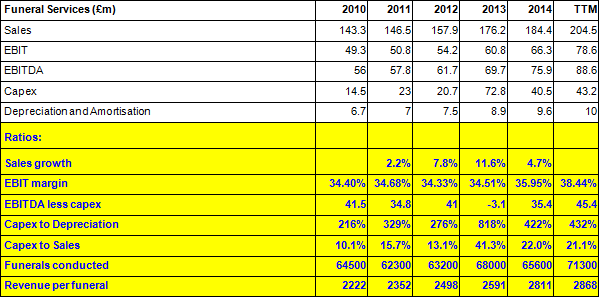

A closer look under the bonnet - Funerals

Dignity's core funeral business appears to be in rude health and is very profitable as shown by its high and rising margins. In 2015, it has been helped by a spike in the UK death rate during the first six months of year which means that profit growth rates will slow in 2016.

The company doesn't disclose a separate figure for capex but lumps it in with money spent on buying other businesses. Maintenance capex is disclosed in the annual report at just under £12m in 2014 which is only just higher than depreciation indicating that the company's profits are believable.

High profit margins are very desirable but they can be competed away if they attract new competition wanting a slice of the pie. The number of funeral directors is increasing in the UK but this doesn't seem to be hurting Dignity as its estimated share of the market is broadly stable. Reputation and local presence count for a lot in this business and this can deter new entrants.

That said, it is spending reasonable amounts of money buying up other funeral companies and so it is buying some market share to defend itself from competition.

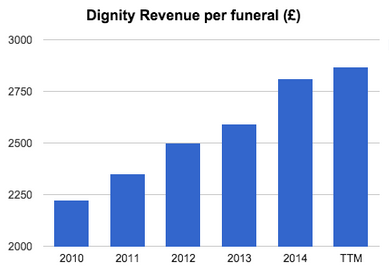

What is encouraging is that Dignity does seem to have some pricing power as the revenue per funeral keeps going up. This is despite the fact that nearly a quarter of Dignity's funeral sales come from pre-paid funeral plans which tend to have a lower price.

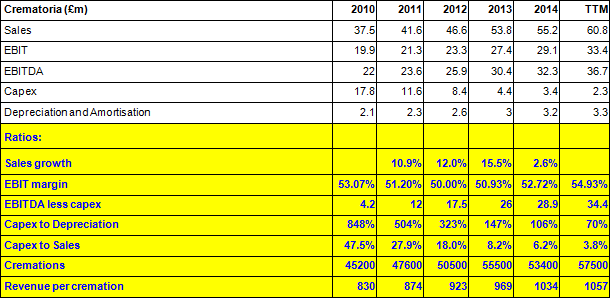

Crematoria

Cremations are extremely profitable with profit margins of over 50%. Here barriers to new competiton are higher than in funerals. Planning permission is needed to build new ones and the costs are not small. This may explain why Dignity's profit margins have stayed high.

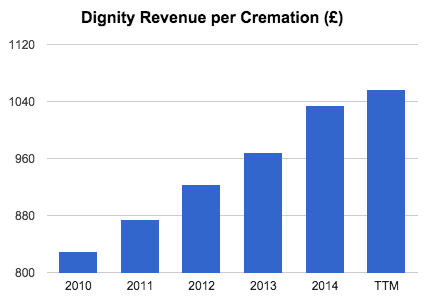

As with the funerals business, Dignity has been able to raise prices to keep its profits growing. Profits have benefited from a spike in the death rate in 2015.

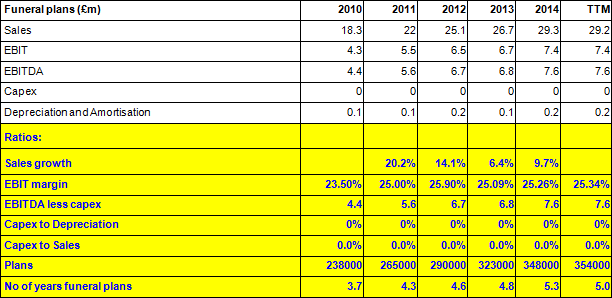

Funeral plans

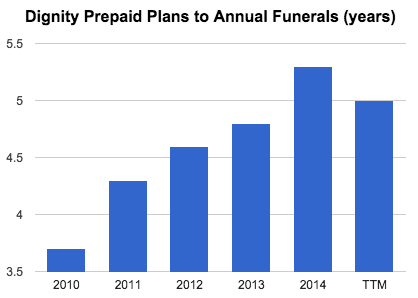

Dignity has been selling a lot more pre-paid funeral plans in recent years. This gives its funeral business a lot of visibility on future sales as the plans are making up a bigger chunk of its total funerals. Dignity currently has five years annual funeral volumes in pre-paid plans.

This business needs to be watched closely. The sale of funeral plans is not currently regulated and there has been some concern that it might be in the future which might increase costs and reduce profits.

Profits here are small and are made up from administering and marketing the plans sold through partner companies. The monies paid for the funerals are held in independent trusts - where they are invested - or are backed by insurance policies and are not handed over to Dignity until a funeral needs to be paid for.

The amount of money in trusts was £678m at the end of 2014 and was sufficient to meet the anticipated costs of future funerals. However, the trusts have recently changed their investment policies and moved more money into shares and overseas markets. A stock market crash might see the value of the funds fall and leave Dignity with a hole to fill to cover the cost of the funerals it is obliged to provide.

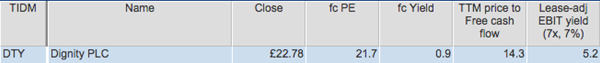

Are Dignity shares cheap or expensive?

Despite being a high quality business with very stable profits and cash flows It seems hard to argue that Dignity shares are particularly cheap at the moment, especially given the fact that 2015 profits will have been given a nice boost from a spike in the death rate. That said, given the high quality of profits maybe it is unreasonable to expect to pay bargain prices for the shares.

To sum up

- Dignity seems to be a high quality business with decent returns on capital and high profit margins.

- Cash flow performance is reasonable and has been improving.

- Debt levels are not too high given the stability of profits and cash flows.

- Dignity seems to have pricing power in both funerals and cremations which has helped preserve high profit margins.

- Pre-paid funeral plans give lots of visibility on future sales.

- The funding of funeral trusts needs to be watched.

- Profits and cash flows have benefitted from a spike in the death rate in 2015.

- The shares have high valuations attached to them.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.