Stock Watch: ITV

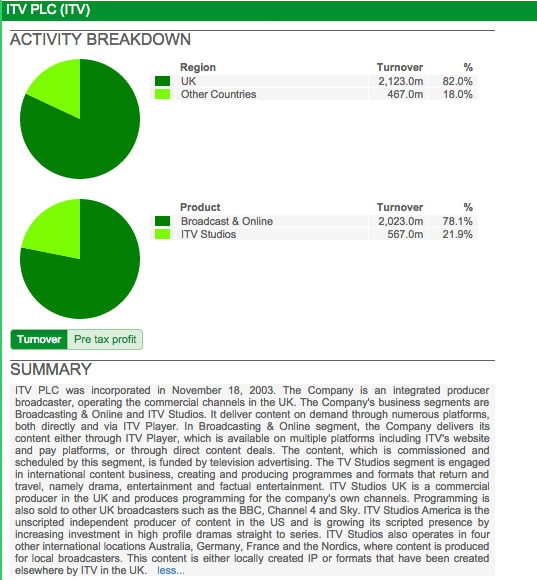

ITV is Britain's largest independent television broadcaster. It is home to some of the country's most popular TV programmes such as Coronation Street, Emmerdale and The X Factor.

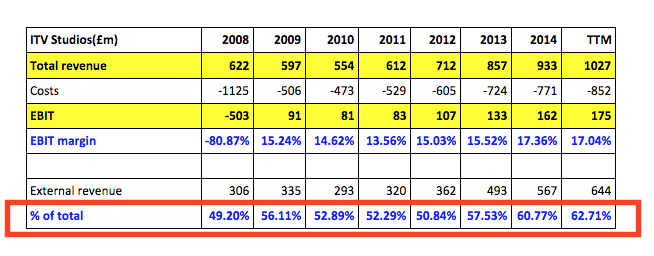

ITV Studios also makes a lot of its own TV programmes and sells them to other broadcasters. It has been expanding overseas in recent years by buying up other TV production companies. More than half of ITV Studios' sales come from outside the UK now.

For years ITV's fortunes went hand in hand with those of the UK economy because the business has always been highly dependent on advertising revenues. ITV is still the best place for advertisers to reach lots of people through TV adverts. This is great for ITV when the economy is growing and advertisers want to spend money but less so when it turns down and companies cut back on their advertising budgets.

Since the last recession a new management team has set about making ITV less dependent on TV advertising and making it a less risky proposition for investors.

Let's open up SharePad to see how it has been getting on.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Returns on investment

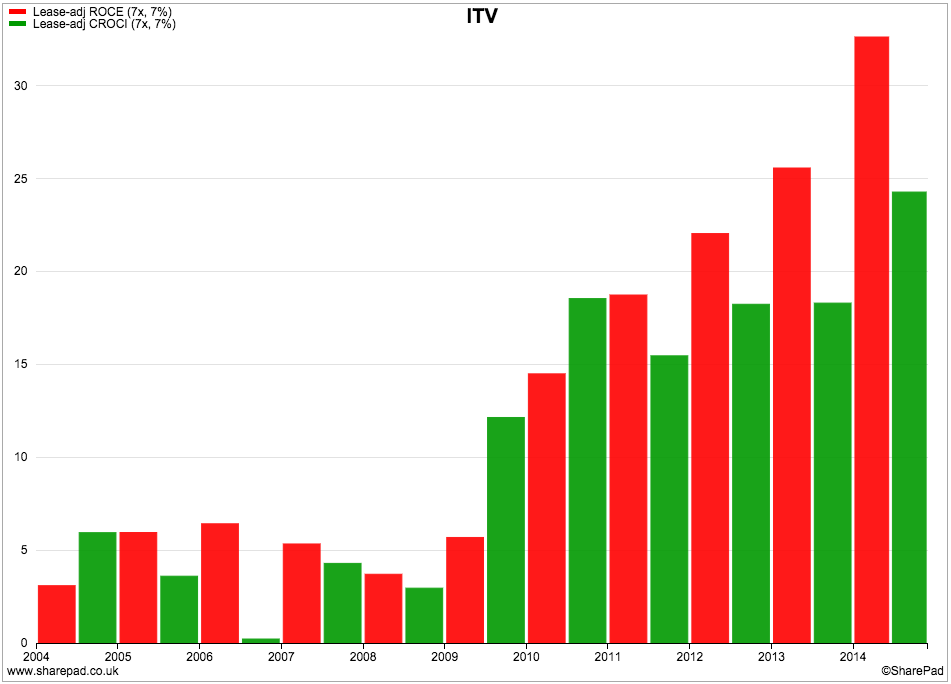

In the early to mid 2000s ITV was not a very good business. Its return on capital employed (ROCE) and cash flow returns on capital invested (CROCI) were very poor. The company was not coming anywhere close to getting a good return on the money it had spent.

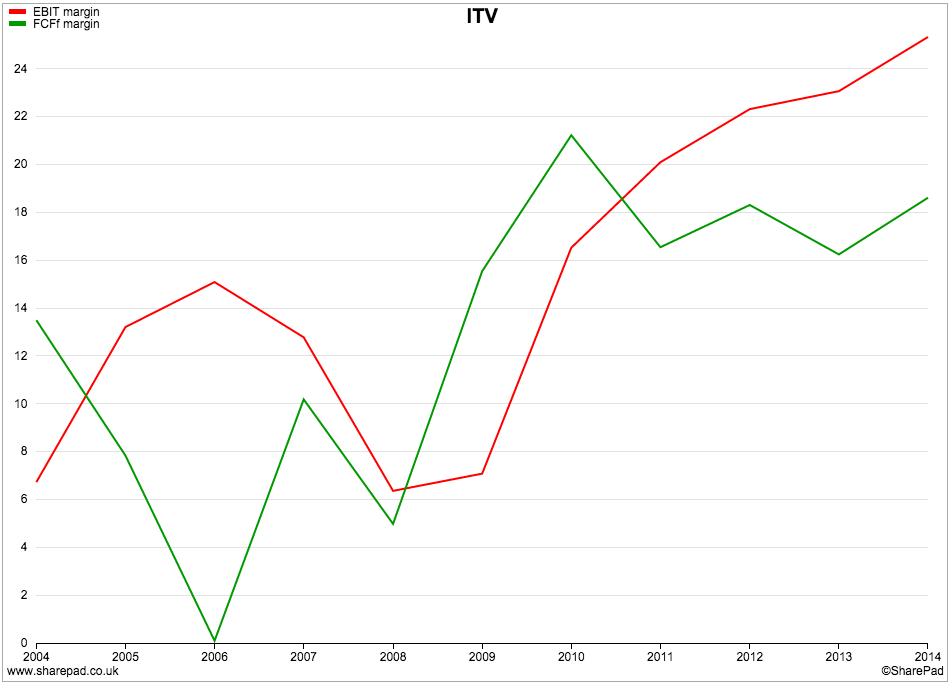

Since 2009, the company's financial performance has been transformed. ROCE and CROCI have soared. ITV now looks to be an excellent business, making good profits and generating lots of free cash flow. This has been driven by big increases in EBIT and free cash flow margins as shown in the chart below.

A closer look at ITV's cash flow performance

A rising CROCI is telling us that ITV's free cash flow performance has been improving in recent years. In most cases that is a good sign but it is always a good idea to take a closer look at what's been going on. Sometimes a company's free cash flow isn't always what it seems.

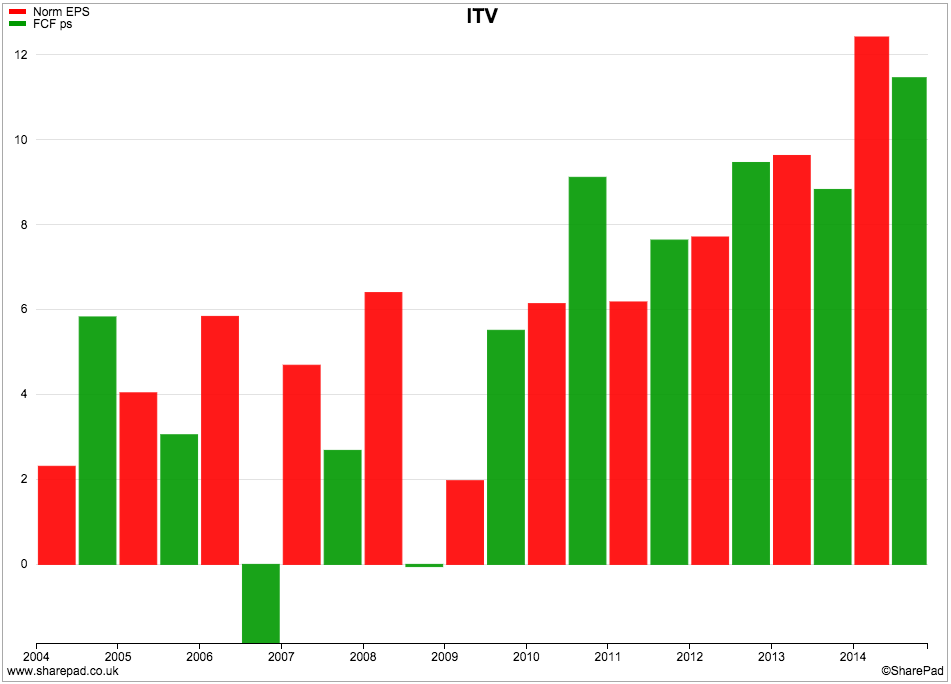

The initial signs look good. During the last few years ITV's free cash flow per share has been very close - sometimes more than - its earnings per share (EPS). This definitely wasn't the case ten years ago.

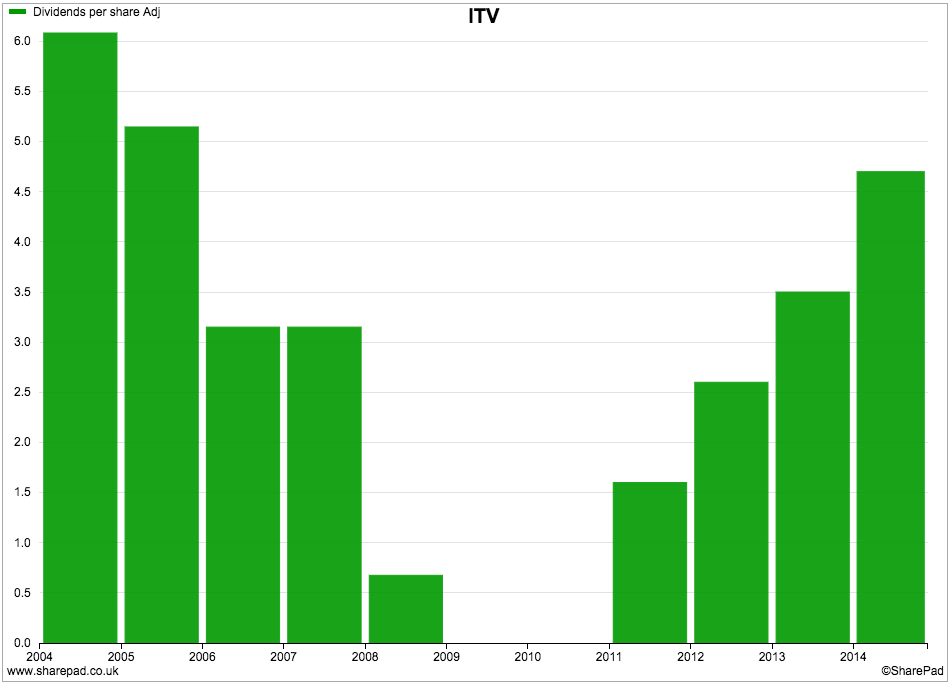

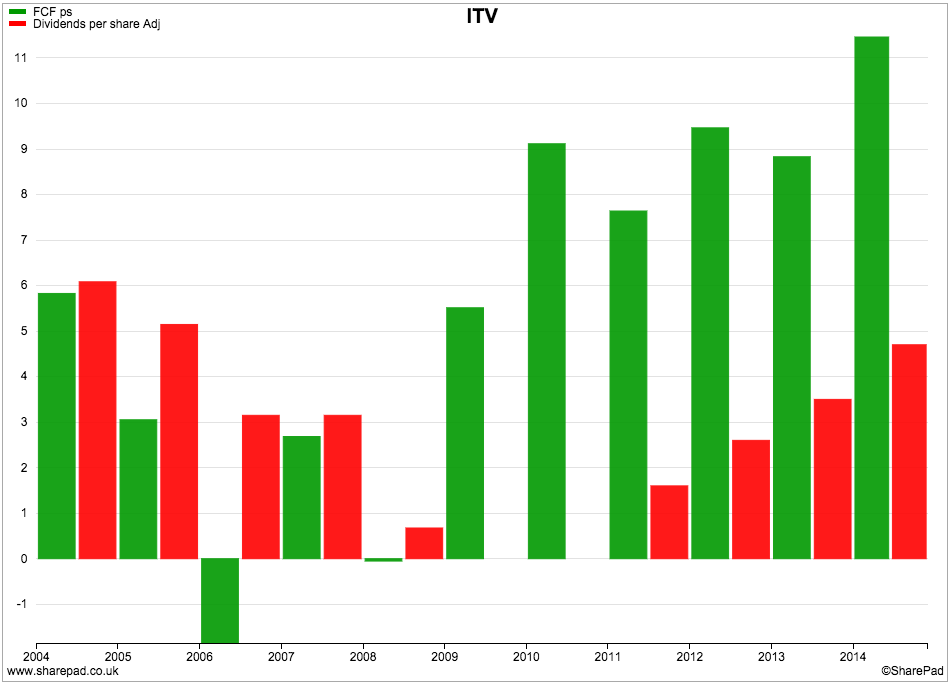

This growing free cash flow per share since 2009 allowed ITV to start paying dividends again in 2011 and then grow them at a very impressive rate.

ITV has also paid special dividends as well for the last three years and it's not too difficult to see why it has been able to do so.

If you look at the chart above you can see that there has been a big surplus between ITV's free cash flow per share (the green bars) and its normal dividend per share (red bars). There has been plenty of spare cash flow to pay shareholders something extra on top.

If ITV's free cash flow continues to be maintained or grow from current levels then further special dividends could be possible.

So why has ITV been so good at generating lots of free cash flow for its shareholders in recent years?

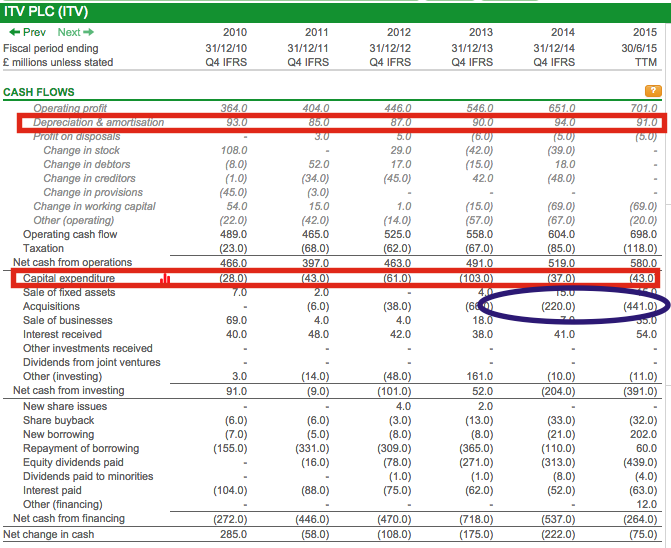

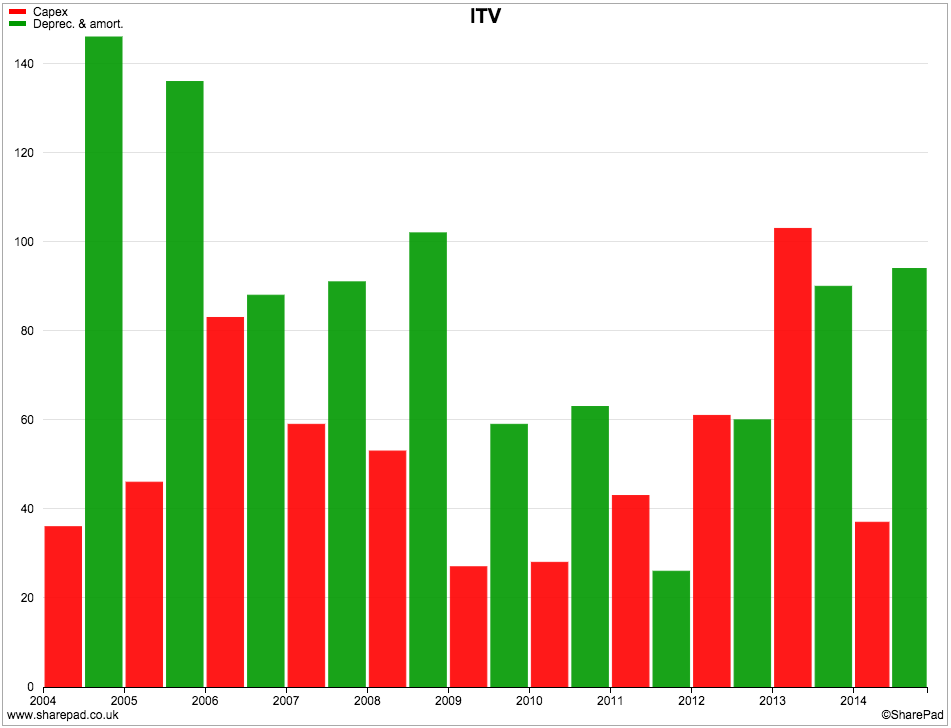

The best source of cash flow improvement is because of bigger profits and ITV ticks this box off nicely. But a closer inspection of its cash flow statement (above) shows that its capital expenditure - spending on new assets - has been a lot lower than its depreciation charge. In some years the gap between the two numbers has been quite big.

Normally this kind of behaviour would make me suspicious. It might make me think that ITV has been under-investing which could hurt its ability to make more money in the future. As you can see from the chart above this is nothing new. ITV has to spread the cost of things such as licences, customer contracts, software and programme libraries over their useful lives which don't need to be matched by outflows of cash every year. I don't think there is anything bad going on here.

ITV has been investing by buying other companies as highlighted by the blue ring in the cash flow statement above.

Financial position

ITV's finances look to be very healthy. The company had more cash than debt at the end of 2014 but now has more debt than cash to the tune of £540m as of the 30th June 2015 after buying some companies for its Studios business.

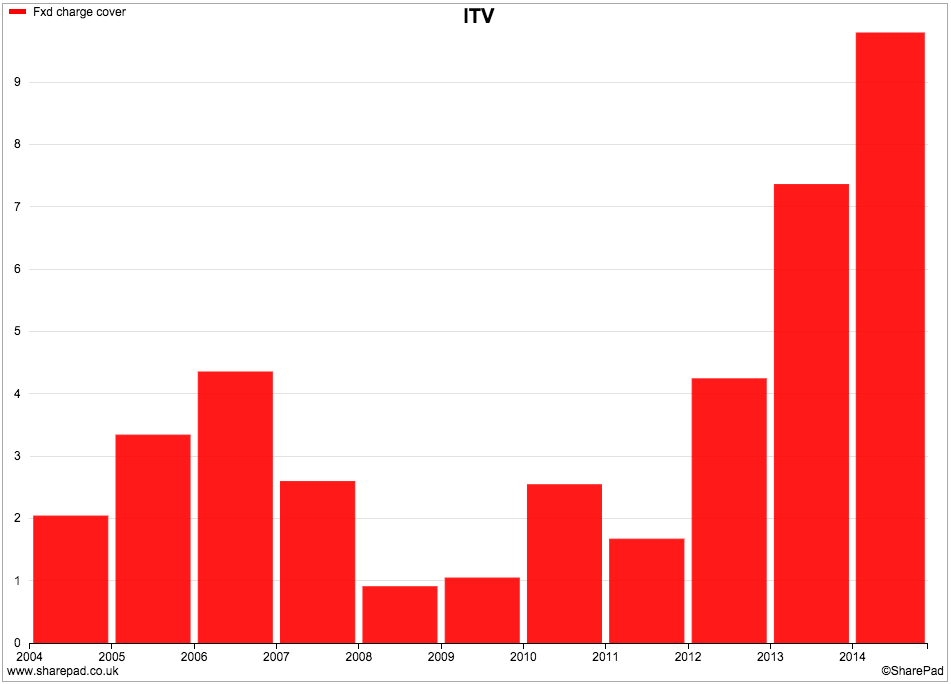

This is not anything to worry about given ITV's strong profits and cash flows. Fixed charge cover has been on an improving trend and is at a very comfortable level. If profits were to fall significantly then ITV looks well placed to cope with it.

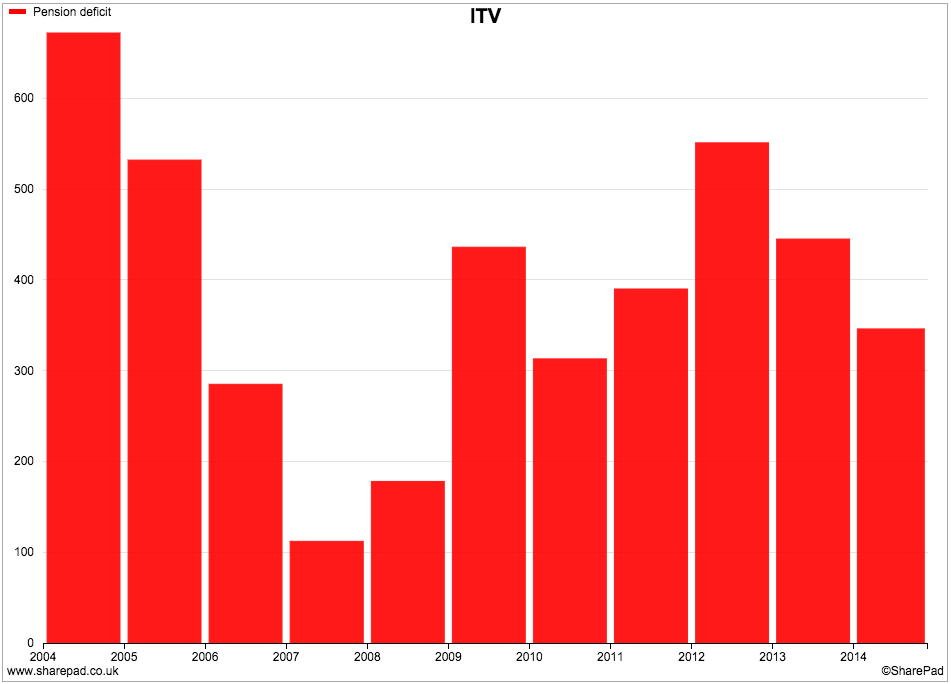

Due to it employing a lot of people over the years, ITV still has a reasonably big pension fund deficit. It has been making quite big cash top up payments to try and bring the deficit down. That said, the recent fall in interest rates on bonds may have pushed up the liabilities again. At the moment, ITV's pension deficit doesn't look like it should keep shareholders awake at night.

ITV's profit story - more revenue without more costs

ITV's profit growth over the last few years has been very impressive. As with many companies the reasons for this can usually be found by looking at their individual businesses.

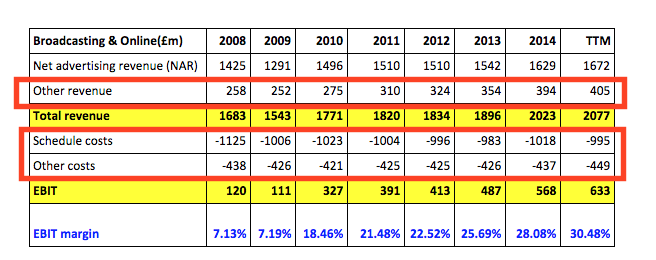

If we look at the results for ITV's broadcasting business above you can see quite clearly what has been behind the big increases in profits.

Net advertising revenue (NAR) has grown by nearly £400m since the trough in 2009. This is no mean achievement given that UK households have lots of choice as to where they watch TV - BBC, Sky and on demand services such as Netflix and Amazon for example - and suggests that ITV's programmes are still very popular.

ITV has also been very successful at growing other sources of income. Its ITV Player on demand product has seen online advertising grow whilst it has also moved into pay TV with a drama channel called ITV Encore and the high definition (HD) versions of ITV2, 3 and 4. These extra revenues have grown by just over £150m since 2009.

At the same time though, ITV has kept a tight rein on its programming costs and has made some big efficiency gains (doing more with less or the same amount of resources). Total operating costs have been kept stable at just over £1.4bn for the last six years. This means that all the extra income has flowed straight through to profit. What looked like a pretty mediocre business with profit margins of just over 7% in 2009 is now making profit margins of over 30%.

The other factor in the ITV profit story has been the growth of ITV Studios, although this has been helped by the buying of content companies both in the UK and overseas.

This business sells a lot of its own made TV programmes back to ITV. However the expansion overseas has seen the proportion sold outside ITV grow from just under half in 2008 to 62.7% in 2015. This is a positive development and might make ITV a more attractive takeover candidate in the future.

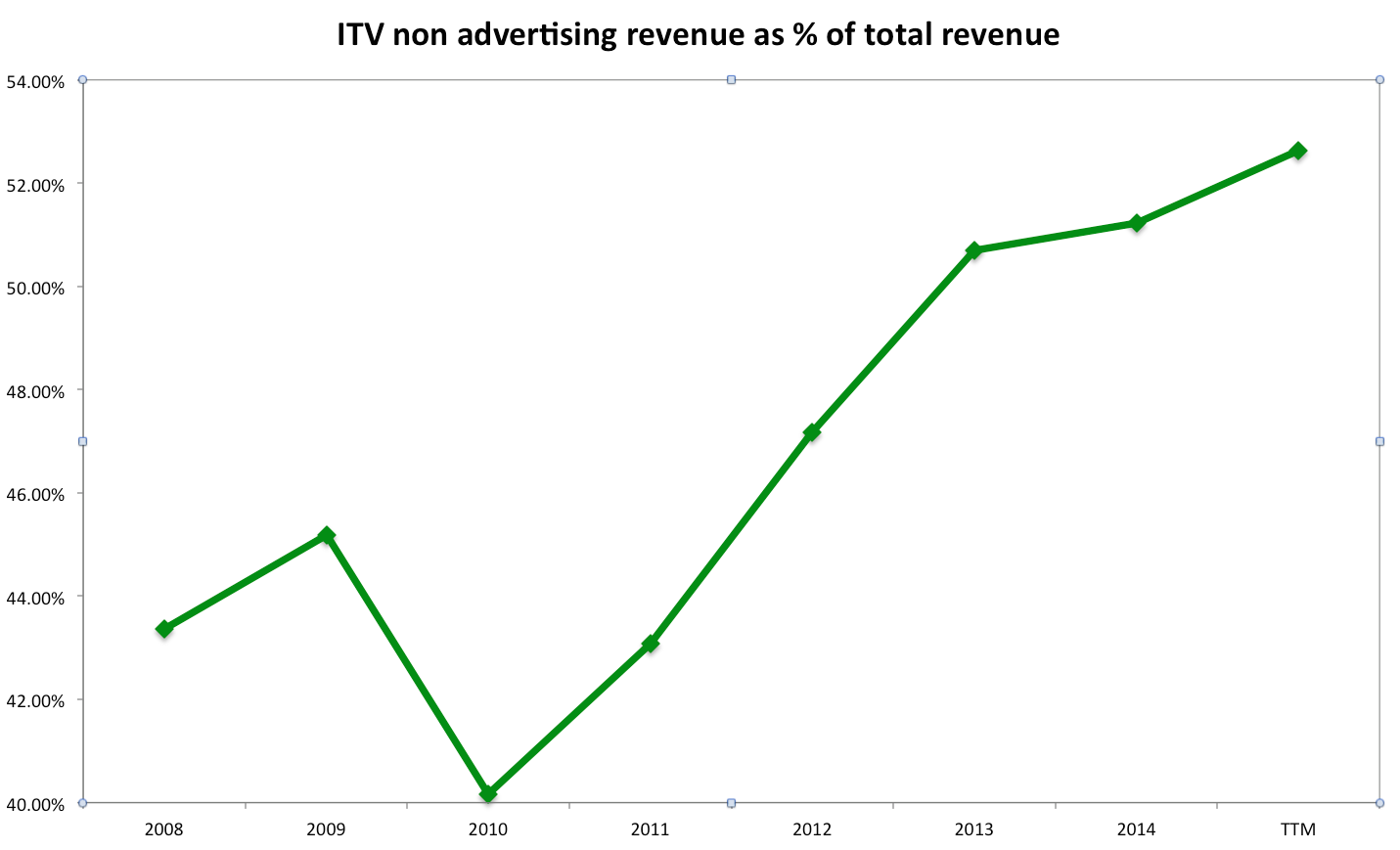

Is ITV still too reliant on advertising revenues?

ITV has done a good job at growing its non-TV advertising revenue. It has grown by over £500m since 2008 and now accounts for just over half of the company's total revenue. However, that means that nearly half still comes from TV advertising.

Fears of a slowdown in the economy in recent weeks have seen ITV shares fall along with the rest of the stock market. That said, ITV's profits still look to be at risk if the UK economy fell into a bad recession.

Back in 2009, ITV's advertising revenue fell by nearly 10%. A 10% fall from the current levels of advertising revenue would imply a revenue reduction of nearly £170m. Given ITV's largely fixed cost base in its broadcasting business this would imply a fall in profits of roughly the same amount or more than 25%. ITV may be less risky than it used to be but it's exposure to TV advertising still looks as if it has the potential to unnerve investors.

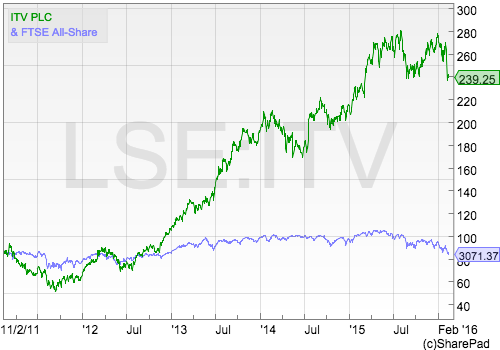

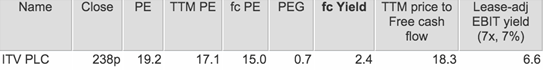

The price of ITV shares

ITV shares trade on a trailing PE of 19.2 times which is quite high in most investor's eyes. The forecast PE ratio of 15.0 and a PEG of 0.7 might be seen as being quite reasonable if ITV can keep growing its profits and cash flow.

The dividend yield of 2.4% doesn't look that attractive but recent dividend growth rates have been high and there is the possibility of a special dividend to boost the near-term yield of the shares.

ITV has been seen as a potential takeover target given the attractions of its ITV channel line-up and its own produced TV content in ITV studios. Given the growing importance of content ownership in the TV business such an idea is not far-fetched. ITV's strength in areas such as drama programmes could be appealing to another company.

Media company Liberty Global own nearly 10% of the shares outstanding and has been cited as a possible bidder for the company in the press as has BT.

To sum up

- ITV has gone from being a very mediocre business to a very good one.

- Its free cash generation is excellent.

- Current level of free cash flow looks like it gives ITV potential for significant dividend growth.

- The company's financial position is very healthy.

- Cost control has been good.

- The reliance on TV advertising revenue has come down but is still high.

- The high fixed costs of the broadcasting business make ITV still quite vulnerable to a fall in advertising income.

- ITV could be a takeover target given its mass audience appeal in the UK and the content made in ITV studios.

- The valuation of its shares is quite high but could be justified if profits keep on growing strongly.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.