Stock Watch: Booker Group

Booker is best known for being a food and drink wholesaler (known in the trade as a "cash and carry" business). It sells branded and private label food and drink items to independent retailers and grocers. In 2013 it bought rival cash and carry business Makro which sells more non-food items such as clothing, electricals and furniture.

It also sells to catering companies, leisure outlets, pubs and restaurants. Booker owns Premier, a convenience store brand which supports independent retailers in return for them spending a minimum amount of money with the cash and carry business.

Booker shares have performed very well during the last five years but they have been very volatile during the last two. As usual, I am going to open up SharePad to have a look at what's been going on and what the future might hold.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Financial returns

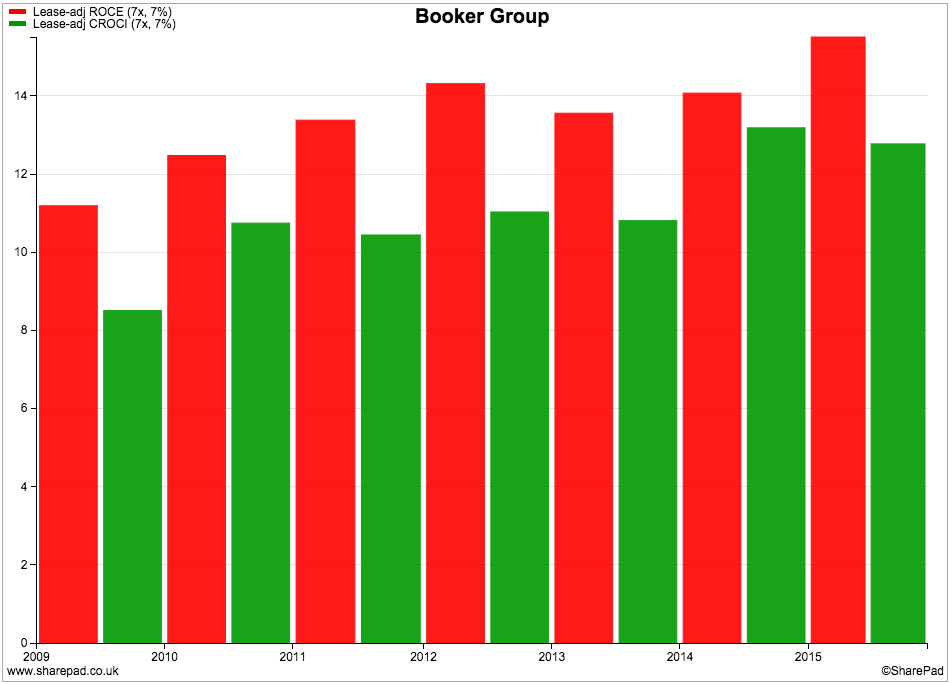

Booker rents a lot of its cash and carry warehouses and therefore has a reasonable amount of hidden, off-balance sheet debt. I always think that it's a good idea to calculate return on capital employed (ROCE) and cash returns on capital (CROCI) by adjusting the amount of money invested for these hidden debts. It means that you get a truer impression of how good a business really is.

If you excluded them you might see very impressive ROCE and CROCI numbers and think a business is very good when in reality it might not be. Booker investors don't need to worry on this score. It looks to be a very healthy business.

You can see from the chart above that Booker's ROCE and CROCI have been very stable during the last six years which is a good sign. A lease-adjusted ROCE of 15.5% and CROCI of 12.8% are the hallmarks of a pretty good business - provided they can be sustained of course.

To get a better understanding of how a company makes its returns on money invested you can break down the ROCE and CROCI calculations a bit more. That's because ROCE and CROCI are made up of two different calculations.

ROCE/CROCI = Capital Turnover x Profit or cash flow margin

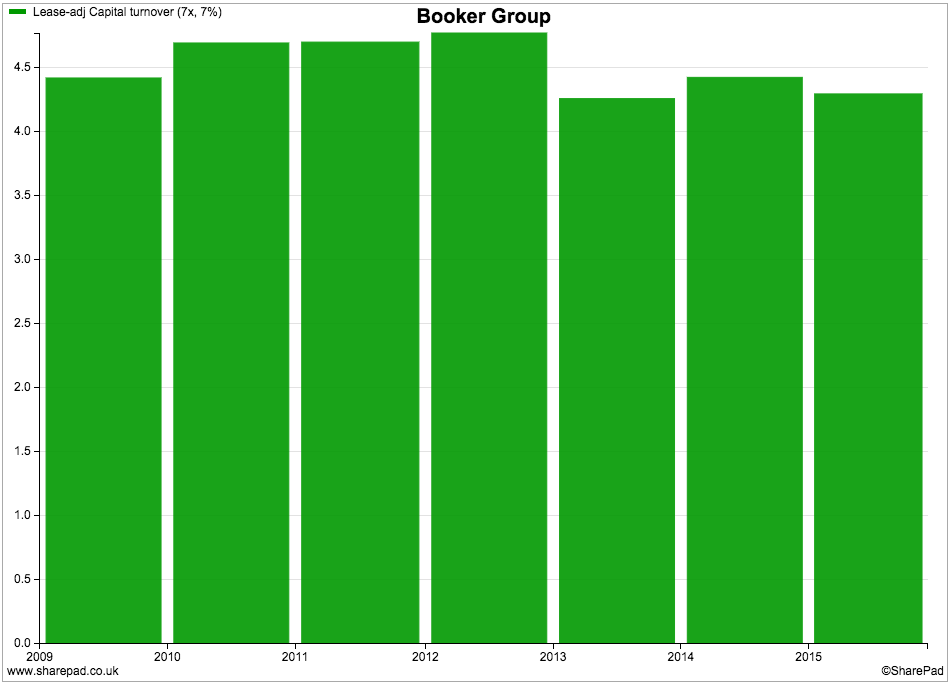

Capital turnover looks at the value of sales a company generates for each £1 of money invested (Sales divided by capital employed). It is an under-used ratio which can be very helpful in understanding how a company generates a return on investment. A declining capital turnover can be the first sign of trouble ahead.

Companies can increase their returns by selling more or by boosting profit margins or both at the same time.

Booker has a high level of capital turnover. It sells more than £4 for each £1 of capital invested. This ratio has fallen slightly in recent years but has not fallen off a cliff and therefore doesn't look like something to worry about.

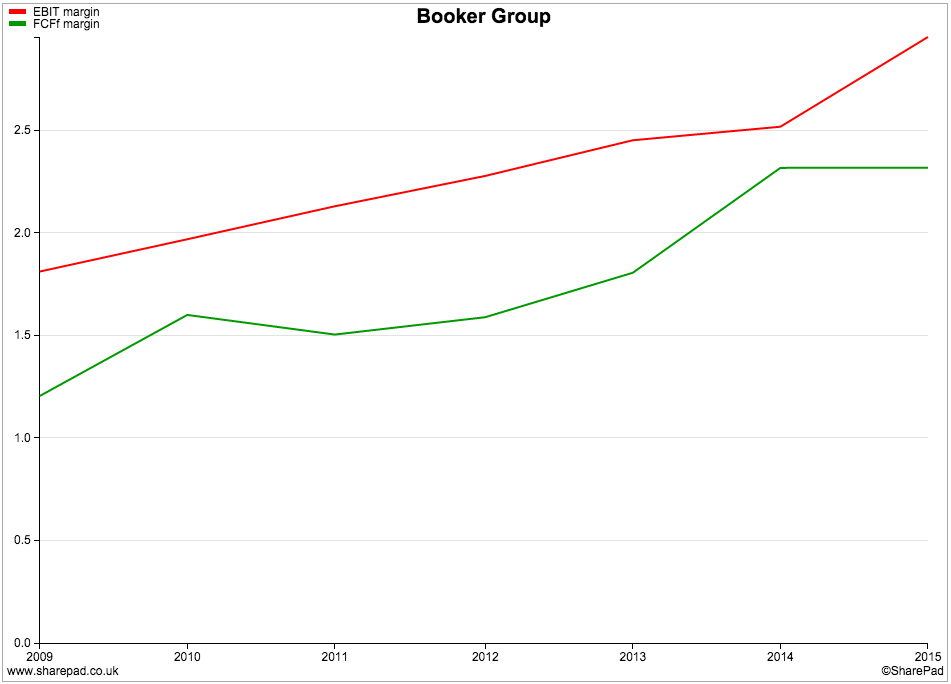

If we look at the other side of the returns equation we can see that although capital turnover has come down slightly, profit and cash flow margins have increased and this has driven the improvement in ROCE and CROCI in the last couple of years.

However, it is important to note that Booker is a very low margin business. Low margin businesses are inherently more risky propositions for investors. That's because they are less able to withstand a downturn in profitability caused by increased competition, cost increases or a severe recession.

What we have learned here is that capital turnover is the key driver of Booker's ROCE and CROCI and this needs to stay high. Cash and carry is a competitive business, whilst falling food prices mean that it might be quite difficult for Booker to keep on increasing its profit margins.

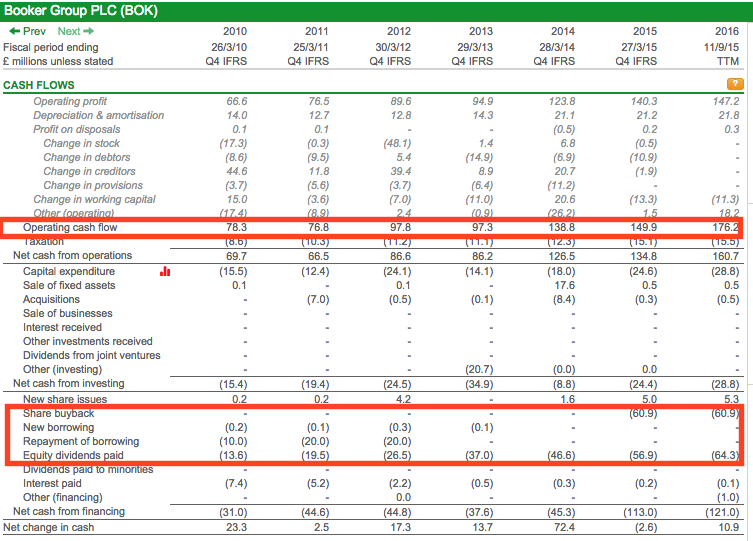

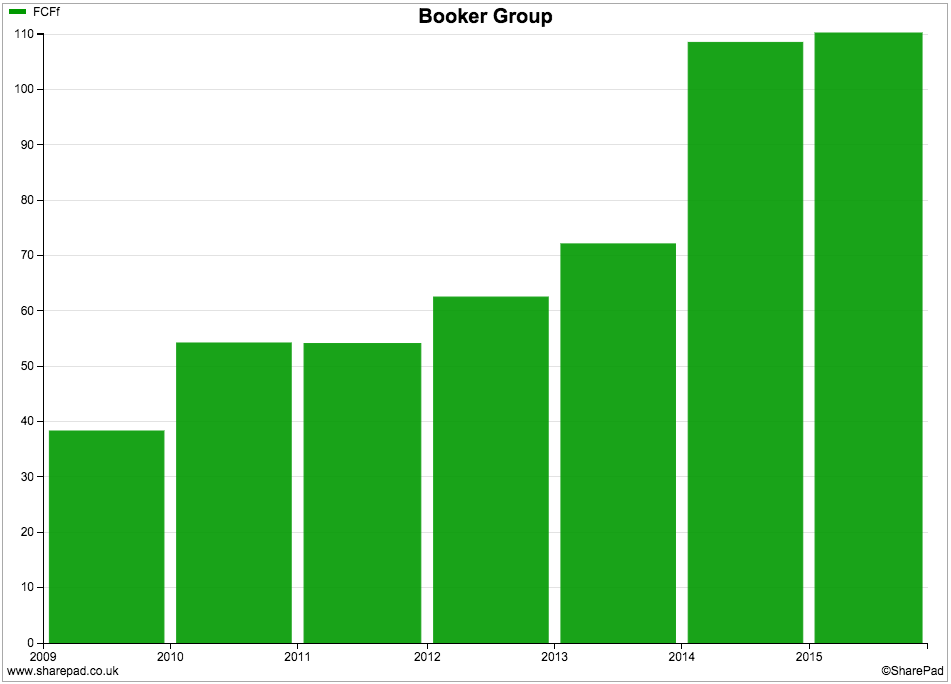

If we look at Booker's cash flow statement in more detail then you can see that there has been a big improvement in cash flow during the last couple of years.

Operating cash flow has gone from just under £100m in the year to March 2013 to £176m in the year to September 2015. Most of this improvement can be explained by Booker buying Makro in 2013. This business was loss-making when Booker got its hands on it and has now not only been turned around to be profitable but also to throw off lots of cash flow as well.

The management at Booker have a very strong focus on cash generation and have done a very good job at producing more of it.

Free cash flow has gone through the roof since the acquisition of Makro. This has led to higher dividends and two one-off returns of cash with another promised in 2016.

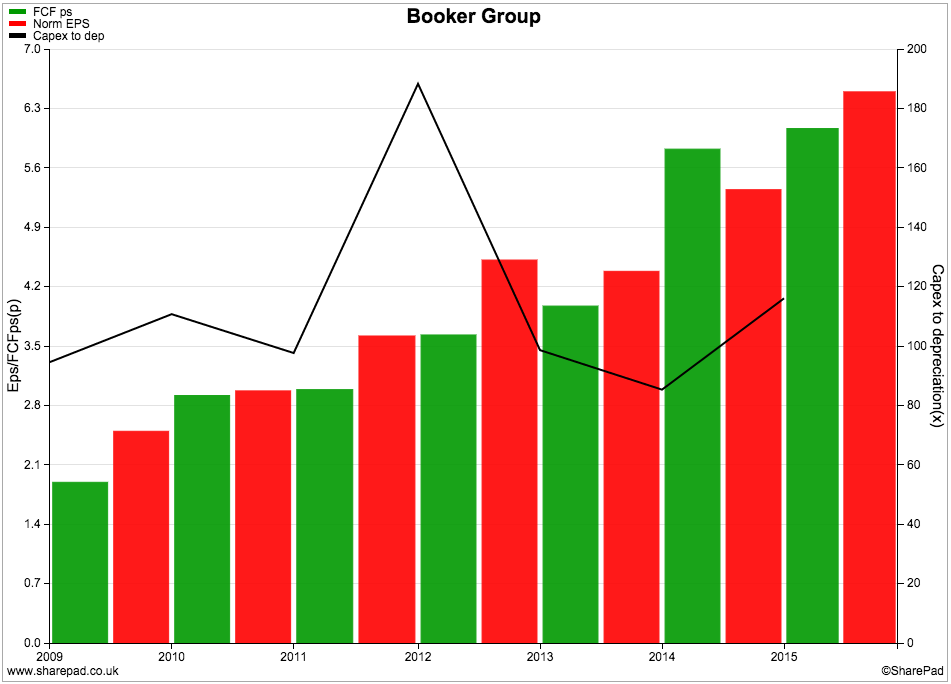

Booker's profit quality is very good . It doesn't seem to have been skimping on investment as the amount spent on new assets (capex) has been roughly in line with the depreciation charge. Consequently, most of its earnings per share (EPS) have been turned into free cash flow per share - always a good sign for investors.

Financial position

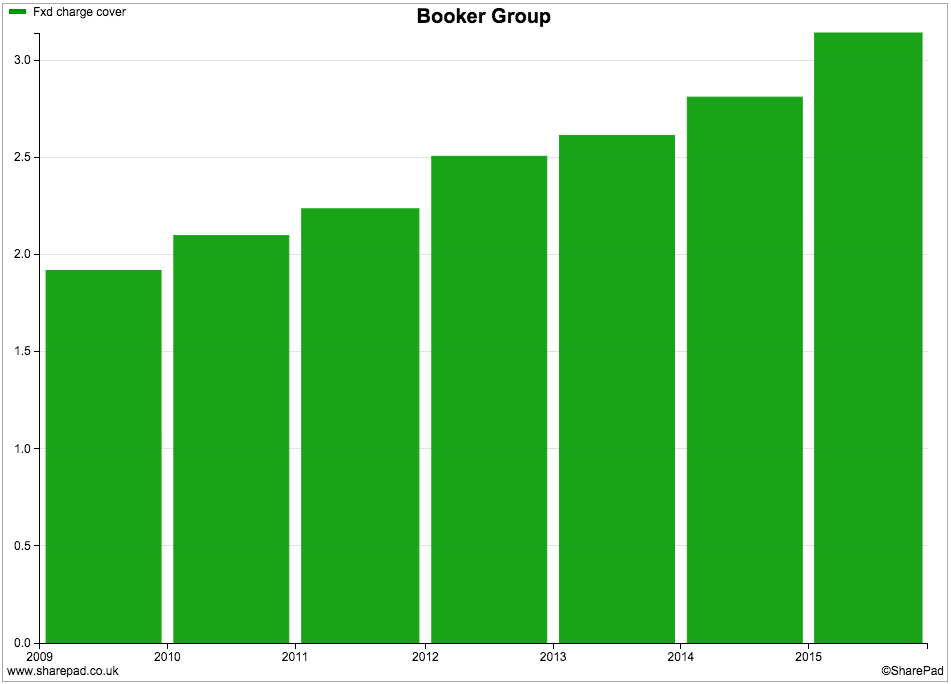

Booker's finances are in rude health. Its fixed charge cover (a measure of a company's ability to pay its rental and interest payments) has been rising for each of the last six years and is at a very comfortable level. The chances of this company getting into financial difficulties look very low as things stand.

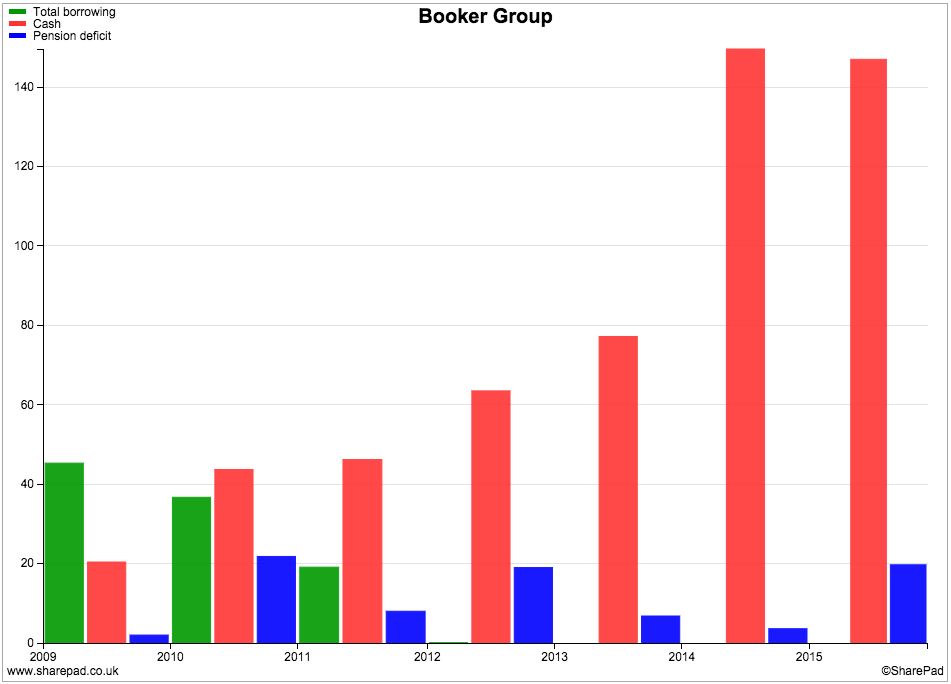

Elsewhere there are other signs of financial strength as shown in the chart below.

This chart looks at the trend in Booker's total borrowings (green or first bar), cash balances (red or second bar) and pension deficit (blue or third bar). Booker paid off all its borrowings in 2011 and has been building up a big cash pile. The pension deficit still exists but doesn't look like a threat to the company or its shareholders.

A large chunk of the cash pile will be paid back to shareholders in 2016 with a one-off cash return. After that, I would still expect Booker to have a sizeable cash balance. That said, given its low profit margins and rental payments, Booker is a business that ideally should have low or no other borrowings.

Valuation and future prospects

Booker is a company with a lot of attractive characteristics. It has good returns on capital and produces lots of free cash flow. Understandably, investors seem to like this and have placed a high price on its shares.

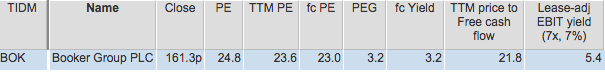

If you look at standard valuation yardsticks such as PE ratios, PEG ratios and dividend yields it is hard to make a case for saying that Booker shares are cheap. A lowish EBIT yield confirms this and is telling us that the shares are pricing in continued strong growth in profits. How likely is this?

Well, the company's current trading is mixed. Sales are the lifeblood of any business and are the engine of future profits growth. Booker's like-for-like sales fell by 1% in the first half of its current financial year and deteriorated to -3.1% after nine months.

A third of its sales come from selling tobacco and this market has been hurt by the ban on displaying them in shops. The rest of the cash and carry business seems to have been doing OK - supplies to catering companies are going well - but the company did mention that some of its customers are seeing weak consumer demand in its January trading statement:

"Non-tobacco sales reduced by 1.3% on a like-for-like basis. They were impacted by deflation in food prices and many customers reporting weak consumer demand during the period."

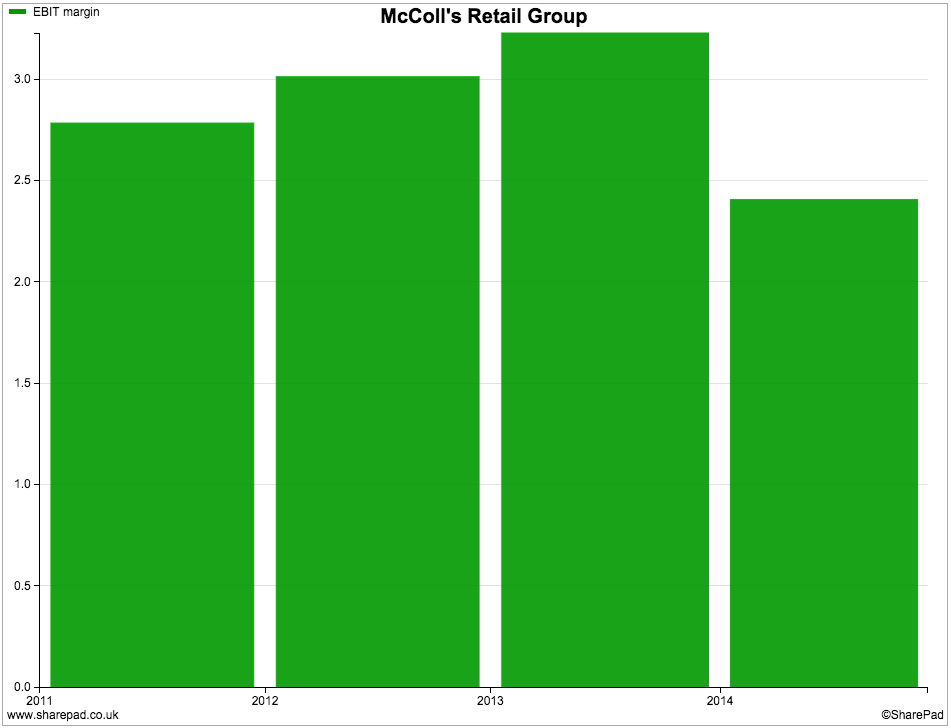

Just under 60% of Booker's sales go to the very competitive convenience retailing sector where profit margins are wafer thin (see McColl's below). It could be hard for Booker to get more money out of this sector even though the number of its own Premier brand outlets is increasing.

Is Booker too reliant on acquisitions?

Is Booker really a growth business as its recent financial history suggests? The company has undoubtedly produced some very impressive financial returns in recent years but it is possible that this has been largely due to it buying poorly performing companies and turning them around. It has made several significant purchases in recent years:

- Blueheath in 2007

- Classic in 2010

- Makro in 2013

- Londis and Budgens in 2015

By taking a business that is losing money and making it profitable it is possible to show very good levels of profit and cash flow growth which make it difficult for the outside investor to see what is going on with the rest of the business.

Booker has been very good at doing this and will likely do this again in 2016-17 with its latest acquisition of the Budgens and Londis convenience store chains. These businesses have been losing money and according to Booker will lose £7m in 2016. By 2017 they should be making a profit of £5m and a decent contribution to Booker's profit growth.

But you can't keep on buying companies. Sooner or later the fortunes of the underlying business will reassert themselves. If sales don't start growing in the core cash and carry business will Booker investors be in for a nasty surprise in a couple of years' time?

To sum up

- Booker looks to be a very good business.

- It makes good returns on capital as evidenced by ROCE and CROCI.

- Profit and cash flow margins are low with returns being driven by high levels of capital turnover.

- Free cash generation in recent years has been very impressive.

- Its financial position is very strong.

- The shares are currently trading on very high valuations.

- Profits and cash flow growth could be too reliant on buying companies.

- The underlying growth of the business could be low.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.