Stock Watch: Connect Group

If you search the stock market for shares with a high dividend yield then Connect Group is one of the shares that will end up on your list. The company used to be known as Smiths News and was spun off from WH Smith a decade ago.

High dividend yields can be seen as a measure of cheapness by investors. This is true if the company can keep paying its current dividend and can grow it in the future. More often than not high dividend yields on shares are a warning sign. They are telling you that the market thinks that the dividend is at risk of being cut or that future dividend growth - a key driver of share prices - is expected to be low.

Which category does Connect Group fit into? Let's take a look.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

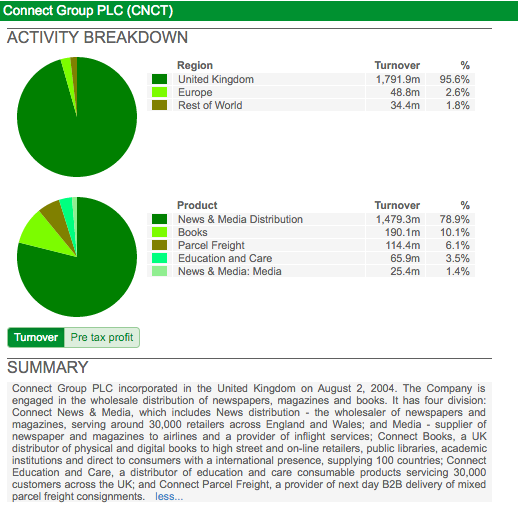

The business

The company makes the bulk of its money delivering newspapers and magazines to newsagents and supermarkets. In recent years it has branched out into new business areas in order to try and grow sales and profits. It has done this by buying other companies which deliver books, consumable items to schools and care homes and specialist parcels.

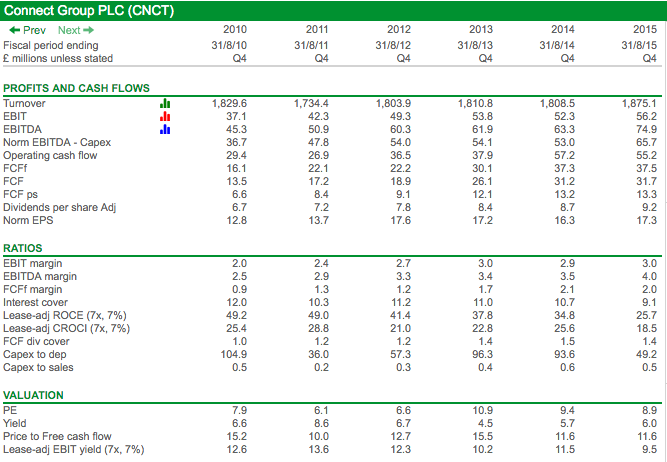

One of the best ways to get a very quick snapshot of a company's performance and financial history is to build yourself a custom results table in SharePad. It's very easy to do. You set up the table with just the numbers that you want to look at.

In the table for Connect Group below, I can quickly see what has been happening with profits and cash flows, key ratios and how the company has been valued by the stock market over time. I can then go and examine these key numbers in more detail. Regular readers will know that I like to do this by charting the financial data - another very useful tool in SharePad.

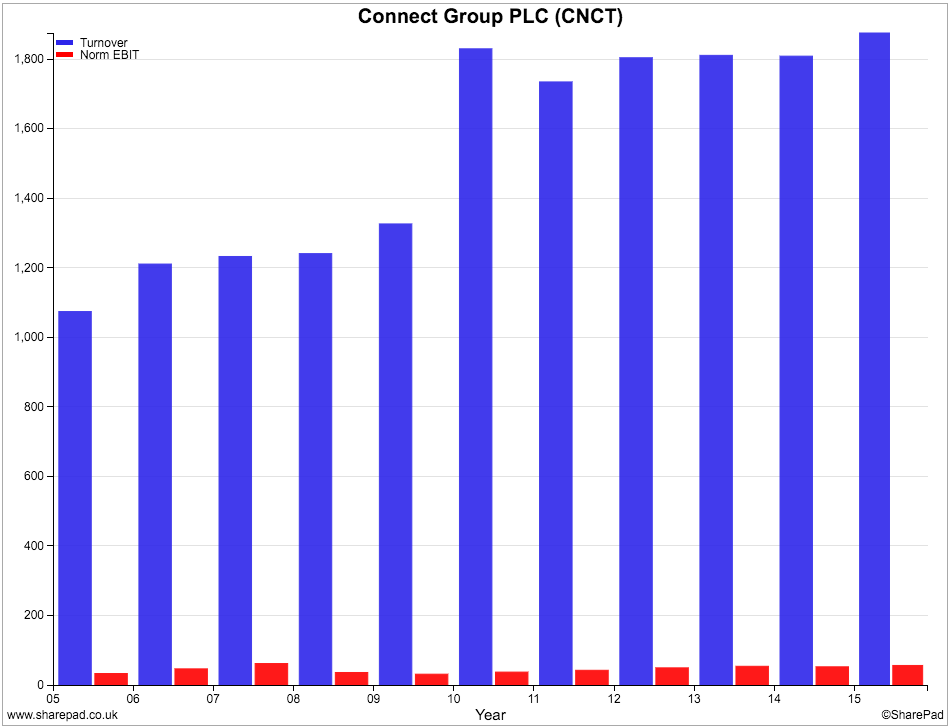

Sales and profit history

Here you can see that sales have been very stable. There is a step up in 2010 when the company made a significant acquisition. One thing that should leap out at you from this chart is how small trading profits (EBIT) are compared with turnover. This is telling you that we are looking at a business with very low profit margins.

This might be nothing to worry about providing the company sells enough goods and services to make a reasonable level of profit. On the other hand, low profit margins can be wiped out if the business runs into trouble and can make the shares a higher risk investment.

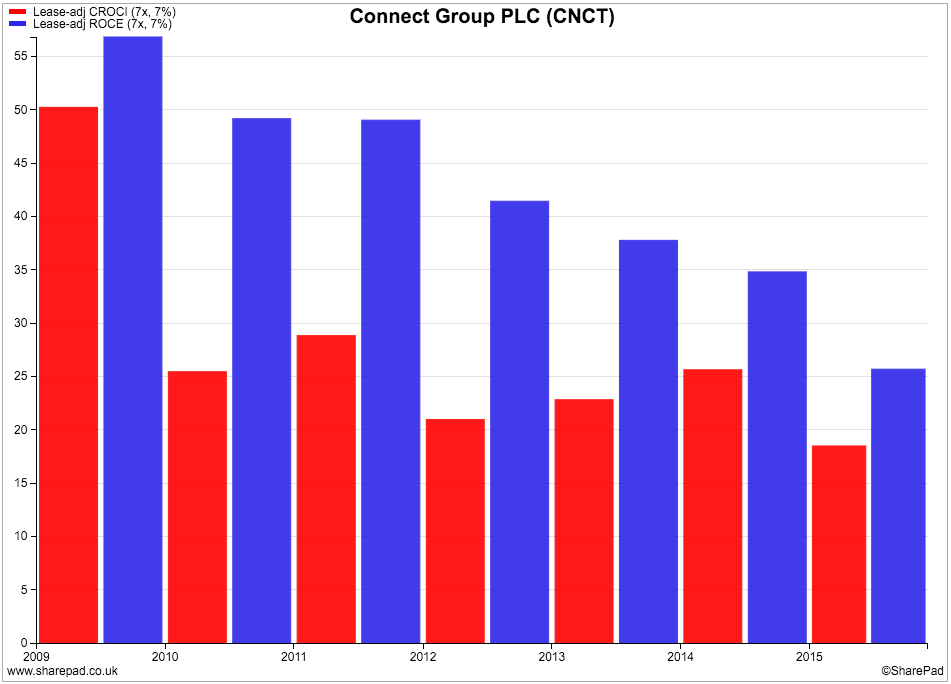

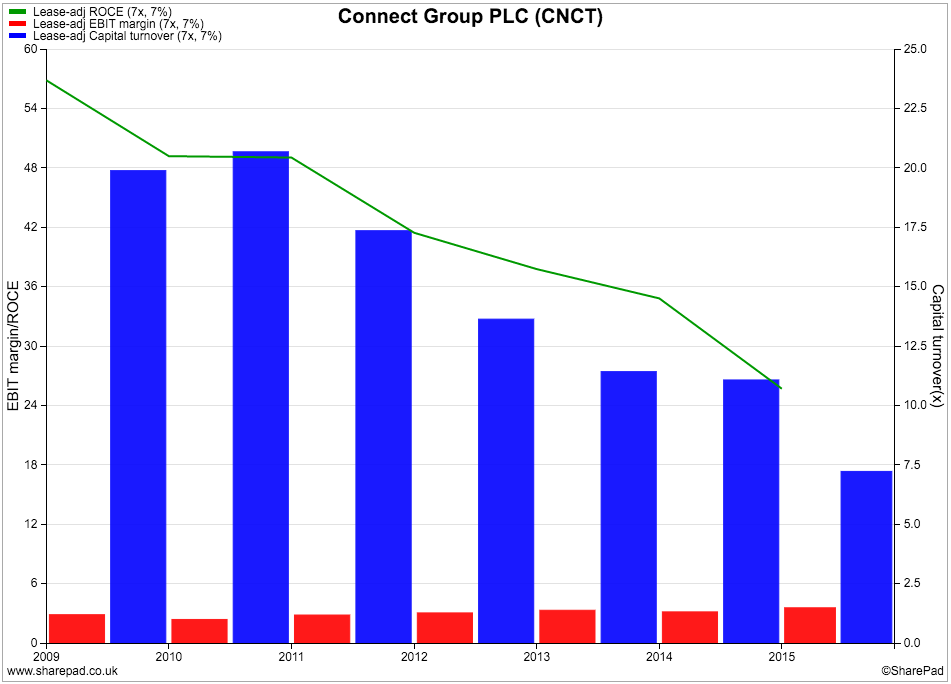

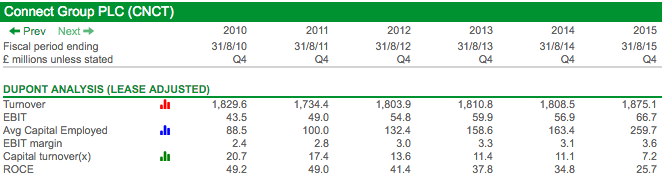

Financial Returns

Despite its low profit margins, Connect Group makes high returns on the money that it invests. Its lease-adjusted ROCE in 2015 was over 25% which is a very healthy number.

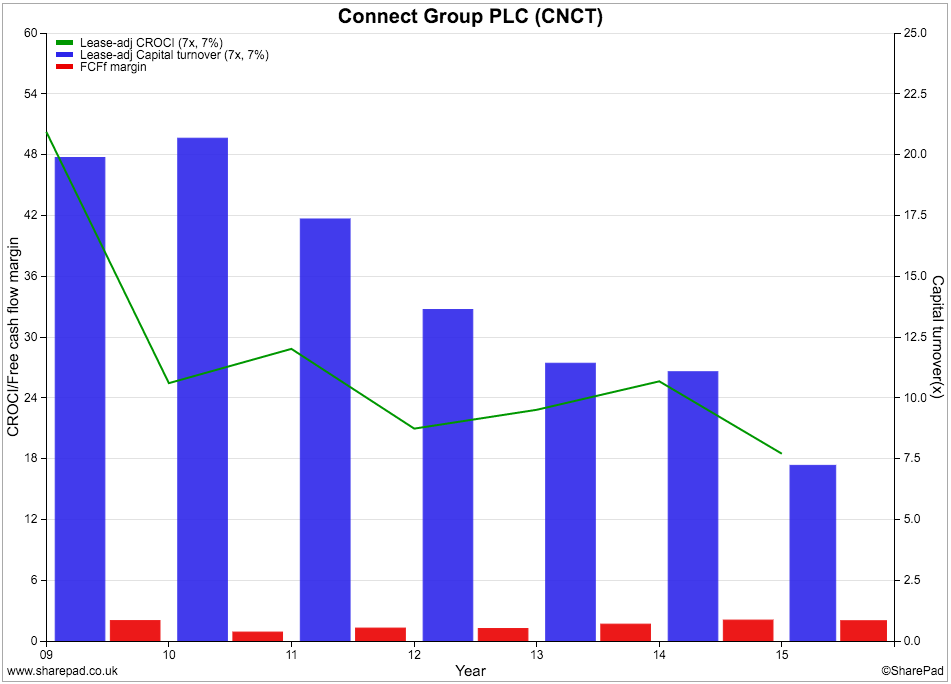

The company is also making good free cash flow returns as measured by CROCI (cash returns on capital invested). CROCI was 18.5% in 2015. Anything above 10% is usually a sign that you could be looking at a reasonable or very good business.

Just as important though is the trend in ROCE and CROCI. As you can see, the trend in recent years is down. We need to try and find out what's causing this.

The best way to look at the trend in ROCE and CROCI is to break them down a little bit further. Returns on capital are made up from the company's profit margins - what proportion of sales turns into profit - and its capital turnover - how much turnover it generates per £1 of capital employed.

ROCE/CROCI = profit/cash flow margin x Capital turnover

We can see what's been going on in the charts below.

EBIT margins have been relatively stable. ROCE has been falling because capital turnover has fallen sharply. In 2010, the company was making over £20 of sales for every £1 invested. That number had fallen to £7.20 in 2015.

I've created a custom results table in SharePad to look at the trends in capital turnover in even greater detail.

The main reason why returns have fallen is because capital employed has increased significantly in 2012 and again in 2015. The purchase of the Tufnells parcels business in December 2014 for £114m also came with a big increase in rental obligations. Whilst all the capital employed has been factored into the ROCE calculation it is important to note that only eight months' of profit were included. Had a full year's profits from Tufnells been included then ROCE in 2015 would have been higher.

Similar trends can be seen in CROCI as well.

As an investor you don't like to see falling returns. That said, the overall levels of ROCE and CROCI are still very high. If the company can make reasonable profits on the extra amounts of money invested in Tuffnells then Connect shareholders will be happy. More on this later.

Cash generation

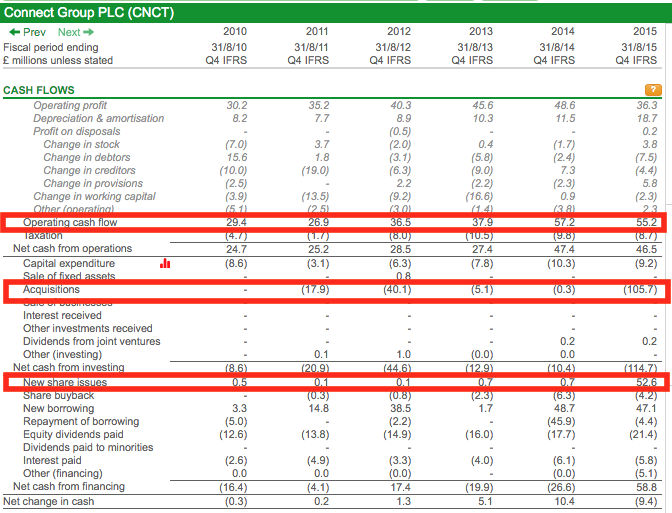

We have already seen from the charts above that Connect Group can generate high free cash flow returns on the money it invests. By having a closer look at its cash flow statement you can see how it does this.

I've highlighted three areas of interest.

Firstly, there has been a step change in the amount of operating cash flow coming into the company. The big jump occurred in 2014 where there was a near £20m improvement. The company has managed to hang on to this in 2015.

It seems that it has been able to operate with much lower working capital in recent years whereas previously this has seen cash flowing out.

Working capital is the money that a company needs to operate on a day-to-day basis. Some companies need more of it than others. That's because they might need to hold lots of stock, pay for things in advance and sell goods to customers on credit. All this can be a drain on a company's cash resources.

In particular, Connect looks as if it has been able to get better payment terms with its suppliers as cash outflows from changes in creditors have come down.

The company doesn't spend a lot of money on new assets with capex below depreciation. But you can see that it has been spending money on buying companies with meaningful cash outflows in 2012 and 2015.

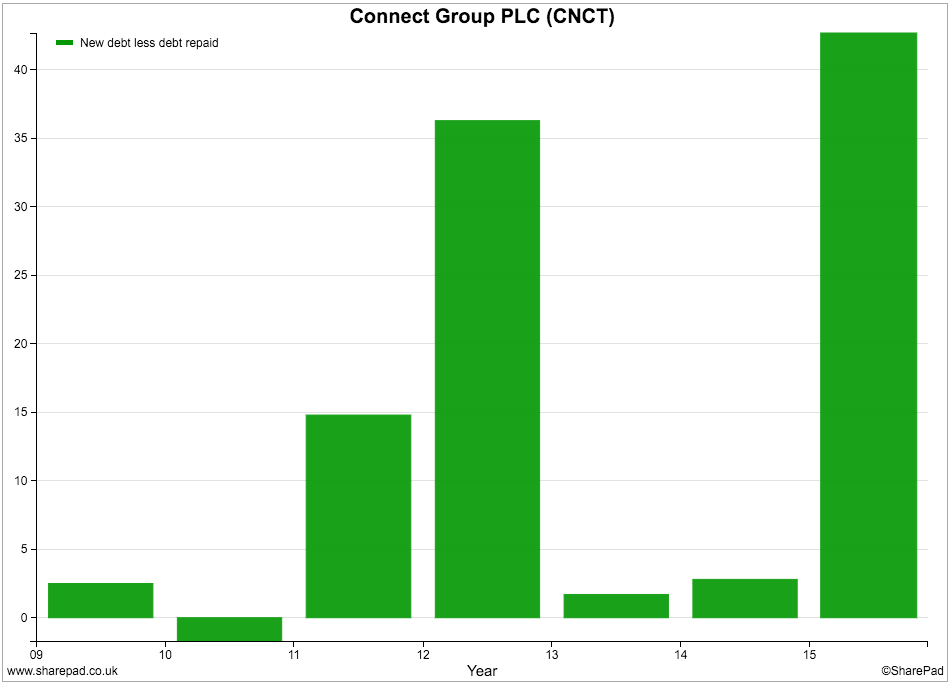

Take a look further down the cash flow statement and you can see two other interesting developments. One is the £52.6m raised from new share issues (a rights issue to pay for Tuffnells) in 2015 and also new borrowing being much higher than repayments in 2012 and 2015. This is what has caused capital employed to go up so much and explains why ROCE has gone down.

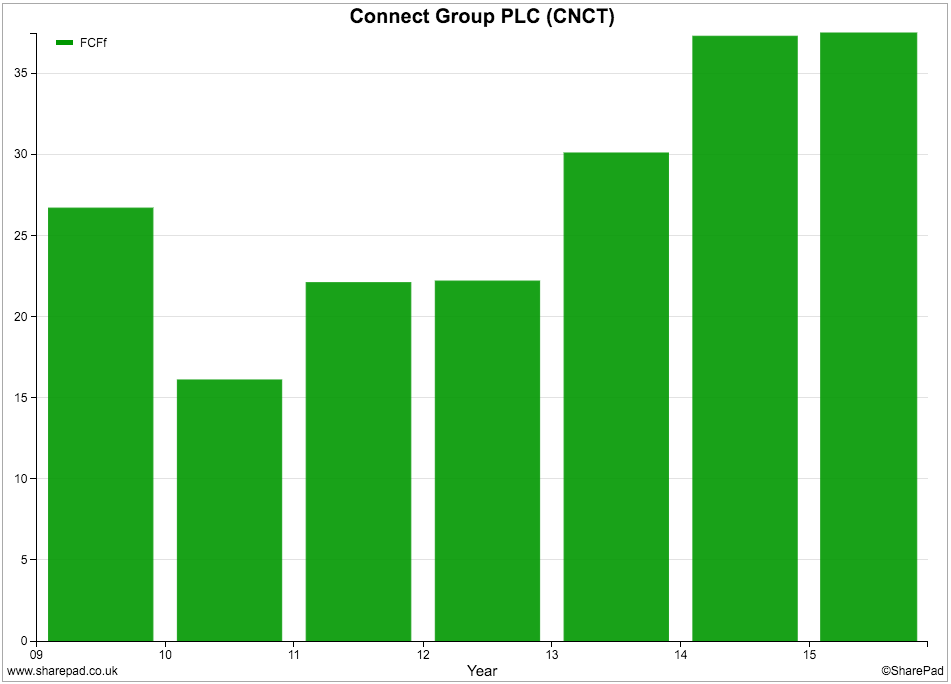

Connect Group has been able to consistently produce a lot of free cash flow. You can see the impact of the step change in operating cash flow on free cash flow since 2014.

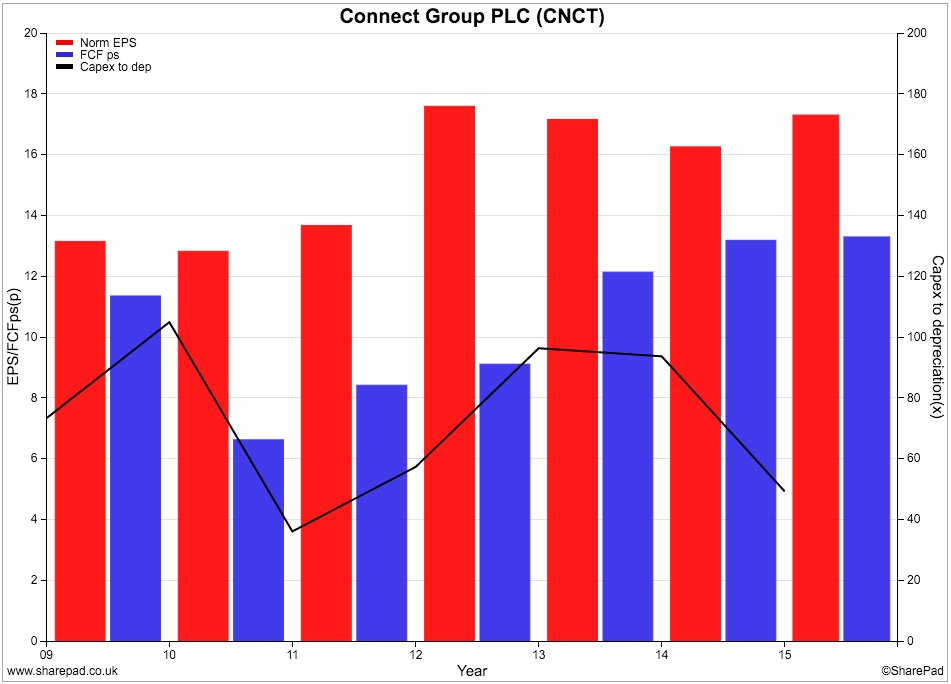

This strong free cash flow generation gives Connect Group high quality profits. A high proportion of earnings per share (EPS) converts into free cash flow per share.

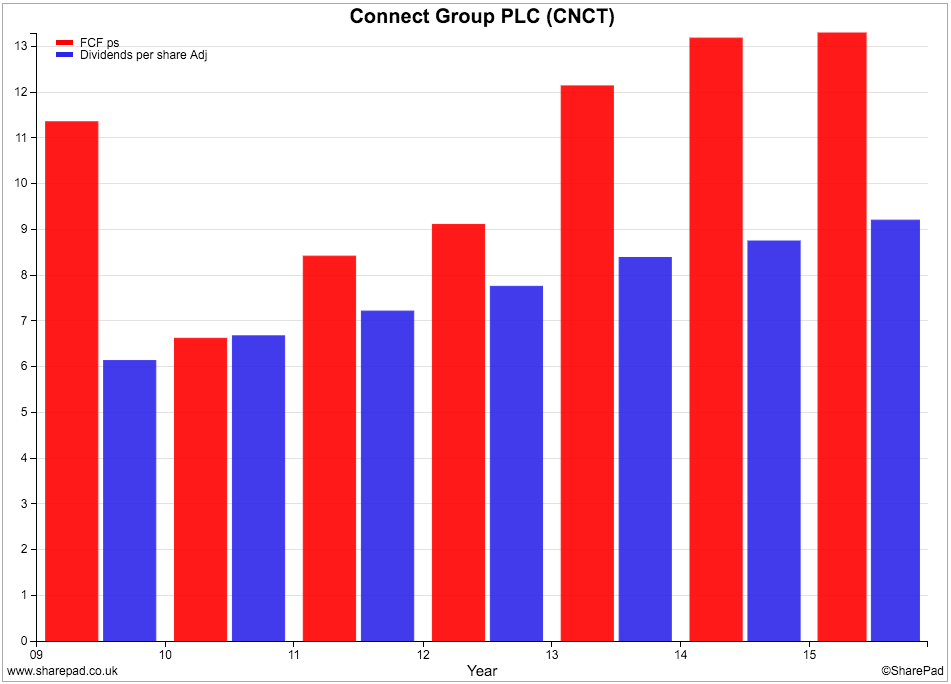

More importantly - especially given the high dividend yield on the shares - free cash flow per share has allowed the company to pay a rising dividend in recent years with plenty of cash left over. In 2015 free cash flow per share was 13.3p compared with a dividend per share of 9.2p. As long as free cash flow doesn't fall sharply then Connect Group's dividend looks very safe for now and looks capable of growing.

Financial Position

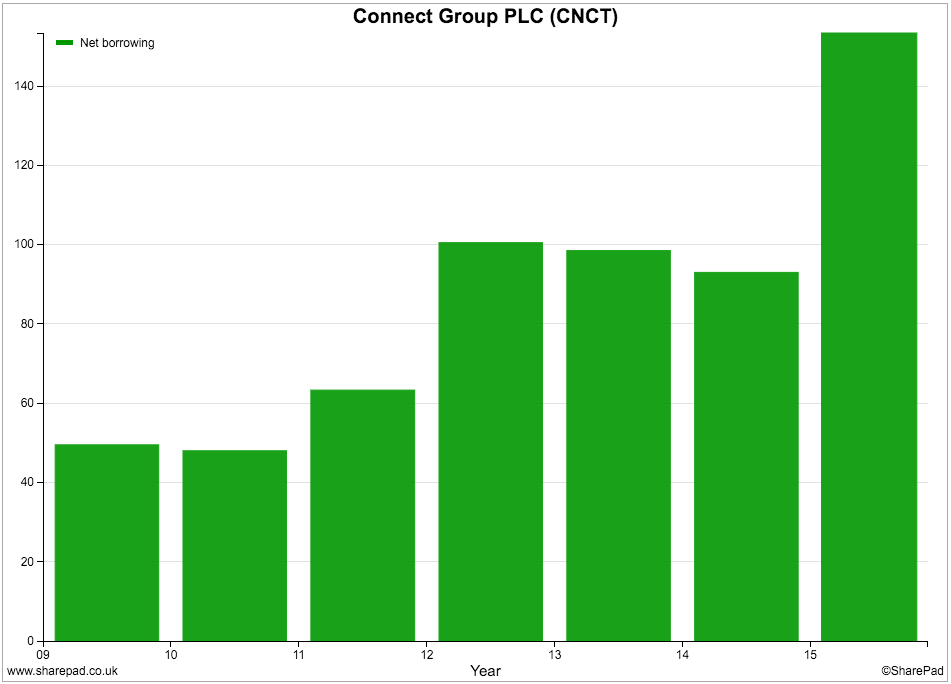

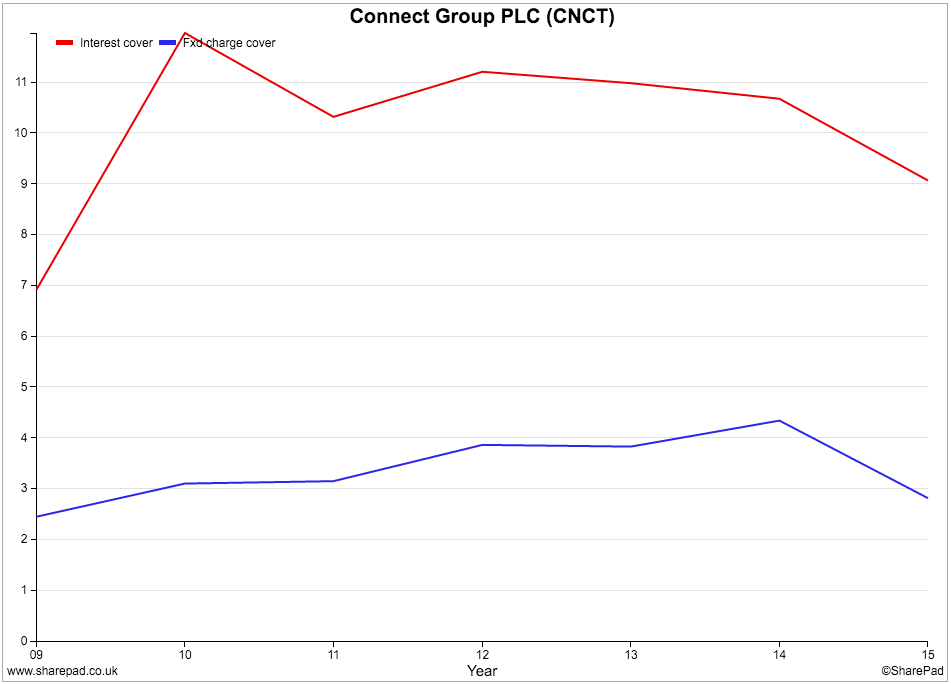

Net borrowing (total borrowings less cash) has seen a big increase following the acquisition of Tuffnells in 2015. However, the levels of interest cover and fixed charge cover are telling us the Connect Group's financial position is currently no cause for any worry.

Valuation and future prospects

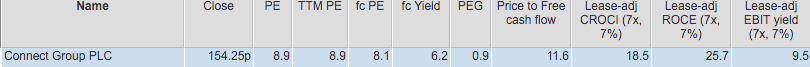

Connect Group shares are currently trading on very low multiples of profits and cash flow whilst offering a very chunky dividend yield. An EBIT yield of 9.5% is also quite high and is at a level which suggests that the stock market thinks that future profits growth will be hard to come by.

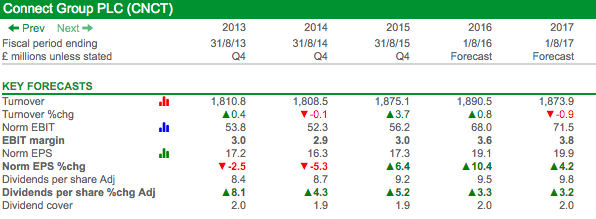

This is confirmed by a closer look at analysts' forecasts in the table below.

So how is the company going to grow its profits?

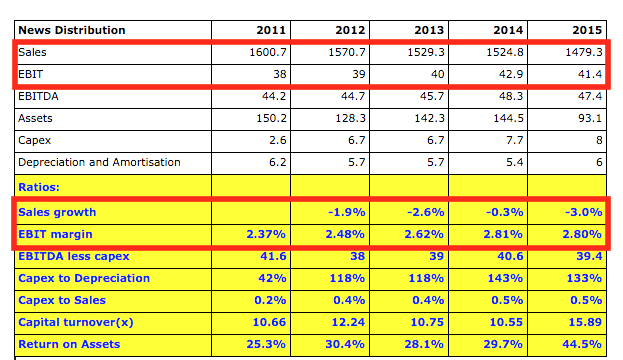

As you can see below, the News Distribution business has barely grown its profits at all during the last five years. People are buying less newspapers and magazines and this trend is expected to continue. Connect gets paid a percentage of the cover price of the newspaper or magazine and these have been rising but not by enough to stop sales falling.

The company expects sales to keep falling by 3-5% per year over the next few years.

In order to stop profits falling sharply the business will have to become more efficient - something the company has been very good at for a long time. It has taken £20m of costs out of the business during the last three years and expects to take out a further £5m in 2016 and 2017. It is able to do this because 85% of its revenues have been contracted until at least 2019. This high level of certainty of its future income means it is able to target cost savings more easily.

Essentially though this business is running hard to stand still. That said, it is trying to sell its expertise in deliveries to other sectors so that it can make more money out of its distribution assets. There have been some encouraging developments in this area.

Connect is trying to make itself a major player in the "click and collect" deliveries and returns business as the growth in internet retailing continues. It has won contracts from Amazon and Asos which could see this business become a decent source of new growth.

Connect has a network of 3,000 parcel shops - local stores - where customers can collect and return orders from Amazon and Asos. During the next three years it wants to increase its network size up to 6,000 shops.

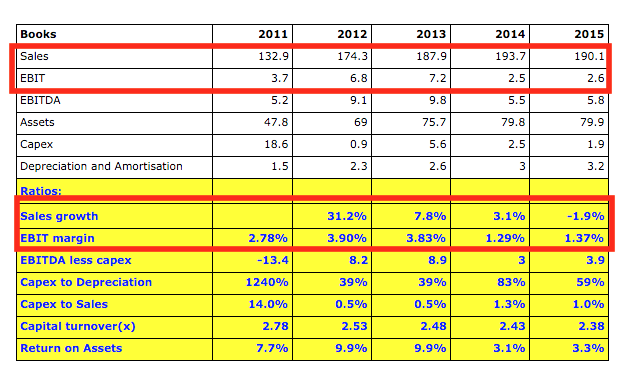

The Books delivery business is struggling to make any meaningful money at the moment and has even thinner profit margins than the News Distribution business. The independent bookstore sector is having a hard time and demand for new books from libraries has been shrinking.

The company is putting a lot of faith in its own online book store Wordery.com which is growing sales rapidly. Sales from Wordery are currently around 20% of the books delivery business's total sales but it looks as if profits growth will be hard to come by here.

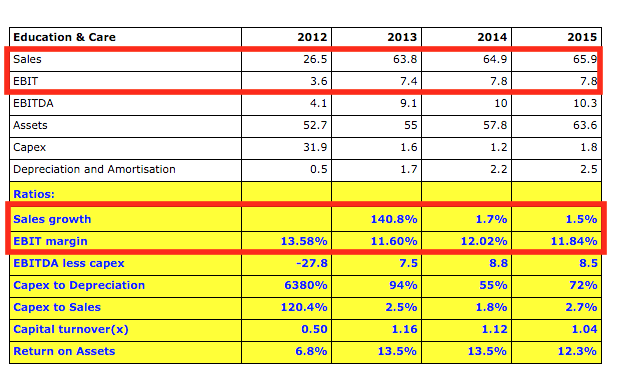

The Education & Care business makes reasonable profit margins but has barely grown for the last three years.

Growth from Tuffnells parcels

In the short-term, Tuffnells will be the main source of profits growth for Connect Group. This will come from a full year's sales and profits being reported in 2016 compared with just 8 months in 2015.

The good news for shareholders is that the underlying business is trading well at the moment. This is coming from a combination of new customers, more sales from existing customers and price increases.

Tuffnells sets itself apart from other parcel businesses by carry large and heavy packages that others don't want to. Connect thinks that it can grow as more companies outsource deliveries of large and heavy goods and by expanding the network from 35 to 40 depots.

Growth should also boost Connect's profit margins as Tuffnells is currently getting EBIT margins of 8.5%. One potential problem is the shortage of truck drivers. Higher wages here could mean lower margins in the future.

To sum up

- Connect Group has low profit margins but high ROCE and CROCI.

- Returns have been falling as capital employed has increased from recent acquisitions.

- Cash generation is good.

- Profit quality is high with a large chunk of EPS consistently turning into free cash flow per share.

- Cash dividend cover is good. The current dividend looks safe and has scope to grow modestly.

- Even though debt has increased the financial position of the company is strong.

- Profits growth from the core News Distribution business is dependent on cost-cutting which might not offset the continuing falls in sales.

- The Click & Collect business from Amazon and Asos could help sales grow.

- The Books and Education businesses are struggling to grow.

- Growth is largely dependent on the success of the Tuffnells Parcels acquisition.

- The shares are lowly valued to reflect the concerns about future profits growth, although the high dividend yield looks safe for now.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.