Stock Watch: Abcam - is lower profitability worth paying for?

Abcam shares are more popular than ever. Perhaps they're worth it.

Share this article with your friends and colleagues:

Nailed on growth stock

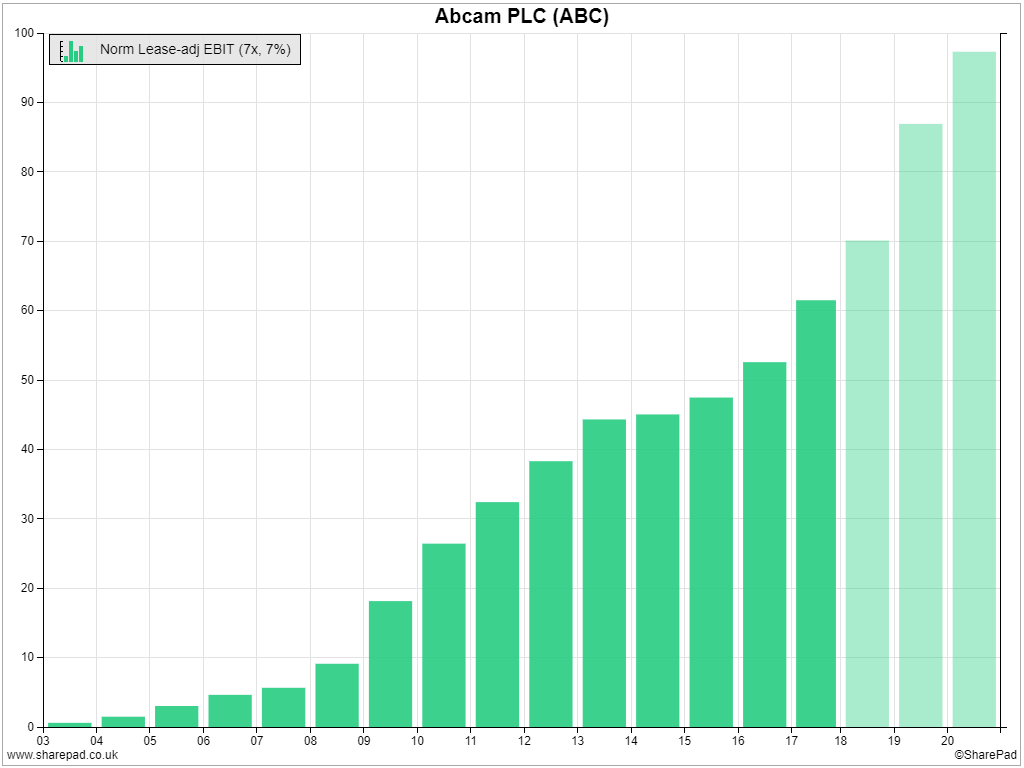

There's no doubt Abcam has grown. In performance terms it's about ten times better than it was when it floated in November 2005. Revenue in its first year as a listed company (to June 2006) was just under £20m. Eleven years later the company brought in nine times that much. Profit has increased more than ten-fold. The consensus of analysts providing data to SharePad predicts Abcam will continue growing:

Abcam is developing a new site in Cambridge that will enable it to double in size, which the biotechnology company expects to achieve between 2016 and 2023.

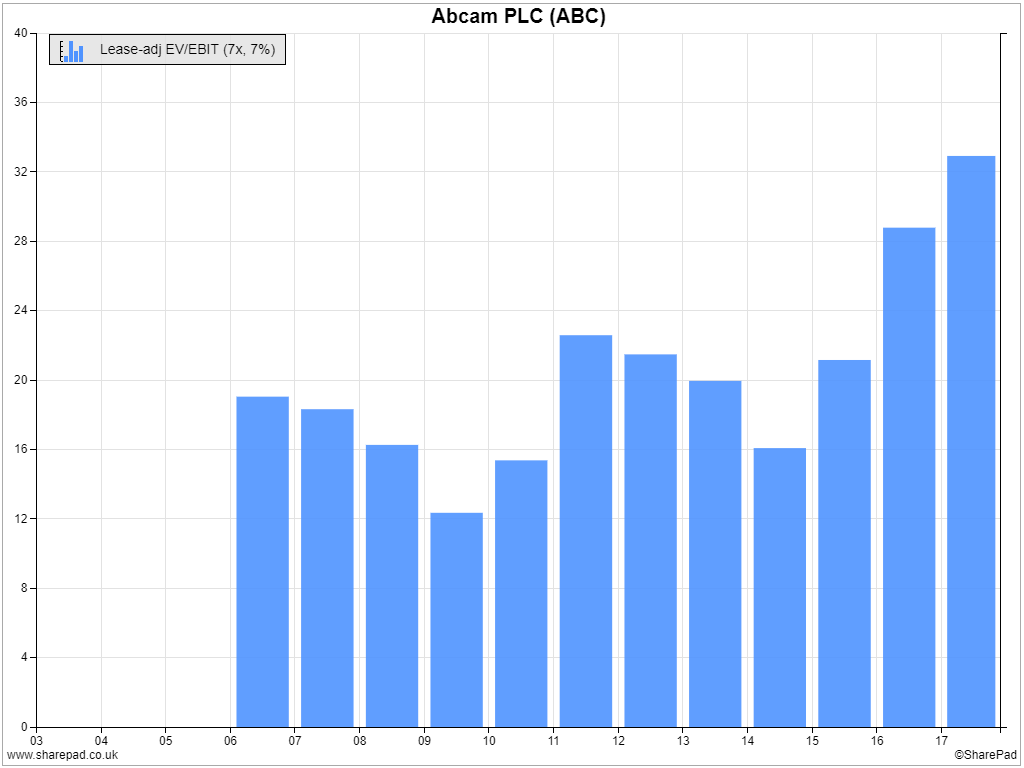

In shareholders' estimations, it's even better. Abcam's share price has increased 25 times since it floated at just over 40p, to £10. It values the enterprise at nearly £2bn or about 32 times EBIT, a measure of profit. Deduct corporation tax from EBIT at the standard rate of 19% to get an investor's return, and it's about 2%.

That's to say profit attributable to shareholders is about 2% of the price of the investment. Since it's unlikely investors are prepared to wait 50 years to earn their investment back at 2% a year, it's fair to assume that current shareholders expect Abcam to grow and pay them back earlier.

How excited are shareholders? At 32 times EBIT Abcam's valuation is higher than it has ever been, which suggests shareholders are more into the stock than ever. They're fans.

Abcam expects to grow. Shareholders expect it to grow. Analysts expect it to grow.

Everybody likes this company, so let's have a look at what it does?

Amazon of antibodies

Abcam earns most of its profit retailing primary antibodies. The antibodies bind to proteins allowing researchers investigating diseases like cancer and Alzheimer's to locate and identify specific proteins in samples they are studying. It's a crucial step in eventually finding cures for these intractable diseases.

Following recent acquisitions, Abcam is developing manufacturing capabilities that augment its long-standing strengths as a retailer. The company has a reputation for sophisticated online marketing, for providing a wide range, comprehensive data, and high levels of customer service.

These capabilities are not unlike those of a much more mainstream retailer, Amazon. Abcam's datasheets, for example, are populated by feedback from the scientists that use its antibodies.

From growth to sloth

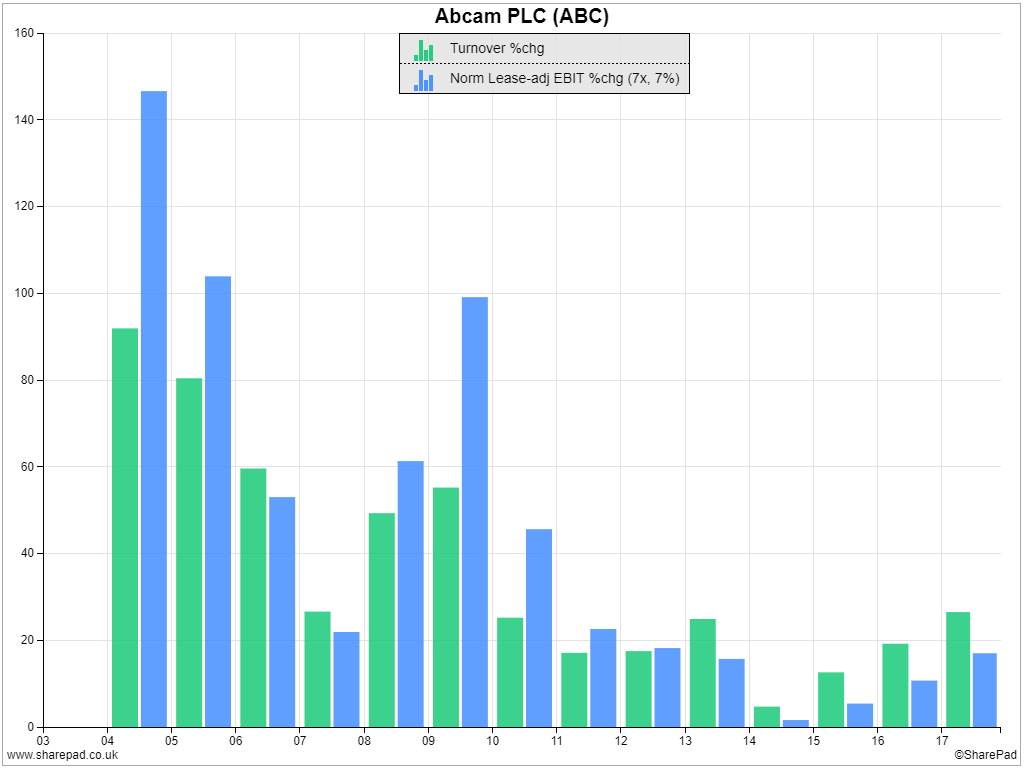

It's an intriguing story, but I've been looking at a couple of charts that prompt questions about Abcam's growth. The first shows the growth in revenue and profit every year since 2003:

The chart tells me two things.

First, the linear scale of the first chart I showed you obscures the fact that growth has slowed. To grow at the same rate, say 10% or 20% a year, a company must increase how much it grows in absolute terms every year. That's because 10% or 20% of a bigger number is itself a bigger number. Abcam doubled profit between 2008 and 2009, but it took the company three years to double profit again, and analysts predict it will have doubled profit again soon - six or seven years later than the last doubling.

Secondly, Profit growth was generally higher than revenue growth before 2014 but since 2014, profit growth has lagged revenue growth.

Ultimately it's profit not revenue that matters so we need to be on our guard if Abcam is sacrificing profitability to grow.

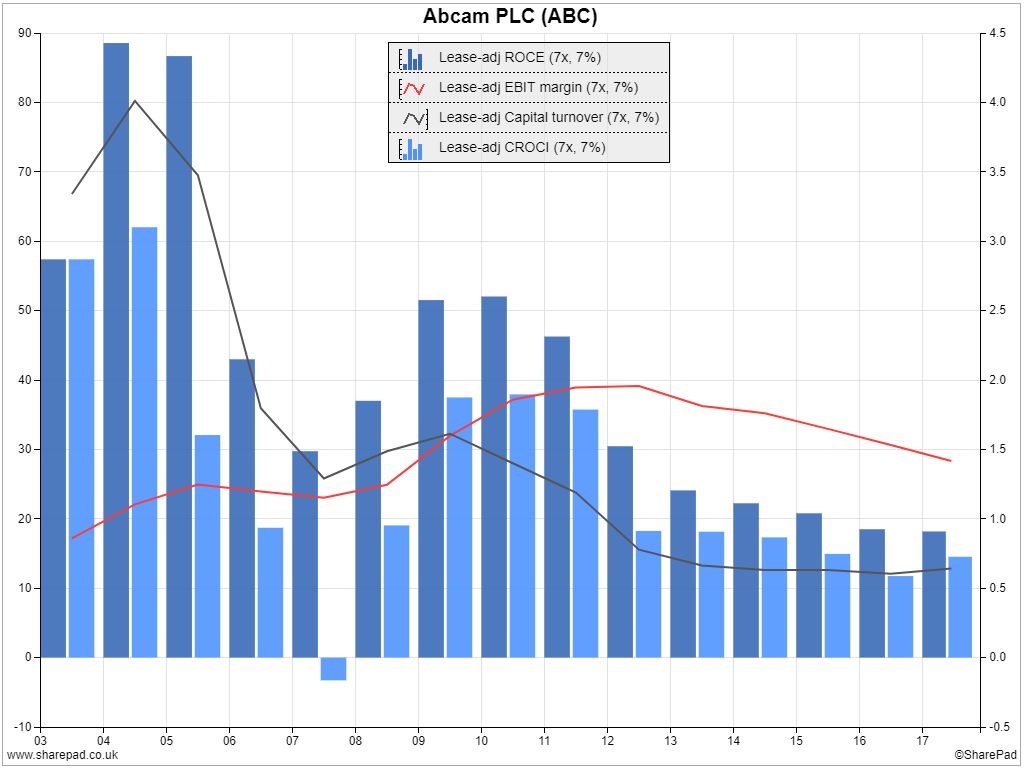

It looks as though it is. Profitability, in terms of profit margin and Return on Capital Employed, is lower than it was when Abcam was a smaller company:

But it's still pretty high. A return on capital employed of 18% is not shabby at all. This is the internal rate of return of the company. If Abcam can continue investing and earning 18% a year, it will make a very good investment at the right price.

What we need from Abcam is some reassurance that the downward trend in return on capital has bottomed out. Maybe this year's result, where return on capital increased marginally, can give us some comfort.

New growth platforms

Abcam's annual report describes the company's growth strategy, announced in 2014. This strategy is based on five pillars. I won't recount them all in detail. The three I'm particularly interested in are the first, second and fourth:

- Grow the core reagents business faster than the market by increasing the range and quality of antibodies it sells and marketing them even more effectively. This is, effectively, a continuation of how the company got where it is today.

- Establish new growth platforms by bundling antibodies and other ingredients into testing kits for researchers and supplying new customers like medical diagnostics companies.

- Sustain attractive economics, effectively by increasing efficiency, aka keeping a lid on costs.

Point four reassures me that Abcam is keeping one eye on profitability because costs are an important part of the profitability equation. The commitment to "sustaining attractive economics" implies an attractive level of profitability without committing to a particular percentage.

The elevation of new growth platforms is intriguing because it coincides with resurgent but less profitable growth since 2014.

The winner takes it all

Now we enter a world of speculation.

Abcam values its core market - primary research grade antibodies - at $906m. In the year to June 2017 it earned £160m (about $215m) from primary antibodies, so its market share may already be as high as 24%. It's good the company still believes it can increase market share in what is still a growing market.

But it also shows there are limits to Abcam's growth, which probably explains why it is diversifying. Since Abcam is entering new markets, costs may be higher and competition may be tougher, which in turn may explain why profitability is falling. Nevertheless, if Abcam can grow a decent market share in new markets, these too could become highly profitable.

The similarities with Amazon, superficially at least, go way beyond the fact that it is an online retailer that uses customer feedback as a sales tool. Amazon is notorious for bearing down on costs (point four of Abcam's strategy) so it can lower prices. It is also long since diversified (point two) from its core market, books, which it nevertheless seeks to deepen (point one). Like Abcam, Amazon develops its own products as well as retailing other firms'.

The widely anticipated end game for Amazon is that it keeps bearing down on competitors until it dominates markets. Then it takes most of the profits.

If you believe Abcam is following a similar strategy in its niche markets, it could possibly justify both lower profitability and a high valuation.

I'm not a believer yet. The future is so uncertain I find it very difficult to buy shares on valuations like Abcam's, particularly when they are high not only in absolute terms but relative to past expectations too.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

If you have a novel strategy or comments on mine, I'd be interested to hear from you. You can contact me by email (richard@beddard.net) or on Twitter @RichardBeddard.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.