Alarms

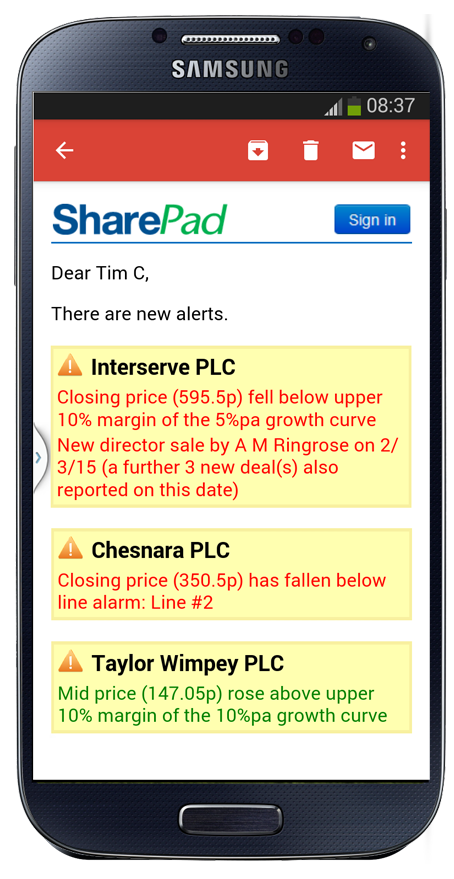

It can be tempting to look at your portfolio every day to make sure that none of your investments are tanking. With ShareScope, you can set alarms to tell you if anything untoward occurs. Alerts can be displayed on the screen or sent to your email account so you can pick them up on your phone wherever you are. That way, if you need to sell you can get onto your broker straightaway. See the full list of alarms you can set in ShareScope.

Here are five smart ways you can use alarms in ShareScope.

In a diversified portfolio, you'll have different expectations for each of your investments. For example, you may be content for a blue chip share like GlaxoSmithKline with a dividend yield of 5% per year to grow at the rate of inflation. On the other hand, if you have invested in a fund which offers exposure to faster-growing and higher risk smaller companies, you may require an annualised growth of 15%.

ShareScope enables you to set your target growth rate for each investment starting from the date you purchased the shares. A green channel will be drawn on the instrument's price chart so you can see, at a glance, if your investment is performing as required. You can set up alarms to tell you if your investments fall below the required rate.

Subscribe

Price & news alarms

If one of your stocks starts tanking, it is probably a news story that has started the mass selling. When this occurs you have a quick decision to make: is this a short-term setback which I can ignore or should I sell out now?

By setting price and news alerts you'll receive alerts telling you when any of your investments fall significantly and details of any news stories related to the stock. By setting alerts for price falls of, say, 3%, 5% and 10% you'll also be kept informed of how far your investment has fallen.

Director and Major Shareholder activity

The activity of directors and major shareholders (City institutions) can give you insights into the value and prospects of a stock. Directors buying when a stock's share price has fallen significantly can be a sign that the company's management believe the price will recover. A major shareholder (City institution) taking a sizeable position or increasing its holding in a small cap growth stock on your watchlist would be an encouraging sign. Let ShareScope send you alerts whenever the directors or major shareholders of your investments increase or reduce their holdings.

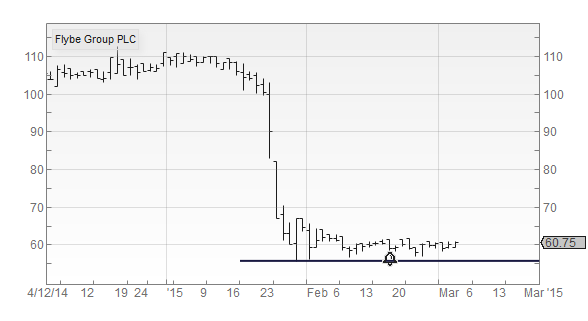

Line alarms

A really easy and visual way to set alarms for important price levels is by drawing lines on the price charts of your investments. In this example, the share has fallen significantly but has levelled out after reaching a low of 56p. You are hoping to profit from a recovery and have invested at 60p. However, if the price falls below 56p you will cut your losses and sell. You draw a line on the chart at 56p and set an alarm on this line.

Subscribe

Technical alarms

Technical alarms alert you when certain chart-based patterns occur. Both traders and investors use these signals to anticipate changes in short-term or longer-term price trends. If you are a trader, you might use technical alarms to find trading opportunities. If you are an investor, you can use technical alarms to identify opportunities to sell existing investments and lock in profit before a fall, or buy more shares in a current holding or an investment on your watchlist.

ShareScope provides a range of alarms for popular momentum indicators like moving averages, MACD, RSI and stochastics.

Compare alarms

| Alarm type |  Subscribe |

Subscribe |

|---|---|---|

| Individual stock alarms | Yes | Yes |

| Email alerts | Yes | Yes |

| Price change alarms | Yes | Yes |

| Line alarms | Yes | Yes |

| Stop loss/gain alarms | Yes | Yes |

| News alarms | Yes | Yes |

| Target growth alarms | Yes | Yes |

| Director buy/sell alarms | Yes | Yes |

| Dividend alarms | Yes | Yes |

| Dividend forecast alarms | Yes | Yes |

| Profit forecast alarms | Yes | Yes |

| Broker consensus alarms | Yes | Yes |

| Technical alarms | Yes | Yes |

| Unscheduled auction alarms | Yes | Yes |