Powerful filtering

Filtering enables you to find shares, or other instruments, which have attractive characteristics - such as low valuations, consistent profit growth or generous dividends. When applied to shares it is also called stock screening. Filtering enables you to search the stock market, or other universes, in minutes. You simply wouldn't be able to do this amount of research manually.

ShareScope's ability to filter the stock market for shares that meet specific criteria is second to none. Not only that, you can also filter funds, investment trusts and ETFs to find those with the best performance and the lowest fee.

Visually I was impressed by the filtering tool...and the quantity and depth of fundamental data on offer is very impressive. As well as the ratios and data items you'd expect, ShareScope also offers many more esoteric, but extremely useful, fundamentals.

Algy Hall, Investors Chronicle

Filtering can be used for simple purposes, such as finding high yield shares with low valuations, or for evolving strategies to uncover exciting opportunities before the majority of the market.

Here are the key features of ShareScope's filtering:

- Broad coverage: As standard, ShareScope includes in-depth results and ratios for all UK and US shares as wells as funds, Investment trusts, ETFs and bonds.

- Experiment: Create as many filters as you like and these will automatically display the latest results whenever you look at them.

- Total control: You can apply a virtually unlimited combination of criteria.

- Deep history: Filter on up to ten years of data e.g. annualised EPS growth of at least 10% for ten years (underlying data goes back as far as 1992).

- Sophisticated criteria: e.g. Forecast PE lower than 5y average PE.

- Ranking criteria: e.g. shares with above average operating margin in their sub-sector

- Technical criteria: moving average crosses, MACD & RSI signals

- Guru filters: A library of "guru" filters which mimic the strategies of famous investors like Warren Buffett, Ben Graham, Jim Slater, Martin Zweig and Peter Lynch.

ShareScope is a product that should meet, and will probably far exceed, the requirements of most private investors

Algy Hall, Investors Chronicle

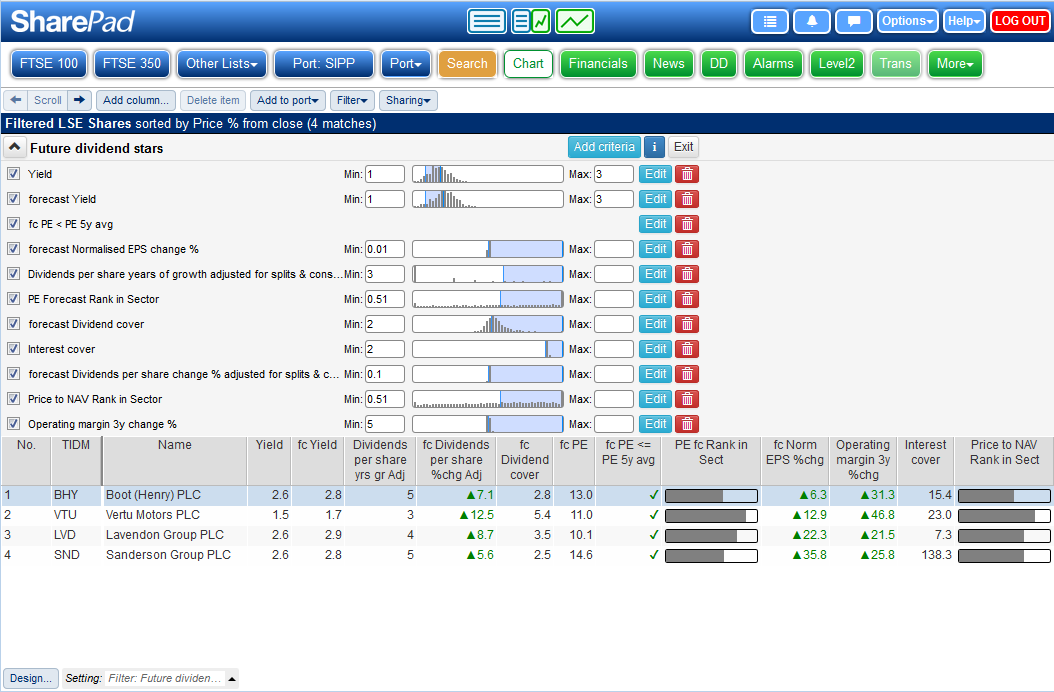

Here's an example filter designed to find companies that could be the dividend stars of the future.

The criteria used are:

- Dividend yield between 1 and 3%

- Forecast yield between 1 and 3%

- Dividend has been increased for three years or more

- Forecast dividend is increased

- Forecast dividend cover is 2 or greater

- Forecast PE is lower than the 5y average PE

- Forecast PE is lower than average for the sector

- Forecast EPS is increased

- Operating margin has increased by at least 5% over the last 3 years

- Interest cover is 2 or greater

- Price to NAV is lower than average for the sector