Sifting for bargains amid the stock market carnage

For a lot of the time the stock market calmly goes about its business giving us prices to buy and sell shares. Every now and again there are unexpected events which trigger the extreme human emotions of fear and greed.

Following last Thursday's decision by the British electorate for the UK to leave the European Union (EU) the stock market has been firmly in fear mode as people try and work out how bad the implications of it might be for the future profits of UK listed companies. At the moment, the stock market seems to think for some companies that their future will be bleak as evidenced by some big falls in share prices.

The truth of the matter is that nobody knows what will happen but it is this uncertainty that has spooked people.

What I do know is that stock markets often overreact to unexpected events. I also know that humans are not very good at predicting the future. A classic example of this was seen in the value of the pound last Thursday. I went to bed around midnight with the experts telling me that the UK was going to stay in the EU and £1 bought $1.50. Three hours later the story was different and £1 bought around $1.35. Who predicted that?

For short-term traders these wild swings in prices can have a huge say on whether they make a profit or a loss. Long-term investors should largely ignore them as they are part and parcel of investing. Over a five to ten year timeframe the ups and downs tend to smooth themselves out a lot.

It also helps to be aware that some companies will use the current uncertainty as an excuse for poor financial results. You have to ask yourself whether profits will fall because the UK will leave the EU or whether they would have fallen anyway.

I haven't sold one share in my portfolio and have no intention of doing so. I'm more interested in looking out for shares to buy. If we look back to the big stock market sell-offs in 2003 and 2008-09 history tells us that they were times to buy rather than to sell shares. Is the current turmoil another buying opportunity?

In this article, I am going to use some very simple filters in SharePad to see if they can unearth some shares that might be worth a closer look. Of course, by the time you read this some of the shares featured could be priced significantly higher or lower.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Surveying the damage

Out of the 629 shares in the FTSE All-Share index, 548 of them declined in value between the close of trading on Thursday 23 June to the close of trading on Monday 27 June. Banks and house builders and companies exposed to the UK economy took a real battering. Airline shares also saw big price falls as investors worried about how they would get on in other European countries once the UK left the EU.

It wasn't all doom and gloom though. Companies with large overseas earnings - especially those with US dollar profits - saw their share prices go up as the lower value of the pound will mean those overseas earnings will be worth more in pounds. At midnight last Thursday (23 June 2016) a UK company with US dollar earnings had to earn $1.50 to make £1 of profit. A few hours later it only had to earn $1.33.

I'm going to use three filters in SharePad to see if we can answer some key questions. Namely:

- Could housebuilder shares be cheap now?

- Are there some large and safe dividend yields on offer?

- Are some shares pricing in no further profit growth?

Housebuilding shares

In my recent article about the housebuilding sector (click here to read this), I showed you how you could use SharePad to model certain scenarios. I used return on equity (ROE) to work out what P/NAV multiple the shares might be worth.

In short, the right P/NAV is based on a relationship between the sustainable returns on equity and the returns that shareholders require to own the shares (known as the cost of equity). So if the sustainable ROE was 8% and investors require an 8% return to own the shares then the P/NAV should equal 1.0 (8% dividend by 8%). If returns are higher/lower than 8% then the P/NAV should be higher/lower than 1.0.

My analysis suggested that the stock market was pricing in a very optimistic future for housebuilders. It was suggesting that the current high profits and returns on equity (ROE) were sustainable forever, and that there would never be another housing market slump again.

Now it seems that some people think that there might be and the share prices of housebuilders have been decimated.

Let's have a look at how they are valued now.

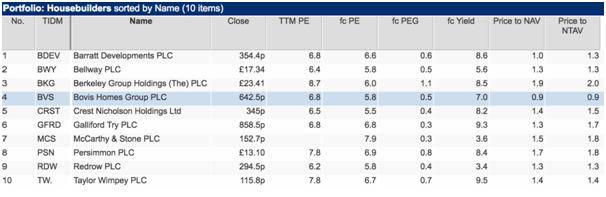

For many of the shares in the sector, their forecast dividend yields are similar or higher than their forecast PE ratios. This is either a sign of impending disaster with markedly lower profits ahead and dividend cuts or a possible over-reaction by the stock market.

Bovis Homes (LSE:BVS) can now be bought on the stock market for less than its tangible net asset value.

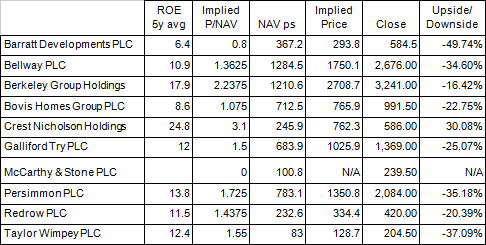

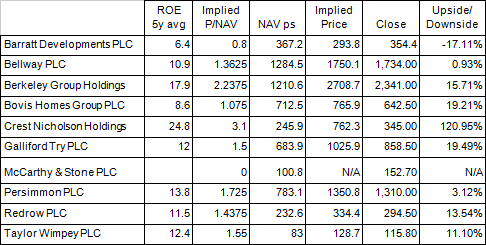

Just over a month ago, using the five year average ROE to calculate the P/NAV for each share, the sector looked expensive. In the table below you can see that most of the housebuilders were priced well above their implied price using this model.

Now many of them are priced below their implied price.

In other words, if you think the sector can maintain its five year average ROE, then the share prices of most Housebuilders offer some upside.

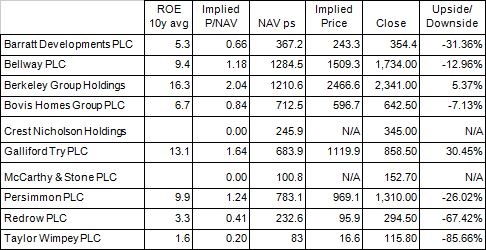

If you think the ten year average ROE, which takes in the last bear market, is likely to be a better guide to profitability in the coming years, the table below suggests that the sector still isn't cheap.

Housebuilder profits and valuations are very sensitive to changes in house prices. House prices are very difficult to predict. Sharp falls tend to happen quickly. Many commentators believe UK house prices are overvalued whilst others argue that affordability is still good - even more so if interest rates are cut in the future.

If you are looking at housebuilder shares as a possible investment then you need to try and work out what future profit outlook is implied in current share prices. As I showed in my previous article on the subject, share prices tend to follow current rates of profitability. You need to ask yourself whether the market has overreacted here or indeed whether there may be bigger falls to come.

Are there any safe and chunky yields on offer?

There are now 36 shares in the FTSE All Share index with forecast dividend yields of more than 5% and forecast dividend cover of more than 2.0. Are these shares potential bargains or will the profit forecasts they are based on be slashed and lead to smaller dividends being paid?

The past does not always repeat itself but companies with a decent track record of paying dividends for many consecutive years might give you some confidence that they can keep on paying them.

Even better would be a company with many years of consecutive dividend growth. This is no guarantee of safety though as businesses can run into trouble that they have not experienced before and this could lead to a dividend cut.

In the table above, Stagecoach has fallen 12.7% and stands out as a company with a decent track record. Can it continue to keep on delivering? (Check out my Stock Watch article on Stagecoach here.)

Are some shares pricing in no further profit growth?

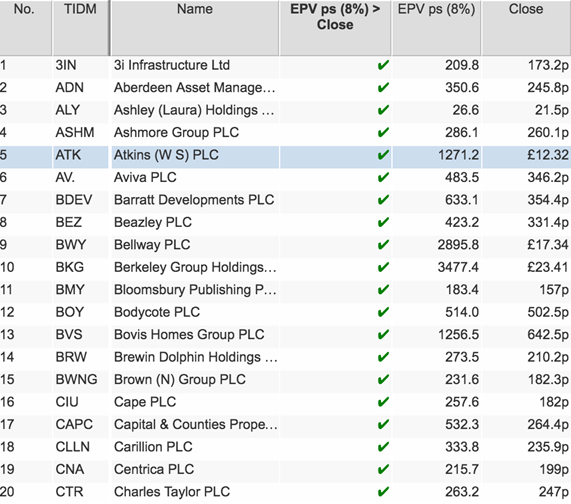

One of my favourite ways of weighing up the valuation of a share is to calculate its earnings power value (EPV). This tells you how much a share would be worth if a company's profits stayed the same forever. You can then compare this value with the current share price and get a feel of how much of it is based on current profits and how much is based on the expectations of future profits growth. Shares can be cheap when they forecast little or no future profits growth.

Back in 2003 and 2008 many shares traded below their EPV when they were still capable of maintaining or growing their profits.

According to SharePad there are 123 shares at the close of trading on 27th June trading below their EPV per share. The key focus of your research on any of these shares is whether the stock market is right and profits are likely to fall.

To read more about EPV click here.

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.