Filter: Cash flow portfolios

Last week I wrote about how you can search for high quality companies based on their free cash flow performance (click here to read more about this). Buying quality companies with high free cash flow returns (CROCI) at a reasonable multiple of their free cash flow makes a lot of sense to me. I use this strategy extensively - but not exclusively - with my own portfolio.

This week I've done a bit more digging to see how well a strategy of picking companies with high cash flow returns has performed in the past. I've also run a screen to see what kind of portfolio could be put together today.

Phil Oakley's debut book - out now!

Phil shares his investment approach in his new book How to Pick Quality Shares. If you've enjoyed his weekly articles, newsletters and Step-by-Step Guide to Stock Analysis, this book is for you.

Share this article with your friends and colleagues:

Back testing strategies with SharePad

SharePad contains a lot of historical financial data. This can be very useful for testing the past performance of investing strategies.

SharePad gives the user the tools to look back at the financial performance and valuation of companies over periods of up to ten years. This is useful because it includes periods of bull and bear markets which might not be the case looking at companies over a shorter period. Eventually we plan to extend the time horizon to over twenty years given that we have data going back to the early 1990s.

However it is not a perfect way of backtesting. You can only currently do it with a list of companies that are listed on the stock exchange. This means that there is an element of survival bias to the results you will get. Companies that are no longer listed may well have had an influence on an investment strategy in the past and this needs to be understood.

But that doesn't mean that you can't still do some very useful historical analysis of investment strategies as I'll show you shortly.

Testing the past performance of cash flow portfolios

I've run the following filter each from 2006 to 2015 in SharePad:

- Financial shares are excluded as they don't fit this strategy well.

- Minimum lease-adjusted CROCI of 10%.

- Minimum free cash flow yield (free cash flow per share as a percentage of the share price) of 5%.

- Minimum market capitalisation of £100m.

Once SharePad had provided me with a list of shares I exported the list to a spreadsheet and assigned a ranking to each company for CROCI and free cash flow yield. I then added the two rankings together to form a combined ranking. This is very similar to the process in Joel Greenblatt's Magic Formula strategy.

I then selected the shares with the lowest combined ranking to build an equally weighted twenty share portfolio (the same amounts of money invested in each share) from twenty different sectors of the stock market. Unlike many academic studies of investing strategies, I wanted to set up a test based on something that private investors could realistically be able to do in practice.

I also wanted to spread the portfolio across different sectors in order to spread out the risks of the portfolio. The portfolio was held for one year. At the start of the next year, a new portfolio based on the same criteria was selected. This process was repeated for ten years.

A ten share portfolio was also tested.

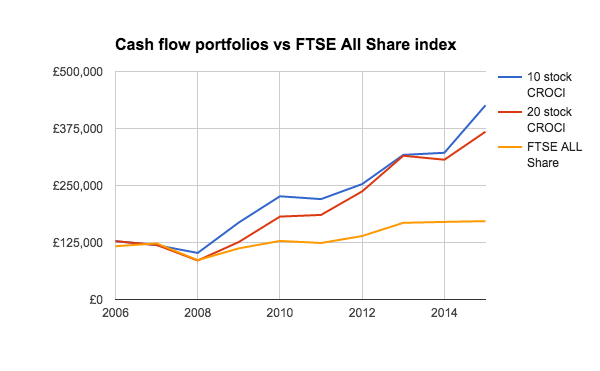

The total return performance of the portfolios was then compared with the total returns of the FTSE All Share index. The chart below shows the results based on a starting value of £100,000 in 2006. For simplicity the costs of buying and selling shares has been ignored. This will overstate the portfolio returns a little bit but as you will see this won't matter too much.

As you can see, the cash flow portfolios have trounced the stock market as a whole.

Let's have a look in more detail

A twenty stock portfolio

| Year | CROCI portfolio TR | FTSE All-Share TR | Difference | Value CROCI portfolio | Value FTSE All-Share |

|---|---|---|---|---|---|

| 2006 | 27.90% | 16.80% | 11.10% | £127,900 | £116,800 |

| 2007 | -6.42% | 5.30% | -11.72% | £119,689 | £122,990 |

| 2008 | -28.56% | -29.90% | 1.34% | £85,506 | £86,216 |

| 2009 | 47.42% | 30.10% | 17.32% | £126,052 | £112,167 |

| 2010 | 44.23% | 14.50% | 29.73% | £181,806 | £128,432 |

| 2011 | 2.01% | -3.50% | 5.51% | £185,460 | £123,937 |

| 2012 | 27.83% | 12.30% | 15.53% | £237,073 | £139,181 |

| 2013 | 32.97% | 20.80% | 12.17% | £315,236 | £168,130 |

| 2014 | -2.76% | 1.20% | -3.96% | £306,536 | £170,148 |

| 2015 | 20.04% | 1.00% | 19.04% | £367,966 | £171,849 |

The twenty stock portfolio made money in seven out of the ten years and beat the market in eight of them. It suffered badly in 2008 showing that it is very difficult for any share portfolio to make money when the stock market is having a very bad year.

Since the start of a new bull market in 2009, the strategy has thrashed the market with only 2014 being a bad year. At the end of ten years, a £100,000 portfolio would have compounded into £367,966 before costs - more than double and nearly £200,000 more than holding the FTSE All Share index.

A ten stock portfolio did even better

| Year | CROCI portfolio TR | FTSE All-Share TR | Difference | Value CROCI portfolio | Value FTSE All-Share |

|---|---|---|---|---|---|

| 2006 | 27.79% | 16.80% | 10.99% | £127,790 | £116,800 |

| 2007 | -6.76% | 5.30% | -12.06% | £119,151 | £122,990 |

| 2008 | -14.32% | -29.90% | 15.58% | £102,089 | £86,216 |

| 2009 | 65.40% | 30.10% | 35.30% | £168,855 | £112,167 |

| 2010 | 34.05% | 14.50% | 19.55% | £226,350 | £128,432 |

| 2011 | -2.74% | -3.50% | 0.76% | £220,148 | £123,937 |

| 2012 | 14.98% | 12.30% | 2.68% | £253,126 | £139,181 |

| 2013 | 25.27% | 20.80% | 4.47% | £317,091 | £168,130 |

| 2014 | 1.48% | 1.20% | 0.28% | £321,784 | £170,148 |

| 2015 | 32.35% | 1.00% | 31.35% | £425,882 | £171,849 |

You might think that holding twenty stocks is a bit too much. So I decided to look at a ten stock portfolio based on the shares with the highest combined CROCI and free cash flow yield rankings.

This portfolio did even better than the twenty stock one and perhaps shows the potential of more focused and concentrated portfolios on investment performance. It made money in the same number of years (seven) but beat the market in nine out of ten of them.

It fared better in 2008 than the twenty stock portfolio and recovered well from 2009 onwards, although the twenty share portfolio actually performed better. By losing less money in 2008, it made more money overall than the twenty share portfolio and thrashed the stock market as a whole.

A portfolio for today

Does this mean that this strategy will do well in the future? I've no idea. I like the reasoning behind the strategy but if the stock markets fall during the next few years I'm not sure the feeling of beating the market but losing money at the same time will make me feel particularly happy. This strategy still lost a reasonable amount of money in 2008.

It's also worth remembering that these results are based on blindly buying a rules based portfolio and sticking to the rules through good times and bad. Personally, I can't do that.

I understand that taking human emotions out of investing and just looking at rules and numbers can have its advantages. But I like to know what I am buying a slice of.

Most of the investment strategies touted by tipsters are based on what has happened in the past and past profits and don't take account of the future. I can't predict the future any better than anyone else but I do know that an oil or mining company that looks cheap today based on last year's profits or cash flows might still get cheaper.

But I also like to have an open mind and consider that I might be wrong. That's why I am going to be running a number of test portfolios and see what they get up to over the short and long run.

Here's a twenty share portfolio based on CROCI and free cash flow yields based on current data. As with the historical portfolios, financial shares are excluded and the minimum market capitalisation for inclusion is £100m. I'll keep you updated on it over the coming months.

| Name | Market Cap. (m) | Lease-adj CROCI | FCF yield | Subsector | CROCI rank | FCF yield rank | Combined rank |

|---|---|---|---|---|---|---|---|

| Indivior | 1116 | 281.2 | 23.8 | Pharmaceuticals | 1 | 3 | 4 |

| Character Group | 102.5 | 43.4 | 15 | Toys | 3 | 5 | 8 |

| GVC Holdings | 278.2 | 28.4 | 13.2 | Gambling | 7 | 6 | 13 |

| Berkeley Group Holdings | 4716 | 29.7 | 11 | Home Construction | 6 | 9 | 15 |

| Cohort | 146.6 | 24.9 | 12.2 | Defence | 10 | 7 | 17 |

| Wizz Air Holding | 1040.7 | 27.3 | 8.9 | Airlines | 8 | 14 | 22 |

| Softcat | 642.6 | 51.8 | 7 | Computer Services | 2 | 26 | 28 |

| Lakehouse | 134.3 | 16.9 | 10.9 | Business Support Services | 22 | 10 | 32 |

| Gem Diamonds | 149.4 | 13.4 | 25.3 | Diamonds & Gemstones | 30 | 2 | 32 |

| Eurocell | 187.5 | 21.5 | 7.4 | Building Materials & Fixtures | 13 | 22 | 35 |

| Costain Group | 358.6 | 14.6 | 9.6 | Heavy Construction | 28 | 12 | 40 |

| GAME Digital | 162.3 | 12.7 | 19.8 | Specialty Retailers | 37 | 4 | 41 |

| PayPoint | 558 | 31.3 | 6.2 | Financial Administration | 5 | 37 | 42 |

| Go-Ahead Group | 1064.8 | 12 | 31.3 | Travel & Tourism | 42 | 1 | 43 |

| Euromoney Inst Investor | 1169.6 | 17.6 | 7.3 | Publishing | 21 | 24 | 45 |

| ITE Group | 353.3 | 15.6 | 7.4 | Media Agencies | 23 | 22 | 45 |

| Matchtech Group | 158.9 | 15 | 7.7 | Business Training & Employment | 26 | 20 | 46 |

| Polymetal International | 2250.6 | 12.8 | 8.8 | Gold Mining | 34 | 16 | 50 |

| Alternative Networks | 223.4 | 20.2 | 6.3 | Fixed Line Telecommunications | 16 | 35 | 51 |

| Craneware | 209.3 | 35.8 | 5.6 | Software | 4 | 48 | 52 |

If you have found this article of interest, please feel free to share it with your friends and colleagues:

We welcome suggestions for future articles - please email me at analysis@sharescope.co.uk. You can also follow me on Twitter @PhilJOakley. If you'd like to know when a new article or chapter for the Step-by-Step Guide is published, send us your email address using the form at the top of the page. You don't need to be a subscriber.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.