ShareScope makes it easier to manage your portfolios successfully

Portfolio management isn't just about how much your holdings have gone up (or down). It's about weeding out poor performers; taking profits on holdings which have become overvalued; buying more of holdings which have become undervalued; and making sure you are outperforming the market.

Here are four ways ShareScope makes it easy to monitor and assess your portfolio.

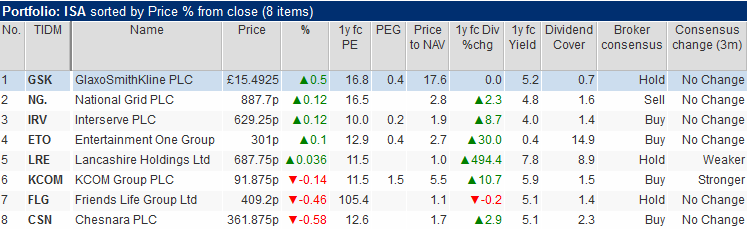

Portfolio health - at a glance

How do you tell you if the companies you are invested in are getting stronger or weaker? Are they currently undervalued or overvalued? Are your income stocks growing or at least maintaining their dividends? You should be asking yourself questions like these on a regular basis to determine whether you should sell, continue holding or buy more of each investment.

Your broker's website won't give you the answers but ShareScope will. Simply build a table for your portfolio which contains the information you are interested in. It could help you:

- Highlight the highest risers and fallers in your portfolio each day

- Identify undervalued and overvalued shares

- Check that your income objectives are being met

- See if broker consensus is getting stronger or weaker

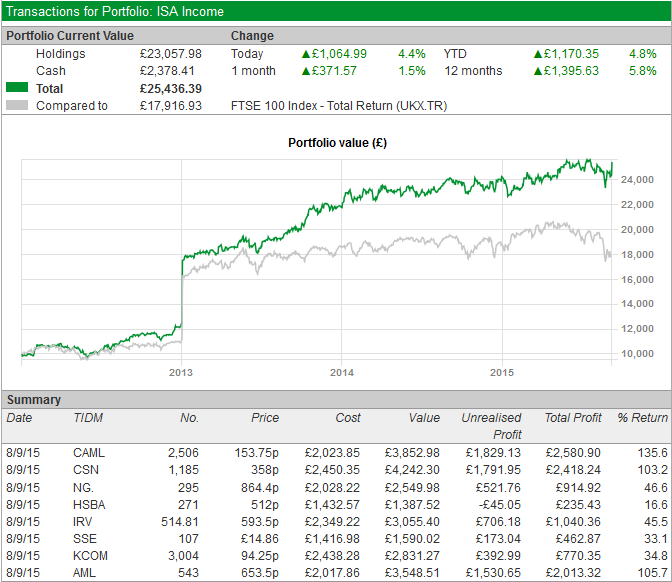

Portfolio Performance

You can choose to record your investment transactions in ShareScope as well. Although your broker account will provide much of this information, you may find that ShareScope provides more advanced tools.

- Create as many portfolios as you like and each one will have an associated cash account so you can record contributions, dividends received and cash withdrawals.

- On the screenshot, you can see how ShareScope displays the current value of your portfolio in tabular and chart format as well as performance over various timeframes.

Set and monitor performance targets for each investment

ShareScope allows you to set the annualised rate of growth you'd like from each of your holdings. This will vary for different types of investment. When displayed on the price chart, this will highlight investments which aren't performing as required so you can consider alternatives. It also helps you worry less about fluctuating share prices - as long as your investments stay above or within your target growth channel.

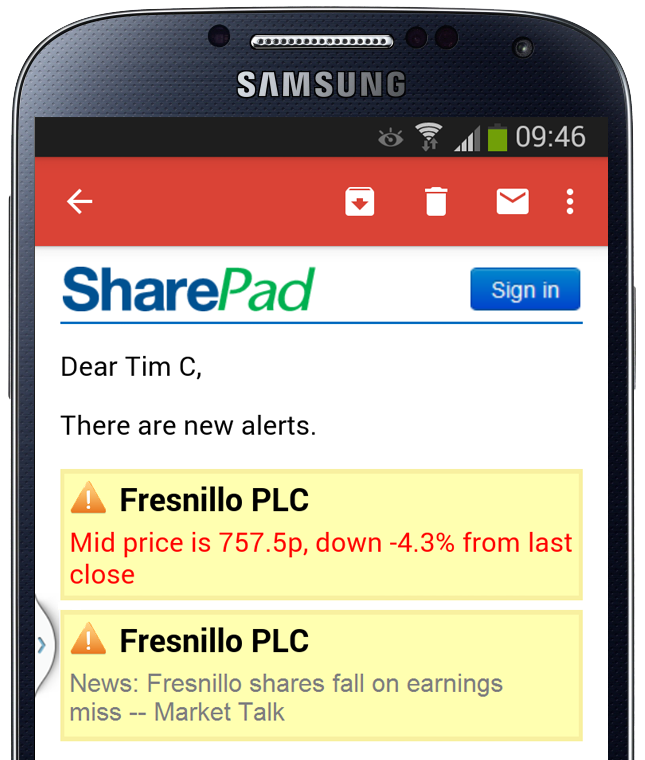

Use alarms so you can react fast to significant events

To save you having to check your investments all the time, ShareScope lets you set alarms to inform you of unexpected price movements and events that could affect the value of your investments (e.g. news stories, a reduction in profit forecasts, directors selling shares). Receive alerts on your phone via email so you can react quickly wherever you are. Read more about alarms.