Meet Alpesh Patel OBE

Use my market-beating stock-picking system

The Alpesh Patel Special Edition of Legacy ShareScope is a series of systems that I have used for many years, developing my own stock-picking filters and analytic settings ("radars"), and which has proved consistently successful for me.

I want it to save you hours and hours of searching for trades and make you much more than it costs. It has done that for me!

APSE is only available for existing Legacy ShareScope subscribers and from 27/11/24 Legacy ShareScope is only available to existing and returning subscribers.

Performance figures Add to my Legacy ShareScope subscription

About Alpesh

Alpesh Patel is a man with his finger on the pulse. When he isn't managing his hedge fund, Alpesh is a "Dealmaker" for the UK Department of Trade and Industry and is also a best-selling investment writer. More...

About Alpesh Patel Special Edition

I have used this system for years now to target 25% growth per annum. It's important to stress the word TARGET. I set my sights high. Each year, I published a basket of stocks for a 12-month buy and hold. In fact, all I did was list the stocks in my Alpesh Patel Value/Growth filter on the day I gave the tips.

Using this method I have achieved an average return of 18% over the last 5 years. Not 25% but I'll take 18% every year and I'm sure you would too. The FTSE All-Share provided an average 0.8% gain over the same period.

My total return since inception: 1214%

Warren Buffett over same period: 434%

Now, the Alpesh Patel Special Edition does not pick sure-fire winning trades and investment ideas every time. It picks trades and investment ideas that already meet specific criteria that I require as a starting point. These are criteria which I have settled upon over years of investing and shorter-term trading.

I may still find reasons not to like some of the opportunities highlighted by my filters but I will tell you the warning signs that I look for.

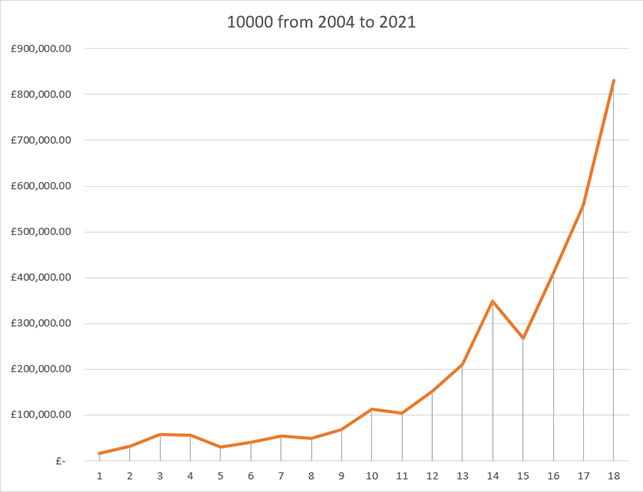

In today's market, people want the safety of buy and holding good quality stocks, but the extra performance of mild leverage that CFDs and Spreadbetting offers. But you do not need to go to extremes to achieve this. If you take the APSE performance since inception, and had just 2:1 leverage, then £10,000 turned to £250,000! I wanted a system that allowed the benefits of buy and hold but also great performance and this is how in the modern world of how we all invest now it should be measured. Of course even with no leverage the performance is outstanding.

Note: trading with leverage not only magnifies your potential profits but also your potential losses.

Alpesh Patel Special Edition is an UPGRADE to Legacy ShareScope for existing subscribers only.

The Alpesh Patel Special Edition is a set of stock screens and auto-generated comment devised by Alpesh Patel alone. Legacy ShareScope identifies matching stocks based on Alpesh's criteria only. Alpesh Patel is an FCA-authorised investment manager.

Click here to see the seven ways I look for opportunities.

Impressive Results

Leveraged performance:

Annual performance:

| Alpesh Patel Special Edition |

FTSE All-Share |

|

|---|---|---|

| 2004 performance | + 34.9% | + 9.2% |

| 2005 performance | + 44.2 % | + 18.1% |

| 2006 performance | + 40.6% | + 10.8% |

| 2007 performance | - 2.3% | + 2.3% |

| 2008 performance | - 22.6% | - 32.4% |

| 2009 performance | + 17.4% | + 28.0% |

| 2010 performance | + 16.1% | + 9.1% |

| 2011 performance | - 4.4% | - 6.5% |

| 2012 performance | + 18.9% | + 7.4% |

| 2013 performance | + 33.5% | + 12.9% |

| 2014 performance | - 4.3% | - 2.4% |

| 2015 performance | + 23.3% | - 6.6% |

| 2016 performance | + 19.4% | + 20.0% |

| 2017 performance | + 32.8% | + 8.7% |

| 2018 performance | - 11.7% | - 13.2% |

| 2019 performance | + 26.6% | + 10.3% |

| 2020 performance | + 18.0% | - 13.1% |

| 2021 performance | + 24.5% | + 11.2% |

| Average | + 16.9% | + 4.1% |

| Average (last 5 years) | + 18.0% | + 0.8% |

Keep up the good work, your filters have already paid for the yearly subscription several times over!

Alpesh Patel Special Edition includes:

Alpesh Ratings

Displays a range of momentum measures and includes my proprietary Value/Growth Rating, Bullish Momentum Rating and Overall Rating. This is loaded into one of your List Table settings. Read more...

My four analytical "Radars"

Four Graph Settings which focus on different aspects of technical analysis. Each radar also includes my proprietary Alpesh Ratings displayed in the top left corner. Read more...

My four proprietary Data Mining filters

My bespoke Value/Growth, Momentum/Value, Bullish Momentum and Bearish Momentum stock screening filters. These are added to your library of Data Mining filters. Read more...

My exclusive monthly newsletter

My newsletter summarises the hours and hours of research I have done for the month ahead and has the best of the research from everything I have read from all the private banks, Bloomberg and hedge fund sources.

I only subscribed to your Special Edition of ShareScope a week or two ago and have already made a couple of thousand on two of your investments - needless to say I am delighted as this has more than covered the cost of your Special Edition and put a bob or two into my pocket - Thank you.

Alpesh's recent newsletters

I use the Special Edition of ShareScope, utilising your systems...pleased to say that it is proving to be profitable for me.

Alpesh Patel Special Edition User Guide

Please select the chapter you would like to view from below.

Testimonials for Alpesh

Alpesh's insight to the markets and trading are a must read for traders of all levels including beginners, there is something for everyone.

Peter Cruddas - Chairman, CMC Group

Find out how one of the UK's best known traders and broadcasters uses the wealth of information out there.

Michael Foulkes - CEO, TD Waterhouse Europe

Alpesh's proven track record speaks for itself. Learning from him will help ordinary people match the results of market professionals.

Clive Cooke - CEO, CityIndex

Takes a no-holds barred approach to uncovering stock market secrets, and searches for the truth that most financial TV coverage keeps well hidden...a brave guide that will help any stock market investor navigate the muddy waters of financial reporting - a sort of Columbo meets Warren Buffet.

Polly Fergusson - Shares magazine

Genuinely attempts and succeeds in giving the tools to convert a private investor to a professional investor for today's "Holy Grail" obsessed market.

Dan Maczulski - IG Index

The lid of the traders' black box has finally been well and truly removed.

John Watson - Co-Chairman, CNBC Arabia

This is great. A magnificent job.

Bernard Oppetit - Chairman, Centaurus Capital (about Mind of a Trader by Alpesh Patel)

The Mind of a Trader successfully captures the character of its subject, with Alpesh's insightful commentary.

Mark Slater - fmr MD Merrill Lynch

Alpesh is a born authoritative commentator and always insightful news editorial contributor. I miss the time when his FT column on online investing was my incentive to buy the weekend edition.

Ivan Schouker - CEO, American Express Sharepeople

Gets to the heart of the matter of trading by clearly elucidating the methodologies of successful trading strategies while capturing the ineffable ethos of singular, successful traders.

Pat Arbor - Chairman of the Chicago Board of Trade

Long overdue and very, very welcome.

Brian Winterflood - Winterflood Securities

Seasoned traders and new investors alike will learn much from Alpesh Patel's "no nonesense" guide to the industry.

Philip Hamsheir - BBC

...one of the savviest traders around. Read [Investing Unplugged] and you are guaranteed to be a better investor.

Peter Temple - Financial Times columnist

An essential companion for the online trader.

Sapna Kandakuri - Wealth Management, Coutts Bank

Let this veteran trading warrior show you how to survive and thrive with his latest internet guide.

Thom Calandra - Editor in Chief, CBS MarketWatch

At last someone brave enough to explain trading clearly.

Justin Urquhart Stewart - Co-founder, Seven Investment Management

The Internet Trading Course is the best guide of its kind to personal investing and will satisfy the beginner and the professional.

Nathan Moss - COO, Merrill Lynch HSBC

The Internet Trading Course gives you an insight into making the markets work for you.

Bharat Masrani - Vice Chairman, TD Waterhouse Group

Insights into online trading from one of the leading authorities in the field.

Craig Walling - CEO, Charles Schwab Europe

Alpesh provides as ever as the leading authority in his field clear and concise guide to making profits from proven trading strategies.

Gaurav Saraf - CEO, Epiphany Ventures

Alpesh clearly brings to life the difference between what analysts and the media "spin" and what you should trust.

Hans Georgeson - Director, Barclays Stockbrokers